/Xylem%20Inc%20%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)

Valued at a market cap of $35.5 billion, Xylem Inc. (XYL) designs, manufactures, and services engineered products and solutions for the utility, industrial, and residential and commercial building services sectors. The Washington, District Of Columbia-based company is scheduled to announce its fiscal Q3 earnings for 2025 before the market opens on Tuesday, Oct. 28.

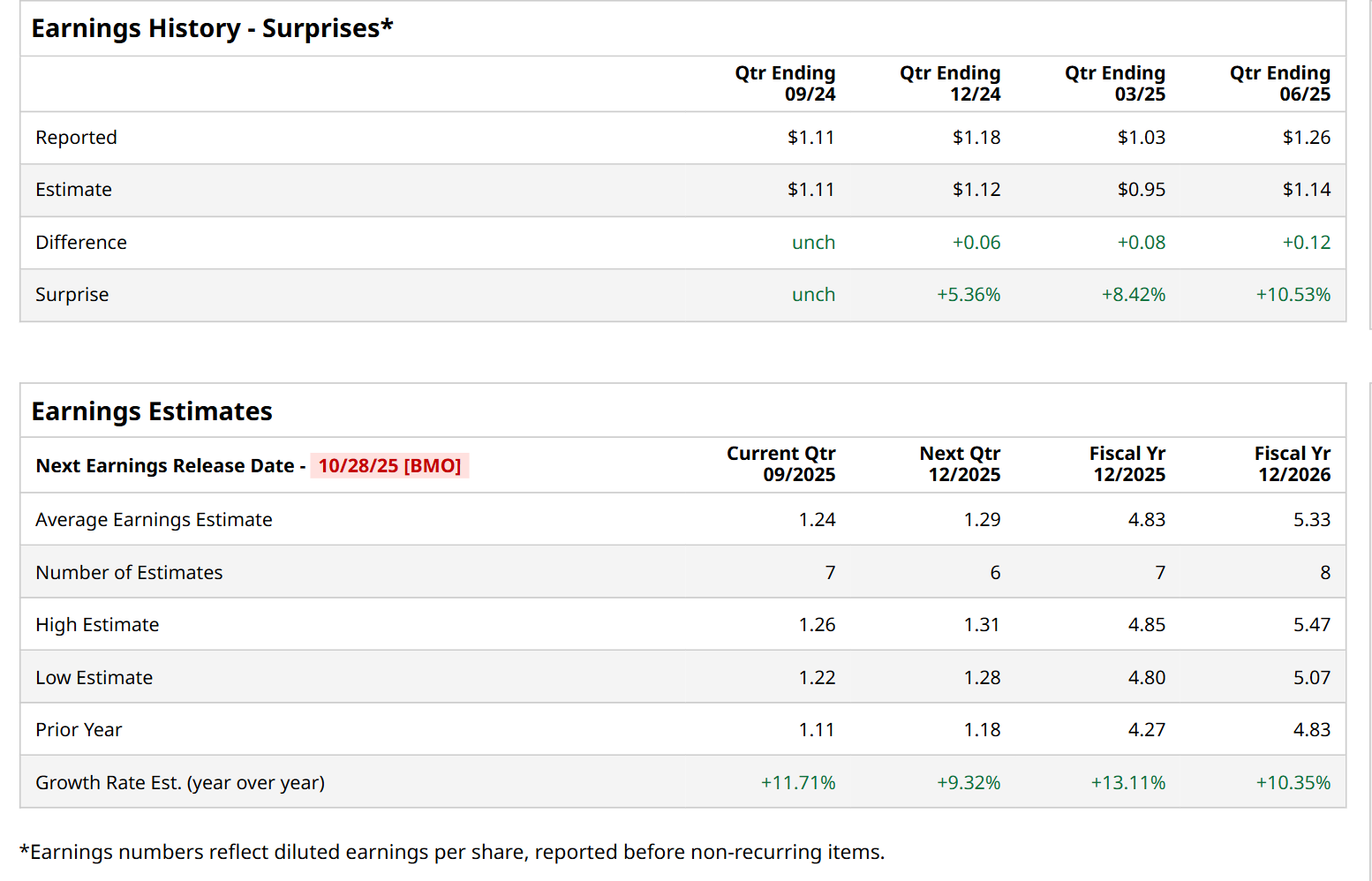

Ahead of this event, analysts expect this water technology provider to report a profit of $1.24 per share, up 11.7% from $1.11 per share in the year-ago quarter. The company has met or surpassed Wall Street’s bottom-line estimates in each of the last four quarters. In Q2, Xylem’s EPS of $1.26 exceeded the forecasted figure by a notable margin of 10.5%.

For the current fiscal year, ending in December, analysts expect XYL to report a profit of $4.83 per share, up 13.1% from $4.27 per share in fiscal 2024. Furthermore, its EPS is expected to grow 10.4% year-over-year to $5.33 in fiscal 2026.

Xylem has gained 6.7% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 14.4% return and the Industrial Select Sector SPDR Fund’s (XLI) 9.4% uptick over the same time frame.

Shares of Xylem soared 10.7% on Jul. 31, after it delivered stronger-than-expected Q2 results. Due to robust organic growth across all segments, the company’s overall revenue advanced 6.1% year-over-year to $2.3 billion, surpassing consensus estimates by 4.1%. Moreover, on the earnings front, its adjusted EPS came in at $1.26, up 15.6% from the year-ago quarter and a notable 10.5% ahead of analyst estimates. Profitability was further boosted by a record-high adjusted EBITDA margin of 21.8%, which expanded by 100 basis points from the same period last year. Additionally, noting its strong performance, XYL raised its fiscal 2025 guidance, further bolstering investor confidence. It now projects adjusted EPS to be between $4.70 and $4.85, and revenue in the range of $8.9 billion to $9 billion.

Wall Street analysts are moderately optimistic about XYL’s stock, with a "Moderate Buy" rating overall. Among 21 analysts covering the stock, 13 recommend "Strong Buy," one indicates a "Moderate Buy," and seven suggest "Hold.” The mean price target for XYL is $162.81, indicating an 11.5% potential upside from the current levels.