A bullish diagonal spread is an advanced option trade and generally not suitable for beginners, but it can have its place within an option portfolio.

It is a bullish strategy that benefits from time decay and is best placed when volatility is low, such as the current conditions.

The strategy involves buying a long-term call and selling a monthly out-of-the-money call against it.

The trade is best placed when the trader has a bullish outlook and thinks the stock could get to the short call strike by the first expiration date.

A rise in implied volatility will benefit the trade as it has positive Vega overall.

The big risk with the trade is a sharp move lower early in the trade.

Let’s look at an example using Robinhood Markets (HOOD).

HOOD Stock Bullish Diagonal Example

Robinhood Markets is undergoing on orderly pullback towards the 50-day moving average and is rated a Buy.

The Barchart Technical Opinion rating is a 88% Buy with a Strengthening short term outlook on maintaining the current direction.

Long term indicators fully support a continuation of the trend.

Relative Strength just crossed above 50%. The market is indicating support for a bullish trend.

Let’s look at how we can use options to find a favorable risk to reward trade on the assumption that HOOD stock might rally to $150 in the next five weeks.

We will look at a bullish diagonal spread which allows traders to get long HOOD without risking too much capital.

A bullish diagonal spread is a trade that involves buying a long-term call option and selling a shorter-term, further out-of-the-money call option.

Structuring the trade at $80 gives the trade around 26 delta, which is roughly equivalent to being long 26 shares of the stock.

Selling the November 21st $150-strike call option will generate around $650 in premium and buying the December 19th, $130-strike call will cost around $1,850.

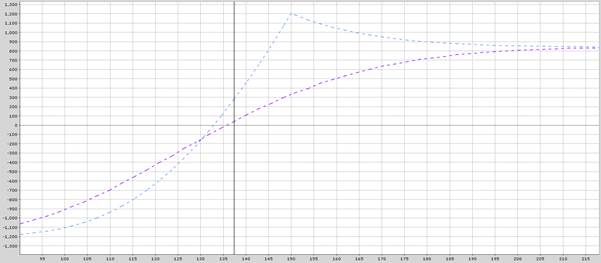

That results in a net cost for the trade of $1,200 per spread, which is the most the trade can lose.

The estimated maximum profit is around $1,200, but that can vary depending on changes in implied volatility. The maximum profit would occur if HOOD closes right at $150 on November 21st.

The trade benefits from time decay as the short-term option will decay at a faster rate than the longer-term option.

The ideal scenario for this HOOD trade is for the stock to move towards $150 in the next few weeks.

A bullish diagonal spread is a good way to gain some upside exposure on a stock without risking too much if the move doesn’t eventuate.

The suggested stop loss level is a close below $125.

Here is a visual of what the trade looks like:

Company Details

Robinhood Financial LLC is a registered broker dealer. Robinhood Securities, LLC provides brokerage clearing services. Robinhood Crypto, LLC provides crypto currency trading.

HOOD rates as a Strong Buy according to 13 analysts with 2 Moderate Buy ratings, 6 Hold ratings and 1 Strong Sell rating.

Implied volatility is at 73.32% compared to a 12-month low of 55.64% and a 12-month high of 114.38%.

Robinhood is due to report earnings on November 5th after the market close.

Please remember that options are risky, and investors can lose 100% of their investment. This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.