/Ameriprise%20Financial%20Inc%20location-by%20APN%20Photography%20via%20Shutterstock.jpg)

Headquartered in Minneapolis, Minnesota, Ameriprise Financial, Inc. (AMP) is a diversified and global financial services firm. It provides comprehensive solutions spanning financial planning, investment management, and retirement and protection services.

With a market capitalization of approximately $46.9 billion, Ameriprise Financial sits in the “large-cap” category – the companies that have a market cap of $10 billion or more. It climbed to this stature by blending wealth management expertise with global reach. Serving everyday investors, ultra-rich clients, and institutions alike, it built trust through disciplined strategies, financial planning, and asset management. Its ability to adapt to shifting markets while nurturing long-term relationships cemented its rise into the top tier of financial powerhouses.

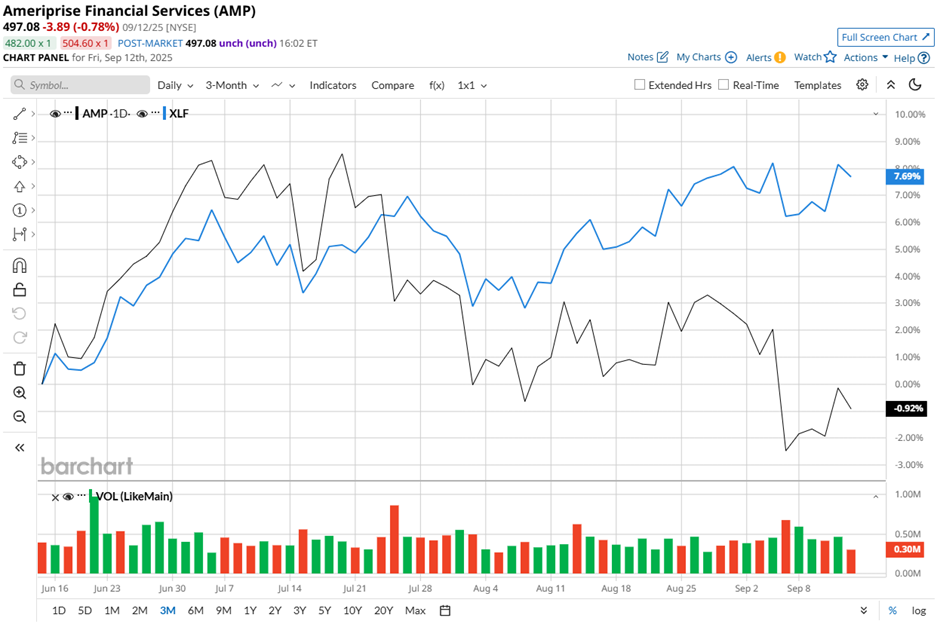

Yet, the AMP stock’s recent journey has been far from smooth sailing. Ameriprise Financial’s shares currently trade approximately 14.6% below the January high of $582.05. Over the past three months, the stock has edged down by nearly 3.6%, while the Financial Select Sector SPDR Fund (XLF) has gained 5.5%.

Expanding the lens to a longer timeframe, AMP stock has climbed 14.2% over the past 52 weeks, though 2025 was not pleasant, with the stock retreating by 6.6% on a year-to-date (YTD) basis. Comparatively, XLF has surged 21.1% over the same 52-week stretch and gained 11.3% so far in 2025.

Momentum for the company remains subdued, evidenced by its shares consistently trading below both the 50-day and the 200-day moving averages since August.

A notable event punctuated the stock’s trajectory on July 24, when the company released its Q2 2025 financial results. Adjusted revenue rose 3.9% year over year (YoY), reaching $4.34 billion, aligning with Street forecasts. Adjusted EPS climbed 6.8% from the prior year’s quarter to $9.11, surpassing Wall Street expectations of $9.

Despite the encouraging results, the stock slipped roughly 3.7% that day. Investor caution appeared tied to rising adjusted operating expenses, which increased 4.3% annually to $3.2 billion, and broader market volatility.

Even so, analysts seem optimistic about the stock’s long-term outlook. Assets under management, administration, and advisement hit a record $1.6 trillion, up 9%. Steady client asset growth, combined with dividend increases and capital return initiatives, could strengthen confidence in sustained profitability.

However, the stock’s performance remains muted when compared with its rival Bank of New York Mellon Corporation (BK), which has surged 54.3% over the past 52 weeks and 38.6% on a YTD basis, illustrating the relative underperformance of AMP shares.

Even with recent hindrances and the stock’s lingering softness, analysts are maintaining a measured optimism about the company’s long-term prospects. AMP stock has a consensus rating of “Moderate Buy” from the 14 analysts in coverage, with the mean price target of $560.18 reflecting a premium of 12.7% from current levels.