U.S. house prices rose 17.7% from the second quarter of 2021 to the second quarter of 2022, according to the Federal Housing Finance Agency House Price Index (FHFA).

House prices were up 4% compared to the first quarter of 2022. FHFA’s seasonally adjusted monthly index for June was up 0.1% from May.

The U.S. housing market may finally be cooling off from its inflationary hot streak, so prospective buyers may just be able to get the house they've been eyeing for some time.

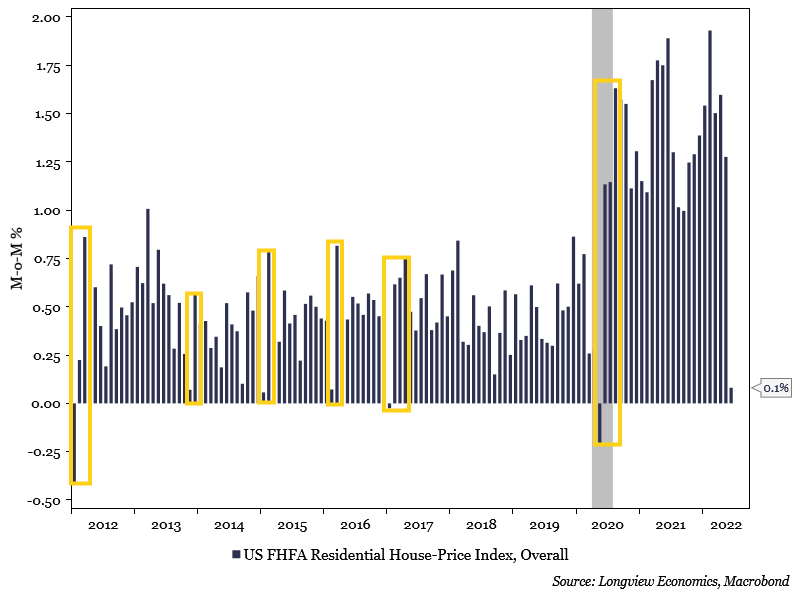

But don't jump to conclusions just yet. What occurs after a 0.1% month-over-month increase in property values is more intriguing.

According to the same data issued by the FHSA, house prices have increased by only 0.1% or less month-over-month in the last 10 years, translating into substantial increases in home value six times in the months following.

“Housing prices grew quickly through most of the second quarter of 2022, but a deceleration has appeared in the June monthly data,” said William Doerner, Ph.D., supervisory economist in FHFA’s Division of Research and Statistics. “The pace of growth has subsided recently, which is consistent with other recent housing data.”

Meanwhile, according to Fannie Mae’s home purchase sentiment index, housing sentiment has fallen to its lowest level since 2011 and mortgage demand is at 22-year lows.

"We're witnessing a housing recession in terms of declining home sales and home building," said Lawrence Yun, chief economist for the National Association of Realtors.

Related: Are We In A Housing Recession? Yes But Not When It Comes To Prices, This Economist Say

Sales of previously owned homes plummeted to a seasonally adjusted annual pace of 4.81 million units in July, down 5.9% from June and 20% from a year earlier. With the exception of a brief decrease at the beginning of the COVID-19 epidemic, the sales pace has been at its lowest point since November 2015.

Prices remain stubbornly high, and demand declines as affordability follow suit. In July, the median price of a house sold was $403,800, an increase of 10.8% over the same month in 2021. The fact that this was the smallest gain since July 2020 is also intriguing; it may be yet another indication that home values are stabilizing before their next leg up.

According to Freddie Mac, the average 30-year fixed rate averaged 5.41% in July, up from the 2.96% rate in 2021.