The Newcastle median house price has surged past $700,000 for the first time and the city's annual growth rate is outstripping rises in all state and territory capitals.

Latest figures from property analysts CoreLogic show the value of a typical house in Newcastle and Lake Macquarie jumped 3 per cent in May to $722,000, up 21.3 per cent in a year.

The typical Newcastle house gained $23,000 in value in a month.

The latest price rises across Australia sparked renewed calls from housing services for the state and federal governments to spend more on social and affordable dwelling stocks.

Everybody's Home campaign spokesperson Kate Colvin said COVID-19 was driving Sydneysiders into the Newcastle market, pushing up sale prices and inflating rents by 10 per cent in a year.

"People have moved out of Sydney with Sydney incomes and are competing in the Newcastle housing market with people who are on Newcastle incomes," she said.

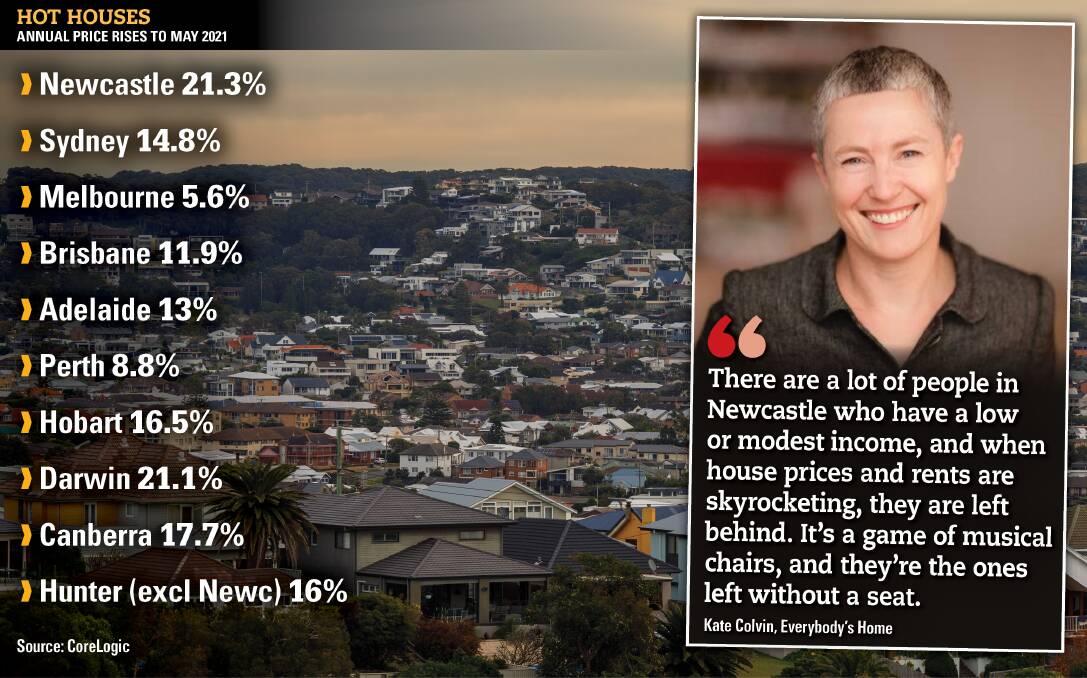

"There are a lot of people in Newcastle who have a low or modest income, and when house prices and rents are skyrocketing, they are left behind.

"It's a game of musical chairs, and they're the ones left without a seat."

The Newcastle rental vacancy rate is 0.7 per cent.

Australian Bureau of Statistics figures show an estimated net loss of 5400 people from Sydney to regional NSW in the December 2020 quarter, up from 3700 in the June quarter and 4700 in the September quarter.

The 21.3 per cent Newcastle annual house price rise was higher than the growth rate of 14.8 per cent in Sydney, 5.6 per cent in Melbourne, 11.9 per cent in Brisbane, 13 per cent in Adelaide, 8.8 per cent in Perth, 16.5 per cent in Hobart, 21.1 per cent in Darwin and 17.7 per cent in Canberra. The Newcastle median apartment price rose 2.1 per cent in May to $566,000, up 11.2 per cent in a year, more than double the increases in Sydney, Melbourne, Brisbane and Adelaide.

Property values are also booming in the rest of the Hunter.

Outside Newcastle, the region's median house value rose 2.8 per cent in May to $547,000, which was 16 per cent higher than it was a year ago.

The Reserve Bank said on Tuesday that it was unlikely to raise official interest rates until "at least 2024".

"Cheap money is like rocket fuel for house prices," Ms Colvin said.

"Unfortunately, this inevitably leads to higher rents, unsustainable debt loads and worsening affordability.

"We need to release the housing pressure by giving more options to those who can't participate in the boom."