With a market cap of $23 billion, Williams-Sonoma, Inc. (WSM) is a multi-channel specialty retailer dedicated to offering high-quality products for the home. The company brings the latest home furnishing trends to life through nine distinct brands, each catering to different life stages and spaces.

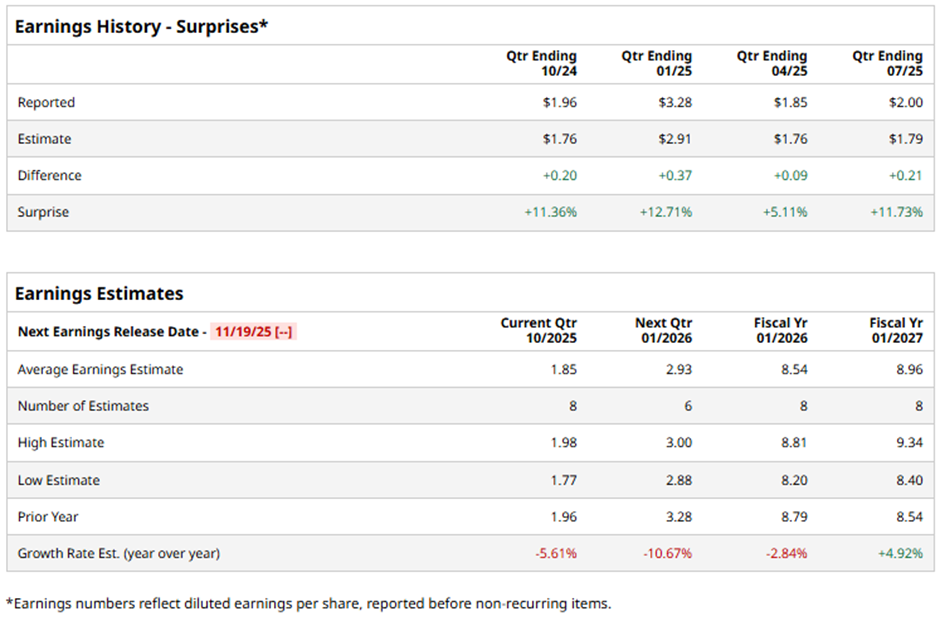

The San Francisco, California-based company is expected to announce its Q3 2025 results soon. Ahead of this event, analysts expect Williams-Sonoma to report an EPS of $1.85, a 5.6% decrease from $1.96 in the year-ago quarter. However, it has exceeded Wall Street's earnings estimates in the last four quarters.

For fiscal 2025, analysts expect the seller of cookware and home furnishings to report an EPS of $8.54, a 2.8% decline from $8.79 in fiscal 2024. Nevertheless, EPS is anticipated to rise 4.9% year-over-year to $8.96 in fiscal 2026.

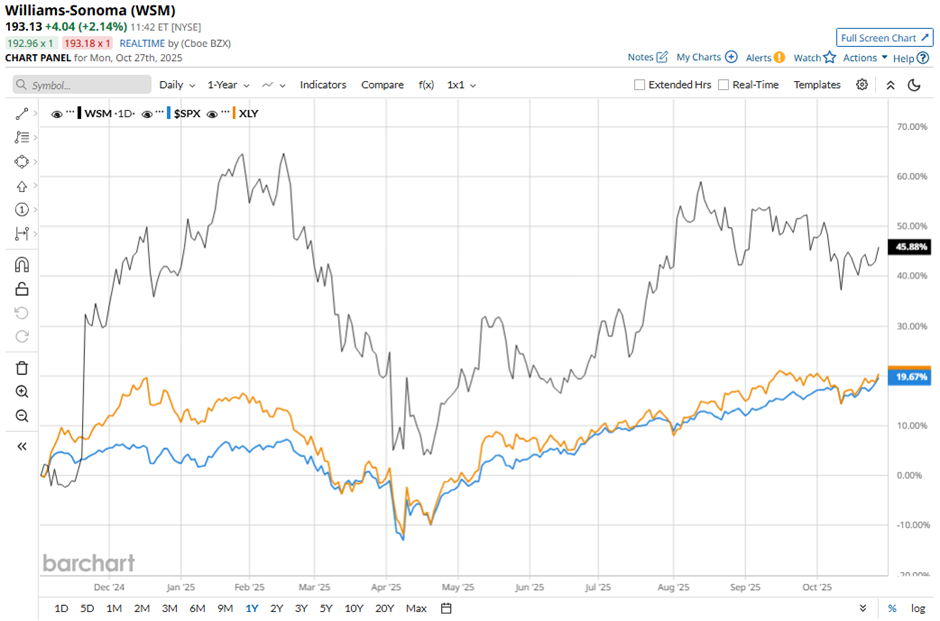

Shares of Williams-Sonoma have surged 42.6% over the past 52 weeks, outperforming both the S&P 500 Index's ($SPX) 17.9% gain and the Consumer Discretionary Select Sector SPDR Fund's (XLY) 19.7% increase over the period.

Williams-Sonoma shares fell marginally on Aug. 27 despite reporting better-than-expected Q2 2025 EPS of $2 and revenue of $1.8 billion. The company disclosed merchandise inventories up 17.7% year-over-year to $1.4 billion from a strategic pull-forward to offset tariffs, highlighting exposure to significant incremental tariff costs (China 30%, India 50%, Vietnam 20%, steel/aluminum 50%, copper 50%) that could erode future profitability.

Analysts' consensus view on WSM stock is moderately optimistic, with an overall "Moderate Buy" rating. Among 20 analysts covering the stock, six recommend "Strong Buy," one suggests "Moderate Buy," and 13 indicate “Hold.” The average analyst price target for Williams-Sonoma is $208.28, indicating a potential upside of 7.8% from the current levels.