Traders and financial professionals deal with time management in ways most jobs don't really have to think about. Markets open early, news breaks at random hours, positions need watching across different time zones. Global markets run 24 hours basically, which means work never actually stops. That takes a toll eventually on personal life.

The Problem With Always-On Trading Culture

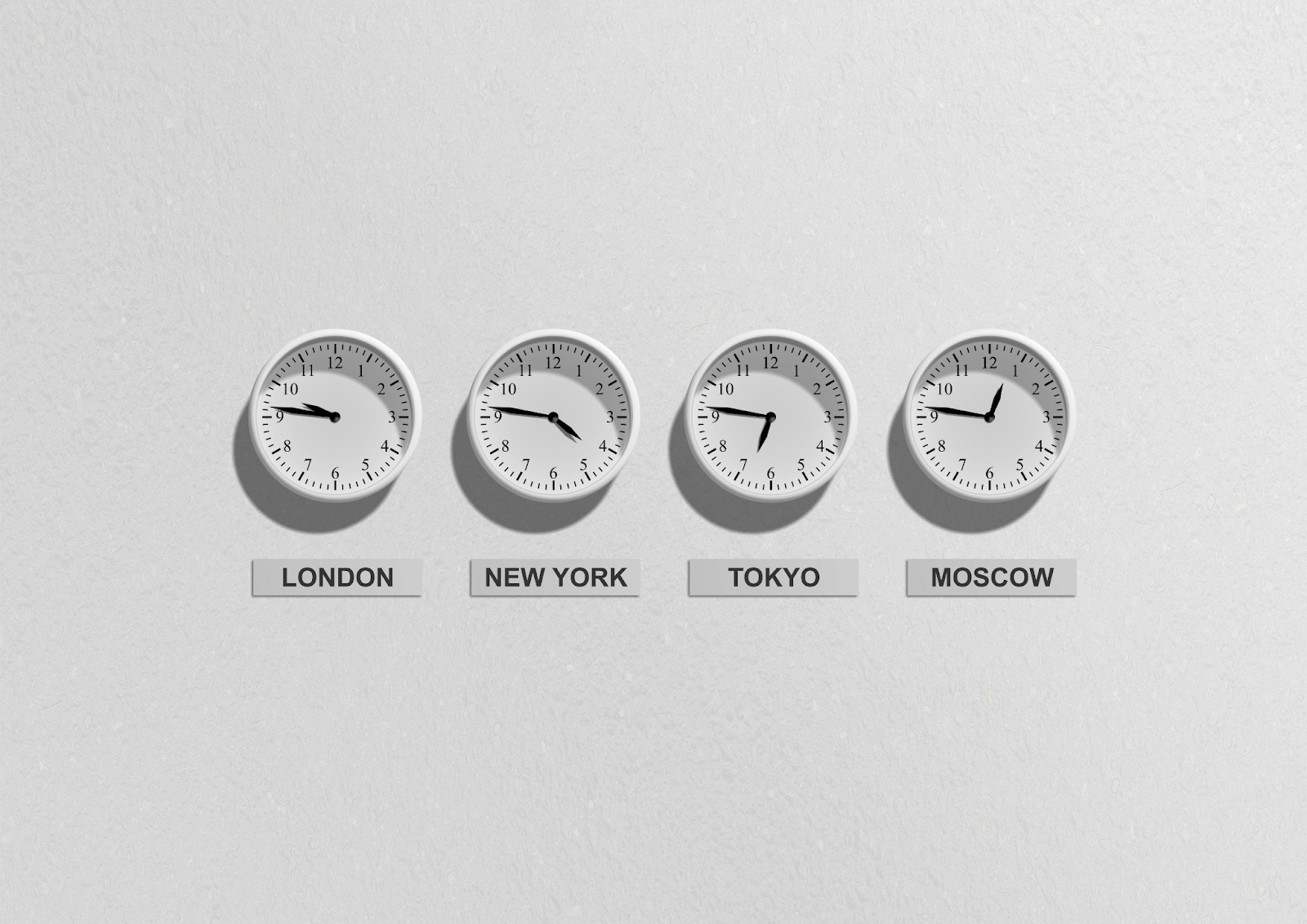

Financial markets don't sleep, which everyone knows but the implications are worse than people think. Forex runs 24 hours during the week, crypto literally never closes. Asian markets open while American traders should be sleeping. This creates constant pressure to stay connected, checking positions during dinner or waking up at 3am to see what happened in Europe.

