With a market cap of $35.7 billion, Vulcan Materials Company (VMC) is the largest U.S. producer of construction aggregates like crushed stone, sand, and gravel, also supplying asphalt and concrete. Headquartered in Birmingham, Alabama, it operates over 400 facilities nationwide. The company is expected to report its Q2 earnings on Tuesday, Aug, 5.

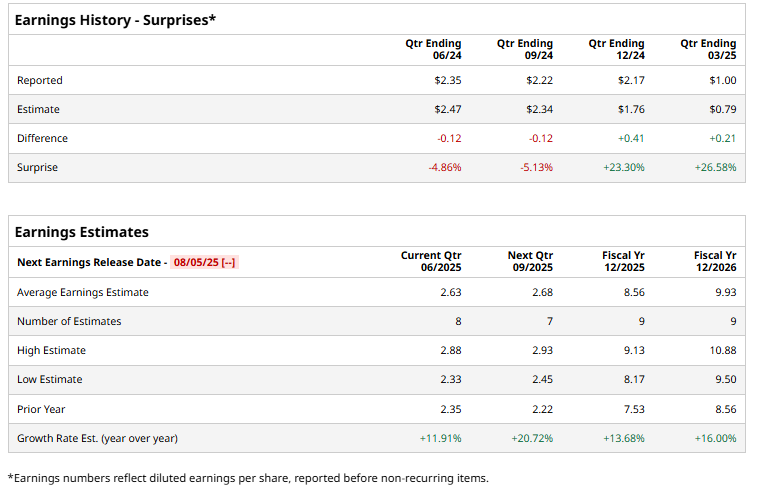

Ahead of the event, analysts expect VMC to report a profit of $2.63 per share, up 11.9% from a profit of $2.35 per share reported in the year-ago quarter. It has exceeded analysts' earnings estimates in two of the past four quarters, while missing in the other two quarters.

For the current year, analysts expect VMC to report EPS of $8.56, up 13.7% from $7.53 in fiscal 2024. Looking ahead, analysts expect its earnings to surge 16% year-over-year to $9.93 per share in fiscal 2026.

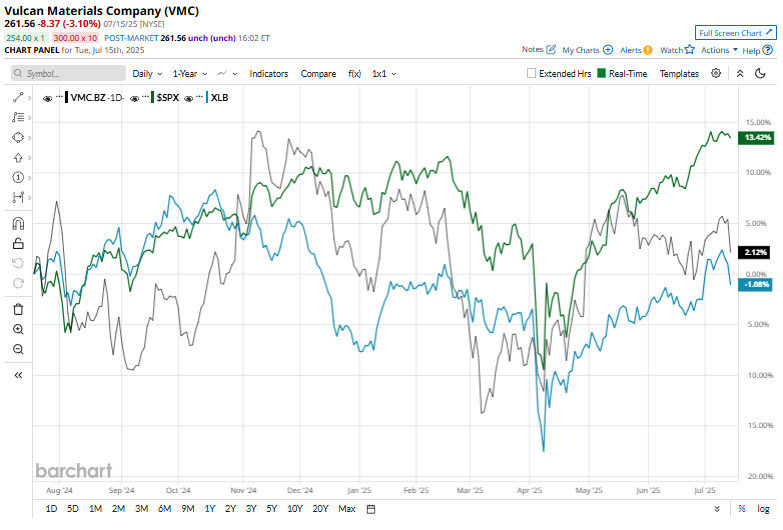

Over the past year, VMC shares have soared 3%, trailing the S&P 500 Index’s ($SPX) 10.9% gains but outpacing the Materials Select Sector SPDR Fund’s (XLB) 1.3% decline over the same time frame.

On April 30, Vulcan Materials shares surged 6.9% after posting Q1 results. While revenue rose 5.8% year-over-year to $1.6 billion, it missed Wall Street expectations by 3%, primarily due to a dip in aggregate shipments. However, the bottom line impressed as adjusted EPS jumped 25% to $1, surpassing analyst estimates by a robust 26.6%. Underscoring its optimism, the company reaffirmed its full-year 2025 adjusted EBITDA guidance in the range of $2.4 billion to $2.6 billion.

The consensus opinion on VMC stock is strongly optimistic, with an overall “Strong Buy” rating. Out of the 21 analysts covering the stock, 16 recommend a “Strong Buy,” one recommends a “Moderate Buy,” and four suggest a “Hold.” Its mean price target of $301.87 indicates a robust 15.4% upside potential from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.