Many components contribute to the cost of your home. Along with price, the interest rate on your mortgage is an important consideration.

Currently, mortgage rates are among the lowest they have been in one year. The average rate on a 30-year mortgage is 6.09%, according to Freddie Mac.

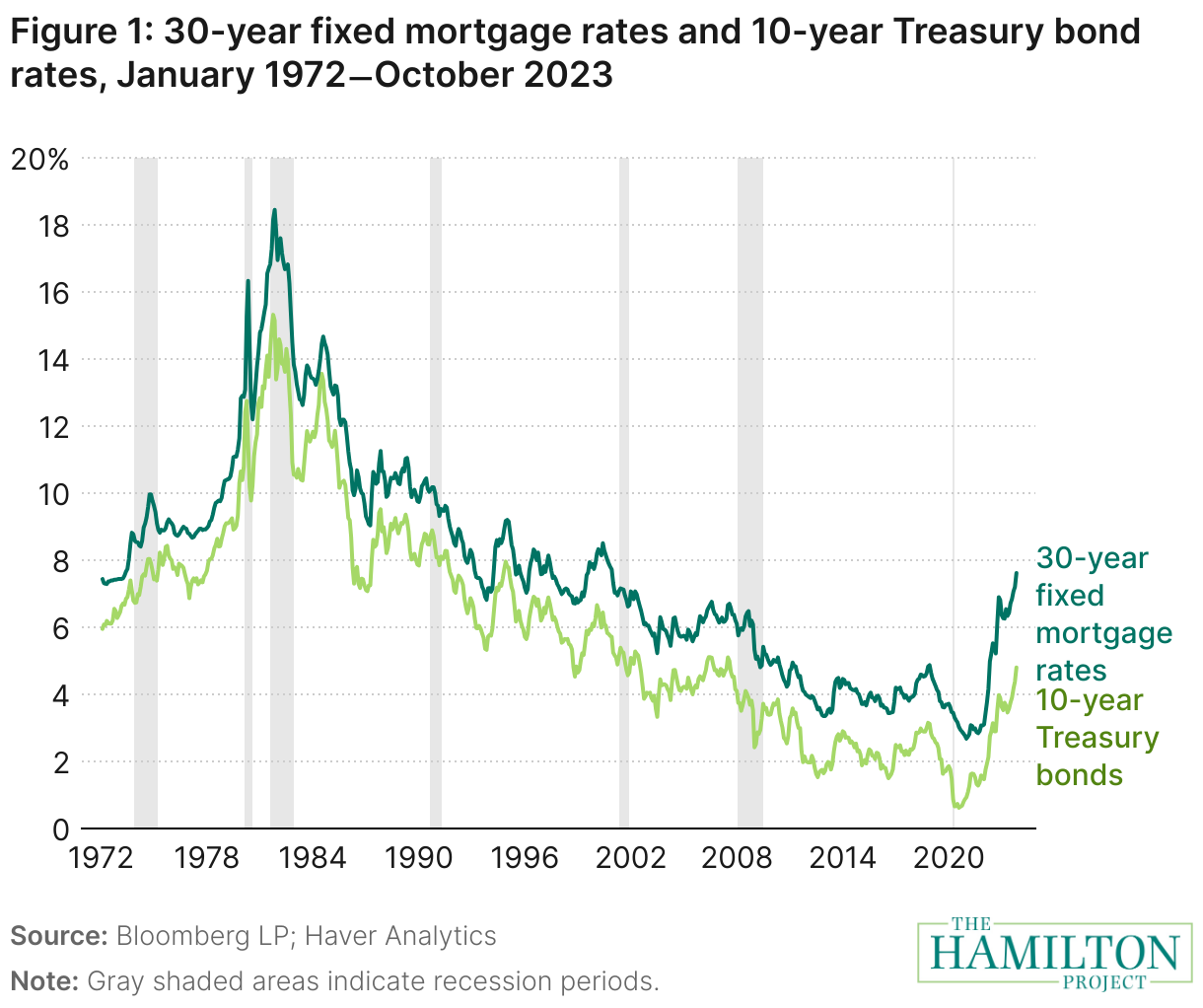

And with the Fed recently cutting rates due to a weak job market, borrowing costs are expected to decrease. But does this apply to mortgages? While the Federal Reserve’s decisions can influence savings accounts and short-term lending rates, mortgage rates tend to follow the 10-year Treasury yield more closely.

What's the 10-year Treasury yield?

The 10-year Treasury yield is the government's borrowing cost for a decade. As such, the Treasury rate influences everything from corporate bonds to mortgage rates.

You can see the correlation between mortgage rates and the 10-year Treasury bond in the chart below:

Why are mortgage rates tied to the 10-year Treasury yield? Since mortgages last longer than shorter-term lending options tied to the federal funds rate, they require a benchmark, where the duration reflects the average mortgage.

This is why the 10-year Treasury yield comes in, because it lasts about as long as the average homeowner has a mortgage.

If you're in the market for a new mortgage, use the tool below, powered by Bankrate, to compare and find some of today's rates:

How does the Treasury yield impact mortgage rates?

Recently, the 10-year Treasury yield increased to 4.26%. And when this yield rises, so can borrowing costs, specifically with mortgage interest rates.

With this in mind, who influences the Treasury yield? It's investors' expectations on short-term interest rates. When investors buy mortgage-backed securities, they're pledging money for a longer term than, say, a one-year Treasury bill since they're investing in a package of mortgage loans.

As such, elevated risk comes with longer-term investments.

It's why investors want a term premium to ensure they're earning a return on their investments. This premium influences the interest rate you'll pay on mortgages.

They use the following economic factors to guide their expectations:

- Monetary policies: When the Federal Reserve sets the federal funds rate, it's a benchmark for short-term rates. While it doesn't directly impact mortgage rates lenders assess, it can give investors an idea of future monetary policy, which they can use to influence investing decisions. And if investors lose confidence in the Fed, they might require higher returns, which could raise mortgage rates.

- Economic growth: When the economy does well, investors seek more promising opportunities such as equities. Meanwhile, when there's economic uncertainty, as there is now, with more tariffs being implemented and slower job growth, investors look for safer investments, which Treasury bonds offer.

- Inflation: When inflation becomes higher, investors seek higher interest rates.

What's the mortgage spread?

On top of this, there's a mortgage spread. It's the difference between your mortgage rate and the 10-year Treasury yield. Traditionally, it's been from 0.71 points to 1.4 points, according to Fannie Mae.

The spread consists of two parts: The primary-secondary spread and the secondary spread. The primary-secondary spread factors in mortgage origination fees, other lender costs and profits.

Meanwhile, the secondary mortgage spread is the difference between the mortgage-backed security (MBS), which investors purchase, and the 10-year Treasury rate.

The secondary spread covers some risks investors might face. To illustrate, an increased risk of prepayment can cause the spread to rise as investors won't maximize returns if the mortgage ends prematurely.

This can happen when homeowners shop around and find a lower interest rate; they might be inclined to take advantage of it through refinancing.

Why the 10-year Treasury yield matters for your mortgage rate

The 10-year Treasury yield plays a major role in determining mortgage rates, so when it drops, borrowing often becomes more affordable. However, economic factors such as inflation and investor confidence can still cause interest rates to fluctuate.

If you're considering buying or refinancing, keep an eye on the Treasury yield, but also compare lenders to find the best deal for your specific situation.