With a market cap of $112.8 billion, Altria Group, Inc. (MO) is a leading manufacturer and marketer of tobacco products in the United States. Through its subsidiaries, the company offers a diverse portfolio that includes iconic cigarette, cigar, smokeless tobacco, oral nicotine, and e-vapor brands such as Marlboro, Black & Mild, Copenhagen, Skoal, on!, and NJOY ACE.

Companies valued over $10 billion are generally described as “large-cap” stocks, and Altria Group fits right into that category. In addition, Altria holds equity investments in Anheuser-Busch InBev and Cronos Group, extending its presence into brewing and cannabinoids.

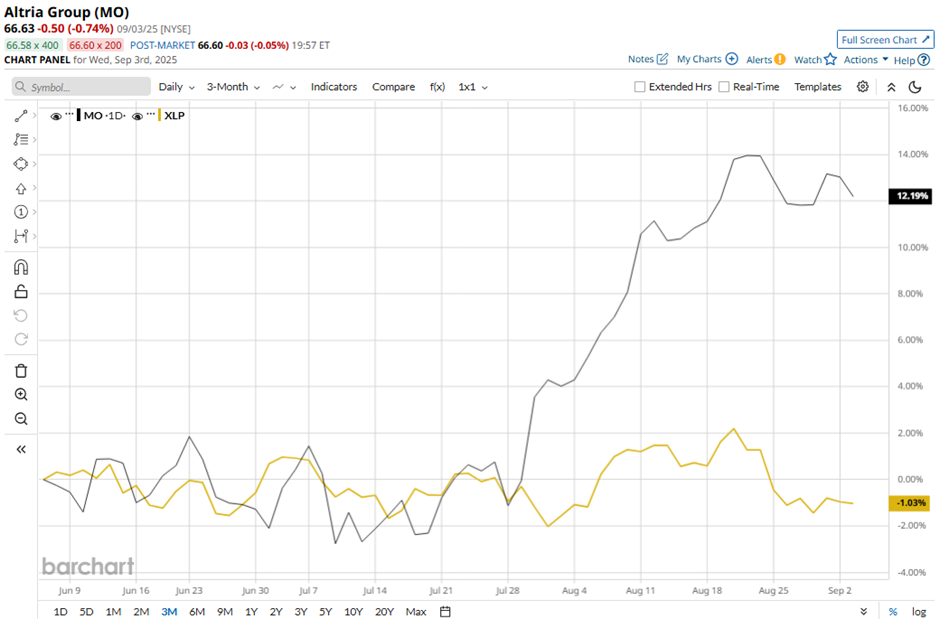

Shares of the Richmond, Virginia-based company have pulled back 2.9% from its 52-week high of $68.60. MO stock has risen 10.4% over the past three months, outpacing the Consumer Staples Select Sector SPDR Fund’s (XLP) 2.7% decrease over the same time frame.

Longer term, MO stock is up 27.4% on a YTD basis, outperforming XLP’s 2.5% return. Moreover, shares of the tobacco giant have increased 23.2% over the past 52 weeks, compared to XLP’s over 3% drop over the same time frame.

Despite a few fluctuations, MO stock has been trading mostly above its 50-day and 200-day moving averages since last year.

Altria’s shares rose 3.6% on Jul. 30 after the company beat Wall Street expectations with Q2 2025 adjusted EPS of $1.44 and adjusted revenue of $5.3 billion. Strong demand for its on! nicotine pouches, with shipment volumes surging 26.5%, offset a 10.2% drop in its smokeable products segment and the ongoing halt of its NJOY vape brand. Investors also reacted positively to Altria raising its annual adjusted EPS guidance to $5.35 - $5.45.

However, rival Turning Point Brands, Inc. (TPB) has significantly outperformed MO stock. TPB stock has climbed 61.4% on a YTD basis and 141.8% over the past 52 weeks.

Due to MO’s underperformance relative to its industry peers, analysts are cautious about its prospects. MO stock has a consensus rating of “Hold” from the 15 analysts in coverage, and as of writing, the stock is trading above the mean price target of $61.45.