Many Americans will spend 20 years or more in retirement, if they retire at age 65. Today’s 65-year-old American has an average life expectancy of 85 years, according to insurance company TIAA. Their savings, however, may be unable to afford a longer lifespan. A new study from GOBankingRates reveals there are five states where single retirees with $1 million in savings plus Social Security will burn through these funds in 20 years or less.

See More: GOBankingRates Original Research Center

View Next: 25 Places To Buy a Home If You Want It To Gain Value

GOBankingRates found how far $1 million in savings plus Social Security income goes in each state by studying key factors such as the population ages 65 and over and the average cost of living for retired households. We utilized the Social Security Administration to source the average Social Security income for one person and a married couple. From there, the cost of living after Social Security income was calculated to determine how long $1 million in savings would last for a single retiree and a couple.

Key Findings

- Hawaii, Massachusetts, California, Alaska and New York are the five states where $1 million in savings with Social Security is wiped out in 20 years or less for single retirees. In Hawaii, this amount is depleted in 12 years for singles and 14 years for married couples.

- There are only three East Coast states where single retirees can fund 30 years in retirement with $1 million and Social Security: North Carolina (30 years), South Carolina (32 years) and Georgia (34 years).

- There are six Midwest states where $1 million and Social Security funds up to 35+ years for single retirees: Indiana (35 years), North Dakota (35 years), Michigan (35 years), Kansas (35 years), Iowa (36 years) and Missouri (37 years).

- In Oklahoma, $1 million in savings plus Social Security affords 39 years for singles and a whopping 71 years for married couples in retirement.

Take a look at the states where Social Security lasts the longest — and where these benefits deplete the fastest. And consider reviewing how much it costs to comfortably retire without Social Security in every state.

Learn More: 3 Ways AI Is Quietly Transforming Retirement Planning — and What It Means for Your Money

