Long considered a stock market leader, Apple (AAPL) stock is looking a little more vulnerable lately.

I guess that doesn't come as too much of a surprise, seeing as though the Nasdaq is being tugged lower on the fear of rising interest rates and the market as a whole continues to struggle.

Still, Apple is a stalwart of strength among mega-cap holdings. It’s not necessarily because of the success of its App Store nor the potential of it being the “master of the metaverse.”

Instead, I think it’s pure relative strength in a stock that has strong momentum, a great underlying business and strong financials.

Apple stock is down just 6% from its all-time high, outperforming all of its FAANG peers, as well as Microsoft (MSFT), Nvidia (NVDA), Tesla (TSLA) and more.

That has traders looking to buy the dip in Apple, which is becoming more a question “how big of a dip” vs. “will Apple stock pull back?”

Trading Apple Stock

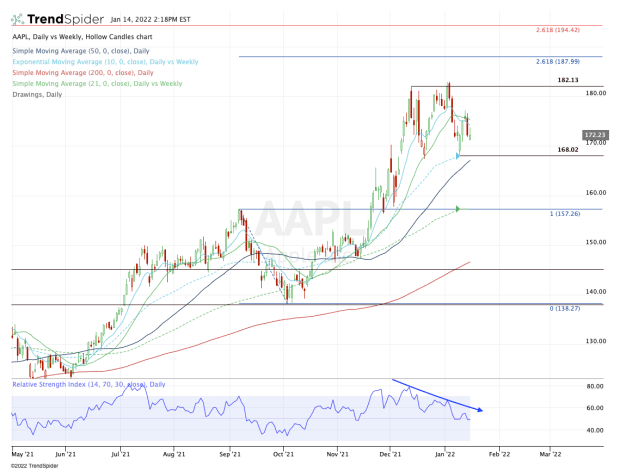

Chart courtesy of TrendSpider.com

In December, all the talk was Apple stock hitting a $3 trillion market cap. Instead, it ended up happening in January.

We were lucky enough to have caught the stock on the rapid dip in mid-December when it failed to hit that coveted market cap level.

However, when Apple stock did finally make new all-time highs, it did so with some bearish divergence on the RSI reading. That led to this week’s dip, which sent Apple down to the 10-week moving average and a near-test of the low from a few weeks ago.

This all has bulls wondering what to do from here.

In Apple’s case, I’m keep an eye on this week’s high at $177.18. Above that mark not only gives the stock the potential for a weekly-up rotation, but puts it back above the 10-day and 21-day moving averages.

That opens the door to the $180 to $182 area, followed by the all-time high near $183.

On the downside, the levels are also quite clear. In fact, they may be quite attractive under the right circumstances.

Keep a close eye on the $168 level next week. Currently that’s this week’s low, but it’s also about where the 10-week and 50-day moving averages come into play.

A break of this level and a test of these key moving averages, followed by a bounce back up through $168 could prove to be a lucrative and low-risk dip-buying opportunity.

However, a severe breakdown could end up putting the December low and 21-week moving average on the table near $157.50.