I’m very proud of myself. Here’s why…

Debt

| Debt Description | October, 2023 Total | Interest Rate | Minimum Payment | Current Total | Payoff Date (Est) |

|---|---|---|---|---|---|

| Student Loans | $22,121 | 2.875% | $307 | $19,036 | |

| CC - Apple** | $500 | $0 | May, 2025 | ||

| CC - Frontier | $3,857 | 29.99% | $0 | $0 | May, 2025 - Closed |

| Dad - New Furnace | $2,600 | 0% | $0 | $0 |

May, 2025 |

| CC - USAA | $5,000 | 19.15% | $0 | $0 | May, 2025 |

| CC - Sam's Club | $0 | May, 2025 (again) | |||

| CC - Amazon | $0 | May, 2025 (again) - Closed | |||

| CC - Southwest | $0 | May, 2025 | |||

| Painter | $0 | May, 2025 | |||

| CC - AMEX | $894 | 29.24% | $0 | $0 | Mar, 2024 - Closed |

| CC - Sams | $1,106 | 29.99% | $0 | $0 | April, 2024 |

| Personal Loan #1 | $2,500 | 0% | $0 | $0 | July, 2024 |

| Personal Loan #2 | $2,500 | 0% | $0 | $0 | August, 2024 |

| CC - Wander | $1,630 | 29.24% | $0 | $0 | August, 2024 - Closed |

| CC - Amazon | $1,497 | 29.99% | $0 | $0 | September, 2024 |

| Total | $44,206 | $307 | $19,036 |

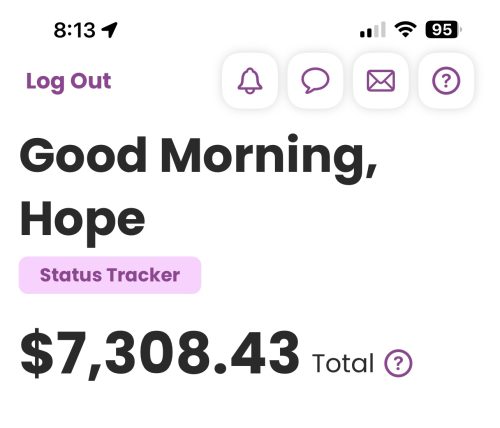

I paid $1,925 to debt in July. (June’s debt update.) For the first time in 3 decades, I have under $20K in debt, no credit card debt, rather no other debt. My car is paid off and in good shape and I am in a great place mentally.

There is a light at the end of this very long tunnel. On top of that, I have money in the bank!

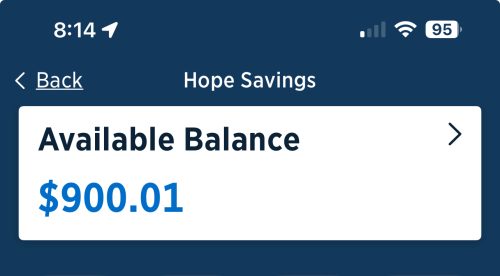

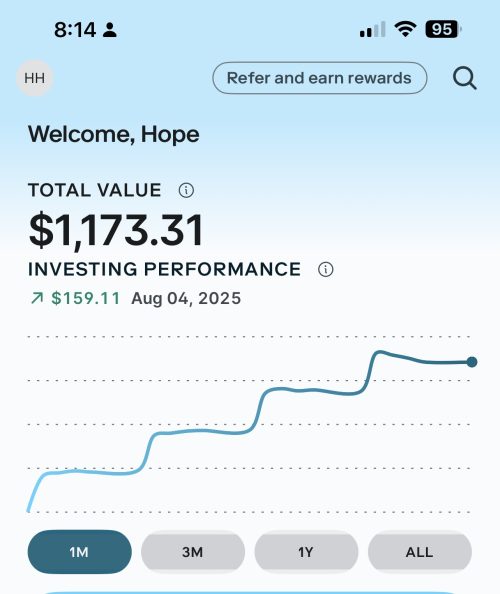

Savings

I have more money in savings than I’ve had in DECADES. And not only that, but I’m not touching it. I have no immediate plans for it (you’ve seen my Budget and the Buckets I’m using in Ally). I have literally not touched my Ally account since I initially opened it with $5,000 from the house sell.

I have WEEKLY automated deposits going to both my Ally account and my investments account. (For the record, these screenshots are from the end of July.)

Summary

Listen, I know it’s not where I need to be at my age. I get that. Truly.

But I can’t go back. I can go forward though, and I am. And I am proud of myself.

My attention is split…debt and savings. Maybe not the most efficient way to do it. But I am doing it. Debt is dropping steadily, savings is growing rapidly.

I literally went from $0 in savings, living on a shoestring to having close to $10K in savings accounts in just over 2 months. And as my income grows, my savings and debt payoff goes more quickly.

This Month

Now this month, I will spend some money. Princess and I are throwing Beauty a bridal shower. I budgeted $1,500 – most coming from my monthly “allowance” that I haven’t really touched. I’ll share the details on how that goes later as I’m still trying to figure everything out. As of today, I’ve spent the following:

- $33 for invitations. I designed them on Canva and then had them printed there. I used stamps I had so not counting that expense.

- $50 to hold the event space. I will pay another $200 before the event. The event space includes tables, chairs, table cloths, and serving ware.

- $11 for my flight to and from ATL – yes, more points.

- $196 for table decorations (flowers) and supplies for an activity.

I know I’m going to supply some food. And another game or too – thinking of the toilet paper to make wedding dresses. I’m honestly just feeling my way as I’ve never had a bridal shower or attended one. But it will be fun to experience this with my girls and celebrate Beauty!

The post Hope’s Debt & Savings Update – July, 2025 appeared first on Blogging Away Debt.