Akira Minamikawa, director at British data and information services company IHS Markit, spoke with The Yomiuri Shimbun about recent global trends in semiconductors and the future of Japanese manufacturers. The following is an excerpt from the interview.

Robust demand for memory

The Yomiuri Shimbun: What do you think about recent demand for semiconductors?

Minamikawa: Global demand for semiconductors is extremely robust. This demand extends to a wide array of sectors, such as industrial machinery, the practical use of big data, and automobiles, where the development of self-driving vehicles is moving ahead. However, semiconductor prices have fluctuated wildly in the past. Great care will be needed in the years ahead.

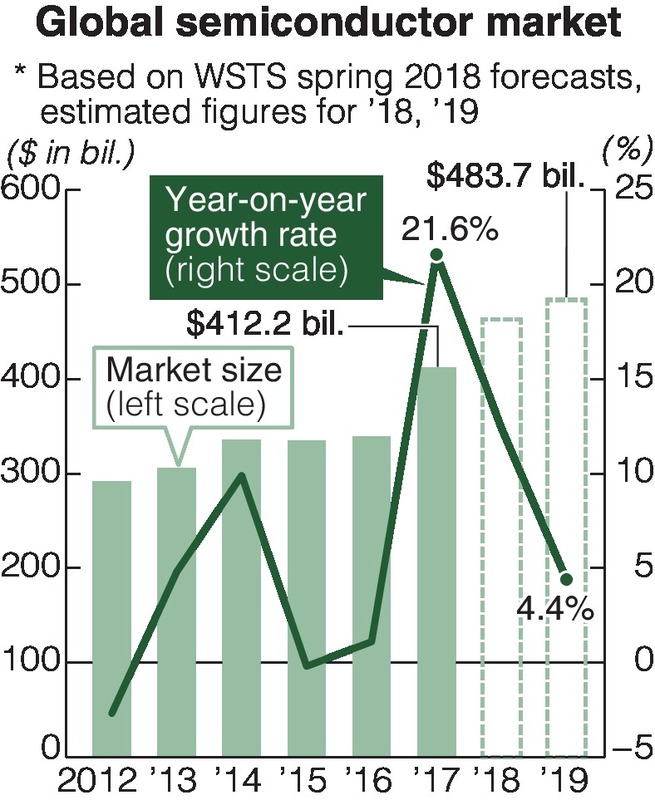

[According to World Semiconductor Trade Statistics, the 2017 global market expanded 21.6 percent from the previous year to reach 412.2 billion dollars (about 46 trillion yen). The market is forecast to grow 12.4 percent in 2018.]

A: There has been especially strong growth in demand for storage media, or memory. The increasing use of cloud computing, in which image and other data is stored and accessed over the internet rather than on your own personal computer, has been a major factor behind this growth. A lot of memory has become a necessity in data centers that store a huge amount of data.

With regard to data storage methods, the switch from hard disk drives (HDDs) to solid state drives (SSDs), which can quickly read data and are better able to withstand physical impact, also has been significant. Memory chips are stored inside an SSD. Because they can process data very quickly, a server is more unlikely to go down, even when there is heavy access.

U.S. information technology giant Hewlett-Packard Co. introduced SSDs to its data center, and other companies have followed suit. Many data centers are now switching from HDDs to SSDs. Even the internet of things, which connects almost any kind of device or object to the internet, will need vast amounts of memory to handle the big data used for everything from medical care to agriculture to transport networks. This field's steady growth probably will continue for the next two or three years.

In addition to memory, semiconductors are used in many forms, such as the central processing unit that is the brain of personal computers and smartphones, and the integrated circuits used in image processing.

A growing number of vehicles are being fitted with advanced driver assistance systems capable of detecting when an accident might occur. These systems use many semiconductors for image processing and other functions.

Factory automation is boosting demand for semiconductors to be used in the control of the movements of industrial machinery. Surging personnel costs in China's manufacturing industries have blunted the cost-competitiveness that was one of their strengths. More companies are making investments to lower their personnel costs.

This unexpected growth in many areas has resulted in a shortage of silicon wafers, the main semiconductor material. A collapse in the supply-demand balance caused prices to skyrocket, which also led to market expansion.

China's production could hit prices

Q: How do you see market trends in the near future?

A: Memory accounts for about 30 percent of the semiconductor market. However, it is difficult to believe that the currently favorable conditions of the memory market will continue for long. World Semiconductor Trade Statistics forecasts growth in the overall semiconductor market will be only 4.4 percent in 2019.

There is a history of memory chipmakers overproducing, which causes prices to fall and profits to drop. This has been dubbed the "silicon cycle." I think this cycle still remains in place.

[Around 2010, prices of dynamic random access memory (DRAM), the main memory chips used in computers, plunged. This resulted in the collapse of Elpida Memory Inc., a symbol of "made-in-Japan semiconductors" that had been created by the merger of several major Japanese manufacturers' DRAM operations.]

A: The memory market had grown because its price was going down. In recent years, prices have risen due to diversified demand, yet memory has sold well. It is hard to think that will continue forever. There are only a few types of memory, and as mass-production moves ahead, many similar products will arrive on the market, which can easily upset the demand-supply balance.

China is strengthening its semiconductor industry as a national policy. Consequently, due to the massive investment in the industry, it is possible that memory production capacity could grow dramatically. If that happens, we could see a repeat of the falling steel prices caused by a glut of steel due to overproduction.

Parts makers should team up

Q: How can Japanese semiconductor manufacturers survive in the years ahead?

A: As things stand, I think Japanese manufacturers will struggle to survive if they intend to rely solely on semiconductors. Huge overseas makers, such as South Korea's Samsung Electronics Co., are trying to get even bigger through business mergers and acquisitions, so the gap between them and the rest of the field likely will grow.

[According to IHS Markit, Samsung Electronics led the global rankings for semiconductor sales in 2017. Japan's Toshiba Corp. ranked eighth, but its memory business has been sold to a Japan-U.S.-South Korea consortium led by a U.S. investment fund.]

A: There is a way for Japanese firms to survive. Electrical appliances are made with semiconductors and many electronic components. Japan is home to many competitive electronic component manufacturers, such as Murata Manufacturing Co. and Nidec Corp. Rather than just focusing on the fight for semiconductor dominance, I think it would be better to strengthen the horizontal connections between electronic component makers involved in the production of electrical appliances.

This strategy would provide systems and modules formed by a combination of semiconductors, electronic components, motors and other parts. This is not something makers in other nations could quickly do. Japan still has plenty of chances to win in this field.

Saving and more efficiently using energy is one of Japan's technological fortes, and there are expectations that the global need for such products will grow. Further honing semiconductor technologies that consume only a little electricity also could become one way for Japan's semiconductor industry to survive.

-- This interview was conducted by Yomiuri Shimbun Staff Writer Daisuke Segawa.

-- Akira Minamikawa / Director, Semiconductor Value Chain at IHS Markit

Minamikawa, 59, graduated from Musashi Institute of Technology's Electrical Engineering Department. After working for U.S. company Motorola, Inc., Minamikawa analyzed the semiconductor and electronics industries while working at research and securities companies. He has been in his current post since 2010.

Read more from The Japan News at https://japannews.yomiuri.co.jp/