For You: Here’s How Much You Need To Retire With a $100K Lifestyle

1. Hawaii

- Population 65+ (%): 21.5%

- Annual cost of living for a retired person: $105,490

- Years $1 million lasts w/Social Security for one: 12.29

- Years $1 million lasts w/Social Security for couple: 14.3

Check Out: Dave Ramsey Warns This Common Habit Can Ruin Your Retirement

2. Massachusetts

- Population 65+ (%): 18.7%

- Annual cost of living for a retired person: $83,964

- Years $1 million lasts w/Social Security for one: 16.7

- Years $1 million lasts w/Social Security for couple: 20.66

3. California

- Population 65+ (%): 16.5%

- Annual cost of living for a retired person: $81,938

- Years $1 million lasts w/Social Security for one: 17.29

- Years $1 million lasts w/Social Security for couple: 21.56

4. Alaska

- Population 65+ (%): 14.8%

- Annual cost of living for a retired person: $73,663

- Years $1 million lasts w/Social Security for one: 20.18

- Years $1 million lasts w/Social Security for couple: 26.24

5. New York

- Population 65+ (%): 18.9%

- Annual cost of living for a retired person: $72,159

- Years $1 million lasts w/Social Security for one: 20.81

- Years $1 million lasts w/Social Security for couple: 27.32

6. Maryland

- Population 65+ (%): 17.6%

- Annual cost of living for a retired person: $66,488

- Years $1 million lasts w/Social Security for one: 23.59

- Years $1 million lasts w/Social Security for couple: 32.33

Read More: The Most Common Retirement Mistake, According to an Expert

7. New Jersey

- Population 65+ (%): 18%

- Annual cost of living for a retired person: $66,430

- Years $1 million lasts w/Social Security for one: 23.62

- Years $1 million lasts w/Social Security for couple: 32.39

8. Vermont

- Population 65+ (%): 22.9%

- Annual cost of living for a retired person: $65,794

- Years $1 million lasts w/Social Security for one: 23.98

- Years $1 million lasts w/Social Security for couple: 33.07

9. Connecticut

- Population 65+ (%): 19.4%

- Annual cost of living for a retired person: $65,678

- Years $1 million lasts w/Social Security for one: 24.05

- Years $1 million lasts w/Social Security for couple: 33.20

10. Maine

- Population 65+ (%): 23.5%

- Annual cost of living for a retired person: $65,620

- Years $1 million lasts w/Social Security for one: 24.08

- Years $1 million lasts w/Social Security for couple: 33.27

11. Oregon

- Population 65+ (%): 19.9%

- Annual cost of living for a retired person: $65,215

- Years $1 million lasts w/Social Security for one: 24.32

- Years $1 million lasts w/Social Security for couple: 33.72

Discover Next: The Roth Conversion Mistake That Could Cost You Tens of Thousands — and How To Get It Right

12. Arizona

- Population 65+ (%): 19.7%

- Annual cost of living for a retired person: $65,099

- Years $1 million lasts w/Social Security for one: 24.39

- Years $1 million lasts w/Social Security for couple: 33.85

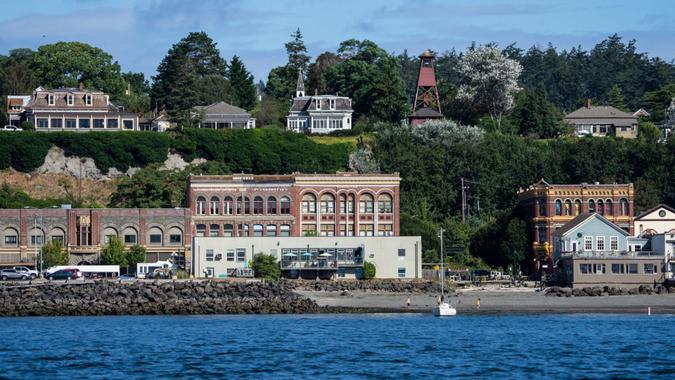

13. Washington

- Population 65+ (%): 17.3%

- Annual cost of living for a retired person: $64,810

- Years $1 million lasts w/Social Security for one: 24.56

- Years $1 million lasts w/Social Security for couple: 34.19

14. New Hampshire

- Population 65+ (%): 21.5%

- Annual cost of living for a retired person: $63,710

- Years $1 million lasts w/Social Security for one: 25.25

- Years $1 million lasts w/Social Security for couple: 35.52

15. Rhode Island

- Population 65+ (%): 19.8%

- Annual cost of living for a retired person: $63,248

- Years $1 million lasts w/Social Security for one: 25.54

- Years $1 million lasts w/Social Security for couple: 36.12

16. Colorado

- Population 65+ (%): 16.5%

- Annual cost of living for a retired person: $60,181

- Years $1 million lasts w/Social Security for one: 27.72

- Years $1 million lasts w/Social Security for couple: 40.61

For You: Dave Ramsey Reveals the Biggest 401(k) Mistake People Make

17. Delaware

- Population 65+ (%): 21.7%

- Annual cost of living for a retired person: $59,891

- Years $1 million lasts w/Social Security for one: 27.94

- Years $1 million lasts w/Social Security for couple: 41.10

18. Florida

- Population 65+ (%): 21.8%

- Annual cost of living for a retired person: $59,023

- Years $1 million lasts w/Social Security for one: 28.63

- Years $1 million lasts w/Social Security for couple: 42.62

19. Idaho

- Population 65+ (%): 17.8%

- Annual cost of living for a retired person: $59,023

- Years $1 million lasts w/Social Security for one: 28.63

- Years $1 million lasts w/Social Security for couple: 42.62

20. Virginia

- Population 65+ (%): 17.6%

- Annual cost of living for a retired person: $58,676

- Years $1 million lasts w/Social Security for one: 28.92

- Years $1 million lasts w/Social Security for couple: 43.26

21. Utah

- Population 65+ (%): 12.4%

- Annual cost of living for a retired person: $58,155

- Years $1 million lasts w/Social Security for one: 29.36

- Years $1 million lasts w/Social Security for couple: 44.25

See Next: Here’s How To Avoid the Biggest Mistake Retirement Savers Make During a Market Downturn

