Shopify (SHOP) on Thursday is giving the bulls something to cheer about, as its shares leap.

At today's high, Shopify stock was up 29% and it’s still sporting big gains, up 27% at last glance. The move comes after better-than-expected earnings results.

The company beat non-GAAP-earnings estimates but missed on GAAP expectations, while reporting stronger-than-expected 25% revenue growth. Shopify also borrowed a page from megacap tech, announcing more job cuts.

Don't Miss: Take a Bite of Chipotle Stock? Here's Where to Buy the Dip

Once a growth-stock darling, Shopify fell on hard times during the 2022 bear market. The shares collapsed, a peak-to-trough decline of about 86%.

That said, today’s rally is icing on the cake for the bulls who bought the big dip.

The shares have now more than doubled (up 144%) from the 52-week low and post a year-to-date gain of 66%. Can it continue?

Trading Shopify Stock on Earnings

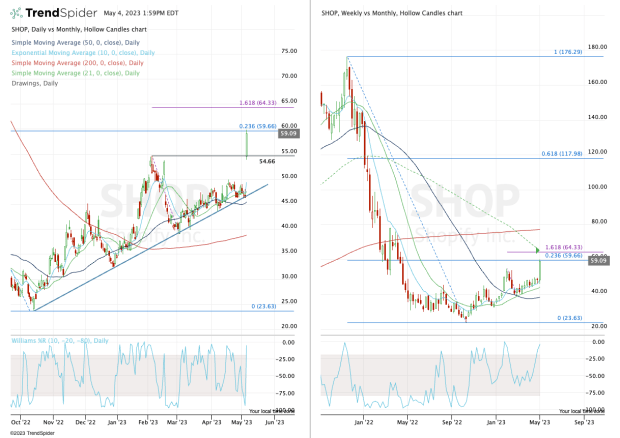

Chart courtesy of TrendSpider.com

Notice how Shopify stock has been grinding higher along uptrend support (blue line) and with each pullback — big or small — found this measure as support.

The shares also continued to put in a series of higher highs and higher lows, a bullish technical development.

With today’s gap-up open, Shopify shares began trading right near the year-to-date high at $54.66.

The rally sent Shopify up to almost $60 before it pulled back. The stock faded after traders took some profits at the 23.6% retracement (as measured from the 52-week low to the all-time high).

Don't Miss: Set Sail With Cruise Stocks? Trading Royal Caribbean and Carnival Now

The move we see today is well-defined, but how it moves from here is less clear.

On the upside, the bulls want to see a move up through the post-earnings high and the 23.6% retracement. A close above $60 could create a move up to the 21-month moving average currently near $65.

That’s also the 161.8% extension from the March low to the February high (or in other words, the previous range) and a reasonable upside target to shoot for should the stock clear $60.

On the downside, bulls need to hold the post-earnings low and current breakout level around $54.50. If the stock cannot do that, it puts $50 or lower back in play, with the post-earnings gap-fill down near $48.

Action Alerts PLUS offers expert portfolio guidance to help you make informed investing decisions. Sign up now.