Phew, it seems like forever since I’ve felt good about giving a debt update. But I am over the moon as I write this!

This girl’s only debt, only debt…are my student loans. And I did make an extra payment to them, along with my now regularly required monthly payment of $307. For those that are new, my student loans have been in deferment for a very long time. But no more!

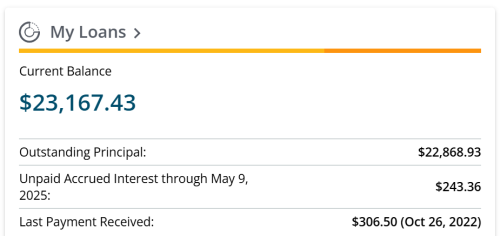

Prior to this month’s payment, this is where my student loans stood.

You can see, it has been a LONG time since I made a payment toward them.

But here we are today…

| Debt Description | October, 2023 Total | Interest Rate | Minimum Payment | Current Total | Payoff Date (Est) |

|---|---|---|---|---|---|

| Student Loans | $22,121 | 2.875% | $307 | $21,811 | |

| CC - Apple** | $500 | Paid off every month | $0 | ||

| CC - Frontier | $3,857 | 29.99% | $0 | $0 | May, 2025 |

| Dad - New Furnace | $2,600 | 0% | $0 | $0 |

May, 2025 |

| CC - USAA | $5,000 | 19.15% | $0 | $0 | May, 2025 |

| CC - Sam's Club | $0 | May, 2025 (again) | |||

| CC - Amazon | $0 | May, 2025 (again) | |||

| CC - Southwest | $0 | May, 2025 | |||

| Painter | $0 | May, 2025 | |||

| CC - AMEX | $894 | 29.24% | $0 | $0 | Mar, 2024 - Closed |

| CC - Sams | $1,106 | 29.99% | $0 | $0 | April, 2024 |

| Personal Loan #1 | $2,500 | 0% | $0 | $0 | July, 2024 |

| Personal Loan #2 | $2,500 | 0% | $0 | $0 | August, 2024 |

| CC - Wander | $1,630 | 29.24% | $0 | $0 | August, 2024 - Closed |

| CC - Amazon | $1,497 | 29.99% | $0 | $0 | September, 2024 |

| Total | $44,206 | $265 | $32,131 |

Getting Acclimated & Making Plans

As of yesterday, I’ve been at my parent’s in Texas for one week. Dad and I are slowly adjusting to a new normal and getting into a routine. And I’m still feeling out the area and keeping an eye out for things to get involved in.

My number one priority is to be available to help care for my mom. What that looks like now is giving Dad the freedom to get out and about a bit without being worried about inconveniencing anyone. We’ve set two days a week that he knows that I will be here, ie not make any plans that would take me away from the house, and he doesn’t have to “ask” for coverage. He’s still struggling with that. (I don’t leave the house often anyways, but this regular schedule gives him more freedom than he’s had in years as mom’s constant companion and primary caregiver. My siblings have been fantastic about helping. But dad struggles with asking and feeling like a burden. I’m hoping this alleviates that weight on his shoulders a bit.)

On the flip side, I’m looking for ways to build community. A type of self care that I need. I visited a new church with Gymnast on Sunday. And I’ve reach out a couple of places to check on volunteer opportunities. Now I’m thinking of creating a flyer to print and drop off at local businesses to advertise my services.

I actually went to a chiropractor and in discussions about what I do, he hired me to help with his website and marketing. I just need to get more bold with putting it out there.

The post Hope’s Debt Update – May, 2025 appeared first on Blogging Away Debt.