22. Wisconsin

- Population 65+ (%): 19.6%

- Annual cost of living for a retired person: $57,577

- Years $1 million lasts w/Social Security for one: 29.87

- Years $1 million lasts w/Social Security for couple: 45.42

23. Nevada

- Population 65+ (%): 17.6%

- Annual cost of living for a retired person: $57,577

- Years $1 million lasts w/Social Security for one: 29.87

- Years $1 million lasts w/Social Security for couple: 45.42

24. North Carolina

- Population 65+ (%): 17.9%

- Annual cost of living for a retired person: $56,593

- Years $1 million lasts w/Social Security for one: 30.78

- Years $1 million lasts w/Social Security for couple: 47.54

25. Pennsylvania

- Population 65+ (%): 20.4%

- Annual cost of living for a retired person: $56,419

- Years $1 million lasts w/Social Security for one: 30.94

- Years $1 million lasts w/Social Security for couple: 47.94

26. South Dakota

- Population 65+ (%): 19%

- Annual cost of living for a retired person: $56,304

- Years $1 million lasts w/Social Security for one: 31.05

- Years $1 million lasts w/Social Security for couple: 48.20

That’s Interesting: 7 Things You Should Own in Retirement, According to Kevin Lum

27. Wyoming

- Population 65+ (%): 20%

- Annual cost of living for a retired person: $56,130

- Years $1 million lasts w/Social Security for one: 31.22

- Years $1 million lasts w/Social Security for couple: 48.61

28. Montana

- Population 65+ (%): 21.2%

- Annual cost of living for a retired person: $55,783

- Years $1 million lasts w/Social Security for one: 31.56

- Years $1 million lasts w/Social Security for couple: 49.45

29. Ohio

- Population 65+ (%): 19.1%

- Annual cost of living for a retired person: $55,031

- Years $1 million lasts w/Social Security for one: 32.33

- Years $1 million lasts w/Social Security for couple: 51.36

30. Illinois

- Population 65+ (%): 17.9%

- Annual cost of living for a retired person: $54,799

- Years $1 million lasts w/Social Security for one: 32.57

- Years $1 million lasts w/Social Security for couple: 51.97

31. South Carolina

- Population 65+ (%): 19.8%

- Annual cost of living for a retired person: $54,741

- Years $1 million lasts w/Social Security for one: 32.64

- Years $1 million lasts w/Social Security for couple: 52.13

View More: I’m a Wealth Coach: 4 Ways To Build a Resilient Retirement Portfolio in 2025

32. New Mexico

- Population 65+ (%): 20.1%

- Annual cost of living for a retired person: $54,510

- Years $1 million lasts w/Social Security for one: 32.88

- Years $1 million lasts w/Social Security for couple: 52.77

33. Minnesota

- Population 65+ (%): 18.2%

- Annual cost of living for a retired person: $54,220

- Years $1 million lasts w/Social Security for one: 33.20

- Years $1 million lasts w/Social Security for couple: 53.59

34. Louisiana

- Population 65+ (%): 17.8%

- Annual cost of living for a retired person: $53,931

- Years $1 million lasts w/Social Security for one: 33.52

- Years $1 million lasts w/Social Security for couple: 54.43

35. Nebraska

- Population 65+ (%): 17.4%

- Annual cost of living for a retired person: $53,468

- Years $1 million lasts w/Social Security for one: 34.05

- Years $1 million lasts w/Social Security for couple: 55.84

36. Texas

- Population 65+ (%): 14%

- Annual cost of living for a retired person: $53,121

- Years $1 million lasts w/Social Security for one: 34.46

- Years $1 million lasts w/Social Security for couple: 56.94

Explore Next: You’ll Run Out of Money in 20 Years’ — Why Retirees Are Rethinking Their Savings Strategy

