/Trimble%20Inc%20hardware-by%20Lutsenko_Oleksandr%20via%20Shutterstock.jpg)

Trimble Inc. (TRMB), headquartered in Westminster, Colorado, provides technology solutions that enable professionals and field mobile workers to enhance or transform their work processes worldwide. Valued at $19 billion by market cap, the company integrates its positioning expertise in GPS, laser, optical and inertial technologies with application software, wireless communications, and services to provide complete commercial solutions. The leading industrial technology company is expected to announce its fiscal third-quarter earnings for 2025 in the near term.

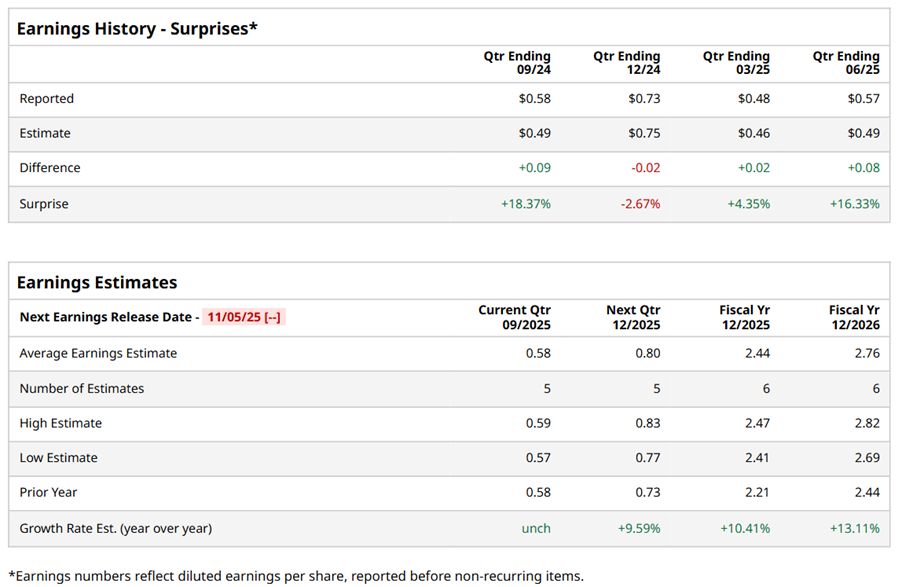

Ahead of the event, analysts expect TRMB to report a profit of $0.58 per share on a diluted basis, unchanged from the year-ago quarter. The company beat the consensus estimates in three of the last four quarters while missing the forecast on another occasion.

For the full year, analysts expect TRMB to report EPS of $2.44, up 10.4% from $2.21 in fiscal 2024. Its EPS is expected to rise 13.1% year over year to $2.76 in fiscal 2026.

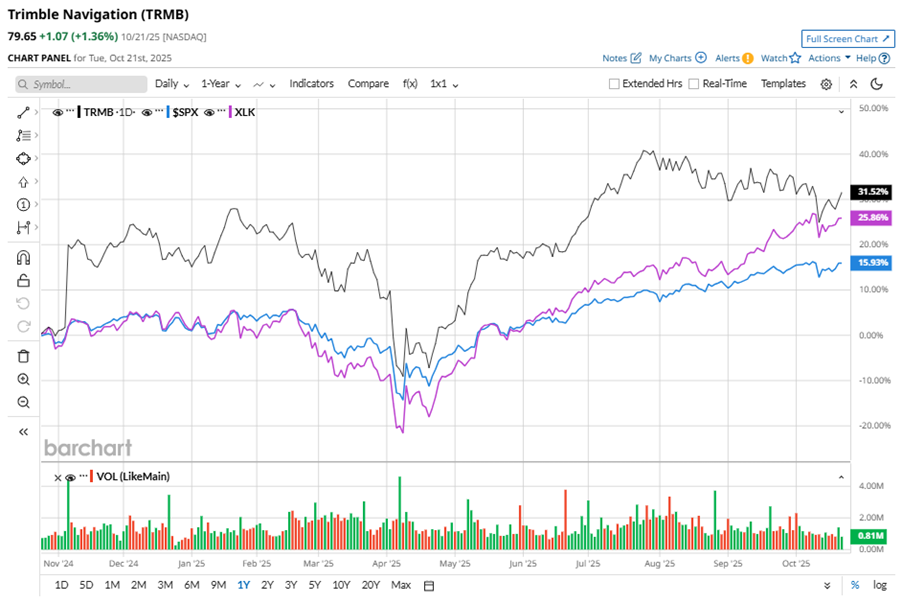

TRMB stock has outperformed the S&P 500 Index’s ($SPX) 15.1% gains over the past 52 weeks, with shares up 31.1% during this period. Similarly, it outperformed the Technology Select Sector SPDR Fund’s (XLK) 24.3% rise over the same time frame.

TRMB's strong performance is driven by robust demand for its integrated solutions, successful product bundling, and increasing adoption of AI tools, boosting investor optimism.

On Aug. 6, TRMB shares closed up by 1.7% after reporting its Q2 results. Its adjusted EPS of $0.71 exceeded Wall Street expectations of $0.63. The company’s revenue was $875.7 million, exceeding Wall Street forecasts of $837 million. TRMB expects full-year adjusted EPS in the range of $2.90 to $3.06, and expects revenue to be between $3.5 billion and $3.6 billion.

Analysts’ consensus opinion on TRMB stock is bullish, with a “Strong Buy” rating overall. Out of 13 analysts covering the stock, nine advise a “Strong Buy” rating, one suggests a “Moderate Buy,” and three give a “Hold.” TRMB’s average analyst price target is $96.89, indicating an ambitious potential upside of 21.6% from the current levels.