/Visa%20Inc%20gold%20card-by%20hatchpong%20via%20iStock.jpg)

San Francisco, California-based Visa Inc. (V) is a payment technology company that operates VisaNet, a transaction processing network that enables authorization, clearing, and settlement of payment transactions. Valued at a market cap of $614.7 billion, the company also offers credit, debit, and prepaid card products, tap-to-pay, tokenization, and click-to-pay services. It is expected to announce its fiscal Q4 earnings for 2025 after the market closes on Tuesday, Oct. 28.

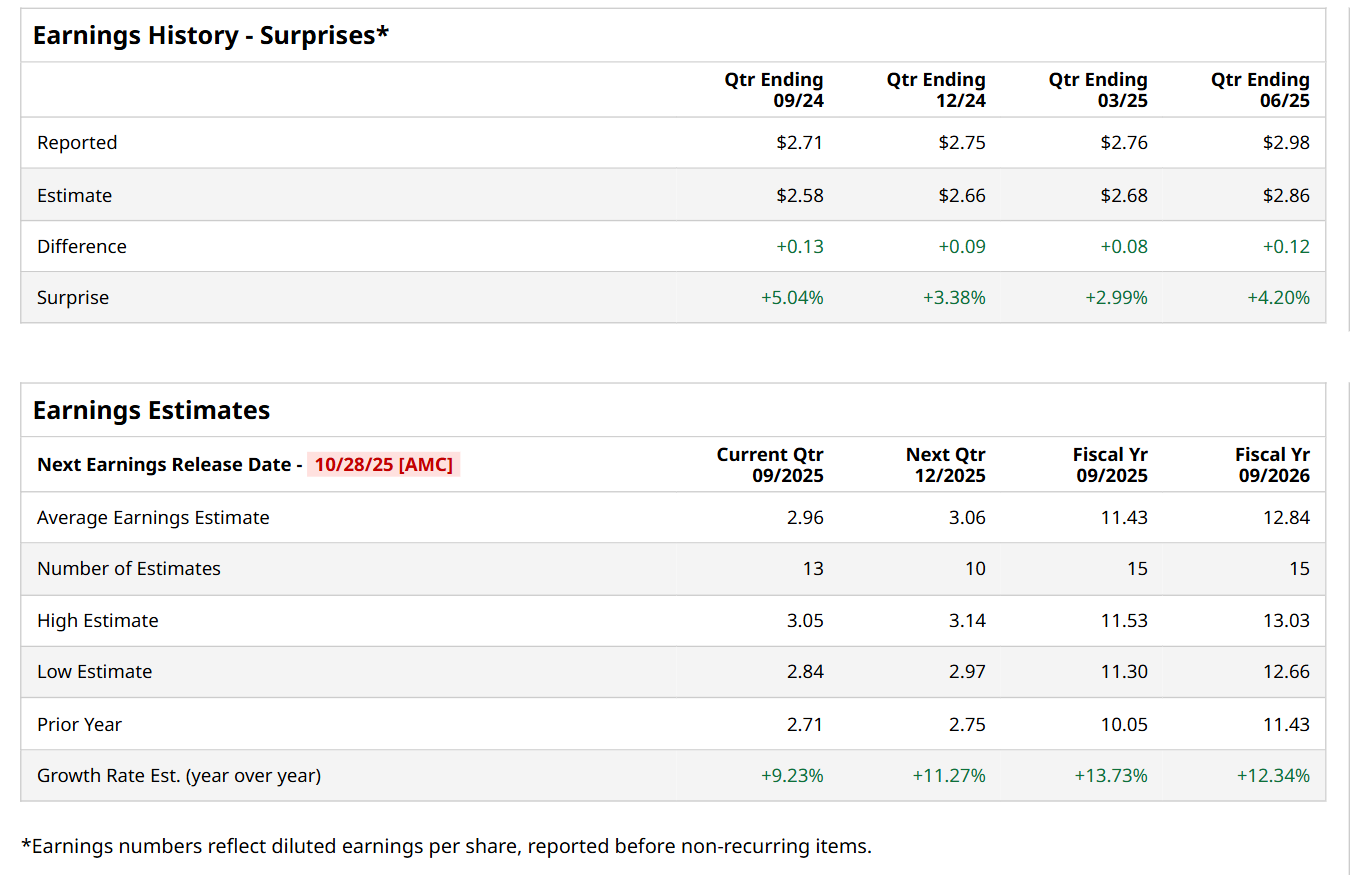

Before this event, analysts expect this payment technology company to report a profit of $2.96 per share, up 9.2% from $2.71 per share in the year-ago quarter. The company has a promising trajectory of consistently beating Wall Street’s bottom-line estimates in each of the last four quarters. Its earnings of $2.98 per share in the previous quarter outpaced the consensus estimates by 4.2%.

For fiscal 2025, analysts expect V to report a profit of $11.43 per share, representing a 13.7% increase from $10.05 per share in fiscal 2024. Furthermore, its EPS is expected to grow 12.3% year-over-year to $12.84 in fiscal 2026.

V has gained 17.7% over the past 52 weeks, outpacing both the S&P 500 Index's ($SPX) 13.8% uptick and the Financial Select Sector SPDR Fund’s (XLF) 9.6% rise over the same time frame.

Visa reported better-than-expected Q3 performance on Jul. 29. The company’s net revenue improved 14.3% year-over-year to $10.2 billion, surpassing consensus estimates by 3%. Moreover, its adjusted EPS of $2.98 advanced 23.1% from the year-ago quarter and came in 4.2% ahead of Wall Street estimates. However, despite this, its shares plunged marginally in the following trading session.

Wall Street analysts are highly optimistic about V’s stock, with an overall "Strong Buy" rating. Among 36 analysts covering the stock, 25 recommend "Strong Buy," four indicate "Moderate Buy,” and seven suggest "Hold.” The mean price target for V is $398.16, implying a 16.4% potential upside from the current levels.