37. Kentucky

- Population 65+ (%): 18%

- Annual cost of living for a retired person: $53,063

- Years $1 million lasts w/Social Security for one: 34.53

- Years $1 million lasts w/Social Security for couple: 57.13

38. Georgia

- Population 65+ (%): 15.8%

- Annual cost of living for a retired person: $53,063

- Years $1 million lasts w/Social Security for one: 34.53

- Years $1 million lasts w/Social Security for couple: 57.13

39. Indiana

- Population 65+ (%): 17.6%

- Annual cost of living for a retired person: $52,542

- Years $1 million lasts w/Social Security for one: 35.16

- Years $1 million lasts w/Social Security for couple: 58.88

40. North Dakota

- Population 65+ (%): 17.6%

- Annual cost of living for a retired person: $52,542

- Years $1 million lasts w/Social Security for one: 35.16

- Years $1 million lasts w/Social Security for couple: 58.88

41. Arkansas

- Population 65+ (%): 18.2%

- Annual cost of living for a retired person: $52,369

- Years $1 million lasts w/Social Security for one: 35.37

- Years $1 million lasts w/Social Security for couple: 59.49

Trending Now: I Help People Retire Every Day — Here’s the Most Common Retirement Mistake People Make

42. Tennessee

- Population 65+ (%): 17.6%

- Annual cost of living for a retired person: $52,079

- Years $1 million lasts w/Social Security for one: 35.74

- Years $1 million lasts w/Social Security for couple: 60.53

43. Michigan

- Population 65+ (%): 19.6%

- Annual cost of living for a retired person: $51,964

- Years $1 million lasts w/Social Security for one: 35.89

- Years $1 million lasts w/Social Security for couple: 60.96

44. Kansas

- Population 65+ (%): 18%

- Annual cost of living for a retired person: $51,906

- Years $1 million lasts w/Social Security for one: 35.96

- Years $1 million lasts w/Social Security for couple: 61.17

45. Iowa

- Population 65+ (%): 18.9%

- Annual cost of living for a retired person: $51,848

- Years $1 million lasts w/Social Security for one: 36.04

- Years $1 million lasts w/Social Security for couple: 61.39

46. West Virginia

- Population 65+ (%): 21.9%

- Annual cost of living for a retired person: $51,269

- Years $1 million lasts w/Social Security for one: 36.81

- Years $1 million lasts w/Social Security for couple: 63.65

Be Aware: Here’s Why You Might Want To Invest Your Retirement Savings in a Roth 401(k)

47. Missouri

- Population 65+ (%): 18.7%

- Annual cost of living for a retired person: $50,922

- Years $1 million lasts w/Social Security for one: 37.28

- Years $1 million lasts w/Social Security for couple: 65.09

48. Alabama

- Population 65+ (%): 18.5%

- Annual cost of living for a retired person: $50,691

- Years $1 million lasts w/Social Security for one: 37.61

- Years $1 million lasts w/Social Security for couple: 66.09

49. Mississippi

- Population 65+ (%): 18.1%

- Annual cost of living for a retired person: $50,517

- Years $1 million lasts w/Social Security for one: 37.85

- Years $1 million lasts w/Social Security for couple: 66.85

50. Oklahoma

- Population 65+ (%): 16.9%

- Annual cost of living for a retired person: $49,475

- Years $1 million lasts w/Social Security for one: 39.41

- Years $1 million lasts w/Social Security for couple: 71.86

Discover more original studies and surveys in the GOBankingRates original research center.

Methodology: GOBankingRates found population from the U.S. Census American Community Survey, cost of living from Missouri Economic and Research Information Center and the Bureau of Labor Statistics Consumer Expenditure Survey. The average Social Security income for one person and a married couple were sourced from the Social Security Administration. The states were sorted to show the shortest to longest amount of time to drawdown. All data was collected on and is up to date as of Oct. 6, 2025.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: How Far $1 Million in Savings Plus Social Security Goes in All 50 States