Institutional traders at hedge funds and banks work brutal hours during volatile periods. Earnings season, Fed announcements, geopolitical stuff, all these require extended attention that just eats into everything else. The culture celebrates overwork sometimes. People brag about pulling all-nighters when markets are stressed, which is kind of ridiculous but it happens. That mindset destroys work-life balance over time, leads to burnout and honestly worse trading decisions because exhaustion clouds judgment.

Why Tracking Hours Actually Matters

Most traders don't track their actual time spent on market-related activities. Screen time watching charts is obvious enough. But research time, reading news, backtesting strategies, journaling trades, responding to alerts, all that adds up fast. What feels like maybe a few hours daily turns into 60-80 hours weekly when properly measured, which is insane.

Using an hours calculator quantifies actual time on trading versus other life activities. The numbers shock people usually when traders first track honestly. Someone thinks they work reasonable hours but the calculator shows 12-hour days six days per week. Not sustainable long-term regardless of how profitable the trading is. Awareness changes behavior though, which is the whole point. When traders see concrete data showing 70 hours weekly on markets, it becomes harder to ignore the imbalance. Vague feelings that work is taking over don't motivate change effectively. Hard numbers proving it do.

Setting Boundaries Through Time Awareness

Tracking work hours creates natural boundaries that didn't exist before. Deciding to limit trading to 50 hours weekly requires knowing when that threshold hits. Without measurement, hours creep upward invisibly until work consumes everything, which happens faster than people expect.

Some traders set hard cutoffs for daily market hours. Trade from 9:30am to 4pm Eastern then close the platform regardless of what's happening. Works for equity traders but currency and crypto traders need different approaches since their markets run longer. The principle stays the same though - defining when work stops requires knowing when it starts and how long it runs.

Weekend trading is where balance gets lost without people realizing. Checking positions Saturday morning seems harmless but leads to chart analysis, news reading, strategy adjustments. Suddenly half the weekend disappeared. Tracking shows how weekend hours pile up and forces decisions about whether that time is actually worth it.

Measuring Productivity Not Just Time

Hour tracking reveals patterns about time versus results. A trader might work 60 hours weekly but only 20 hours involve actual trading or meaningful analysis. The rest is distraction, news consumption with no actionable edge, repetitive chart checking without real purpose.

Institutional analysts spend huge amounts of time in meetings that don't improve market insights. Tracking makes this waste visible, which is uncomfortable but necessary. When 15 hours weekly go to meetings producing nothing useful, that's clear data for pushing back on unnecessary attendance.

The Mental Health Connection

Overwork in trading damages mental health differently because positions create ongoing stress even outside market hours. An overnight position means stress while trying to sleep. Weekend positions mean work time and hence stress through Saturday and Sunday instead of actual rest. Time tracking shows how much of life exists under this stress versus truly disconnected time. Hedge fund managers and institutional traders have high rates of anxiety and depression, partly from unlimited work hours obviously. The competitive environment makes taking time off feel like falling behind everyone else. Tracking hours helps see when operating at unsustainable levels before complete burnout hits.

Professional trading is a marathon not a sprint, though the industry often treats it like sprinting constantly. Careers last decades if managed properly but only a few years if burnout wins. Time management separates traders who last from those who flame out despite having talent. Institutional traders switching to independent trading struggle with boundaries initially. Corporate jobs had some structure even if hours were long. Independence removes all external limits which sounds great until it isn't. Without deliberate time tracking, former institutional traders sometimes work even more hours independently than they did at big funds, which defeats the whole purpose of going independent.

Building Better Systems Through Measurement

Keeping track of time identifies inefficiencies in trading workflows that you wouldn't notice otherwise. Spending three hours daily on research that doesn't improve decisions is pure waste. Maybe that research time drops to 30 minutes with better systems or gets eliminated entirely if it's not producing edge, which is often the case.

Risk management improves with time awareness too. Traders who constantly monitor positions do so usually because their position sizing is too large for comfort. Appropriate position size means checking once or twice daily works fine. Time tracking shows excessive monitoring patterns indicating position sizing problems underneath. Automation becomes more valuable once traders see time going to routine tasks. Maybe trade journaling takes 45 minutes daily, that's 5.5 hours weekly that software could handle instead. Tracking quantifies the time value of automation investments, making the ROI calculation actually possible.

Conclusion

Clocking work hours sounds simple but represents a significant mindset shift for trading professionals. Markets reward attention and punish inattention so limiting hours feels dangerous initially, like leaving money on the table. Data shows consistently though that rested focused traders outperform exhausted overworked ones even when total hours are lower, which goes against the industry culture but it's true.

Starting hour tracking doesn't require complex systems or fancy software. Basic spreadsheet showing start time, end time, activity type provides enough information to identify patterns and problems. The barrier isn't technical, it's psychological resistance to seeing reality clearly without filters.