Starbucks Corporation (NASDAQ:SBUX) was trading slightly lower on Monday after five bullish days last week saw the stock soar almost 10% higher in total.

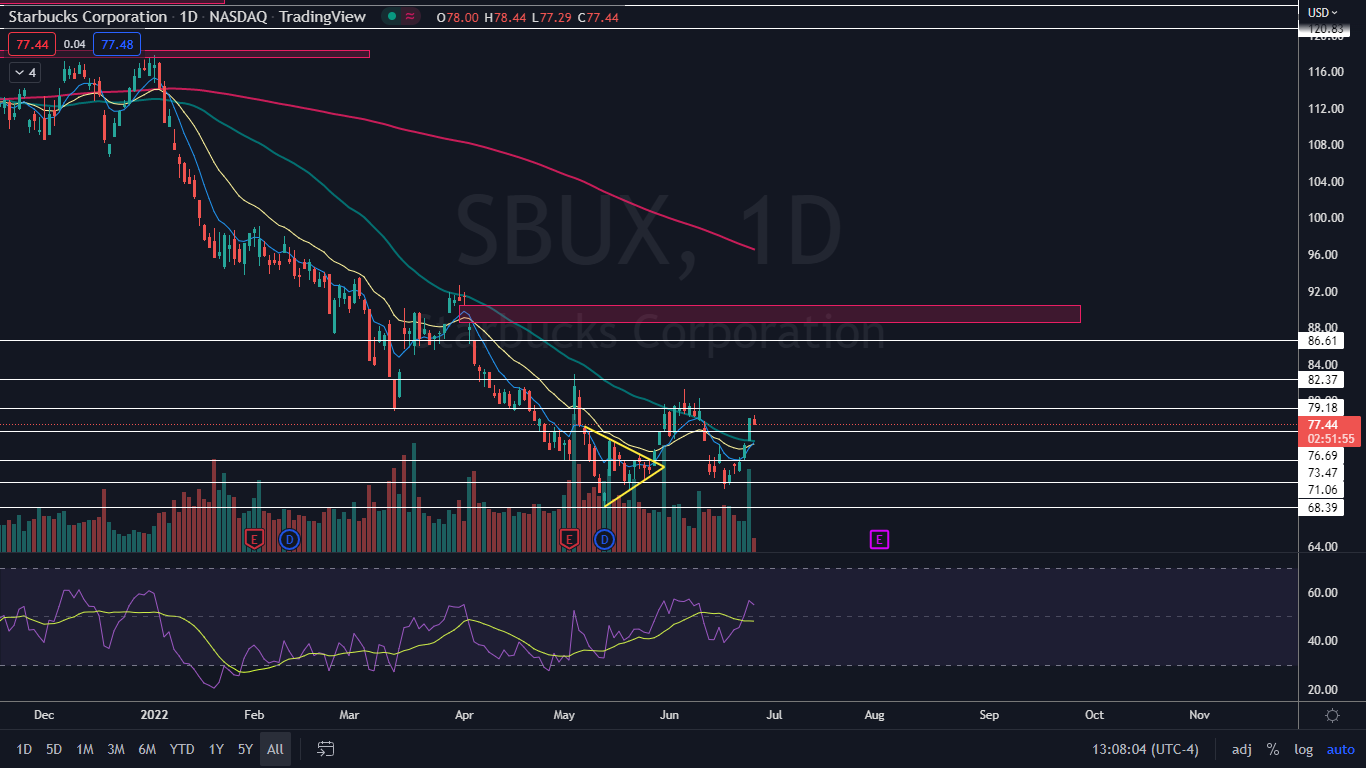

The stock is trading down about 38% from its July 23, 2021 all-time high of $126.32 but has recently been trending higher in a weekly uptrend after bouncing up from the 52-week low of $68.39 on May 12.

Although the weekly uptrend remains intact, Starbucks hasn’t yet confirmed a daily uptrend on the most recent move higher, which began on June 16.

An uptrend occurs when a stock consistently makes a series of higher highs and higher lows on the chart.

The higher highs indicate the bulls are in control, while intermittent higher lows indicate consolidation periods.

Traders can use moving averages to help identify an uptrend, with rising lower time frame moving averages (such as the eight-day or 21-day exponential moving averages) indicating the stock is in a steep shorter-term uptrend.

Rising longer-term moving averages (such as the 200-day simple moving average) indicate a long-term uptrend.

A stock often signals when the higher high is in by printing a reversal candlestick such as a doji, bearish engulfing or hanging man candlestick. Likewise, the higher low could be signaled when a doji, morning star or hammer candlestick is printed. Moreover, the higher highs and higher lows often take place at resistance and support levels.

In an uptrend, the "trend is your friend" until it’s not, and in an uptrend there are ways for both bullish and bearish traders to participate in the stock:

- Bullish traders who are already holding a position in a stock can feel confident the uptrend will continue unless the stock makes a lower low. Traders looking to take a position in a stock trading in an uptrend can usually find the safest entry on the higher low.

- Bearish traders can enter the trade on the higher high and exit on the pullback. These traders can also enter when the uptrend breaks and the stock makes a lower low indicating a reversal into a downtrend may be in the cards.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

The Starbucks Chart: In order for Starbucks to confirm a daily uptrend, the stock will need to print a higher low above the $70.35 mark over the coming days.

When Starbucks eventually retraces lower to print the higher low, it may provide a solid entry point for bullish traders who aren’t already in a position.

- On Monday, Starbucks attempted to break up bullishly from an inside bar pattern, but lack of momentum caused the stock to drop back down into Friday’s trading range. Bullish traders can watch for increasing volume on smaller time frames to break the stock from the pattern later on Monday or on Tuesday.

- Friday and Monday’s price action near the $78 level has caused Starbuck’s eight-day exponential moving average (EMA) to cross above the 21-day EMA, which is bullish. The stock has also regained support at the 50-day simple moving average, which indicates longer-term sentiment has turned bullish.

- Starbucks has a number of gaps above on its chart, with the closest gap falling between $88.46 and $90.48. Gaps on charts fill about 90% of the time, which suggests Starbucks is likely to trade up to fill the empty range in the future. If that happens, Starbucks will increase about 16% from the current share price.

- Starbucks has resistance above at $79.18 and $82.37 and support below at $76.69 and $73.47.