With a market cap of $15.6 billion, Hormel Foods Corporation (HRL) is a global branded food company that develops, processes, and markets a wide range of meat, nut, and food products. With a portfolio of iconic brands such as Planters™, SKIPPY™, SPAM™, Hormel™, Applegate™, and Jennie-O™, the company serves retail, foodservice, and international markets.

Shares of the Austin, Minnesota-based company have underperformed the broader market over the past 52 weeks. HRL stock has dropped 12.6% over this time frame, while the broader S&P 500 Index ($SPX) has gained 16.1%. Moreover, shares of the company are down 9.9% on a YTD basis, compared to SPX’s 9.7% rise.

Narrowing the focus, shares of the Skippy peanut butter maker have lagged behind the Consumer Staples Select Sector SPDR Fund’s (XLP) 1.7% return over the past 52 weeks.

Shares of Hormel Foods rose 1.1% on May 29 after the company reported Q2 2025 adjusted EPS of $0.35 and revenue of $2.9 billion, meeting Wall Street expectations. Despite a 7% decline in sales volumes in both the retail and foodservice segments due to supply chain challenges and lower raw material shipments, investors were encouraged by the reaffirmed annual organic net sales growth outlook of 2% to 3%. The company also narrowed its full-year adjusted EPS forecast to $1.58 - $1.68, keeping the lower bound intact.

For the fiscal year ending in October 2025, analysts expect HRL’s EPS to grow 1.3% year-over-year to $1.60. The company’s earnings surprise history is mixed. It beat or met the consensus estimates in two of the last four quarters while missing on two other occasions.

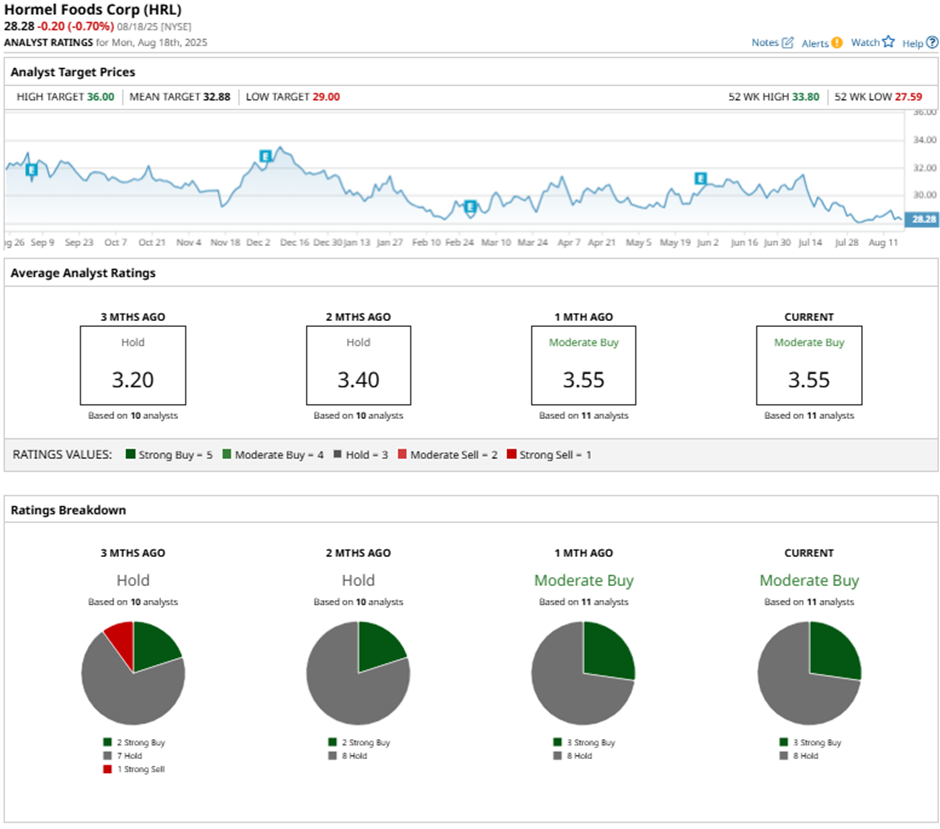

Among the 11 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on three “Strong Buy” ratings and eight “Holds.”

This configuration is slightly more bullish than three months ago, with two “Strong Buy” ratings on the stock.

As of writing, the stock is trading below the mean price target of $32.88. The Street-high price target of $36 implies a potential upside of 27.3% from the current price.