Minneapolis, Minnesota-based Target Corporation (TGT) operates as a general merchandise retailer, offering apparel, accessories, pet supplies, food and beverage products, appliances, home decor, and more. Valued at $42.8 billion by market cap, Target operates as one of the largest discount retailers in the U.S.

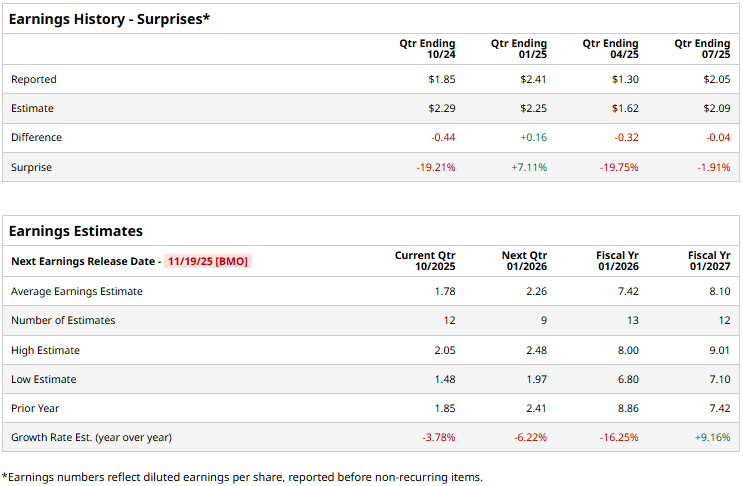

The retailer is set to announce its third-quarter results before the markets open on Wednesday, Nov. 19. Ahead of the event, analysts expect TGT to report an adjusted EPS of $1.78, down 3.8% from $1.85 reported in the year-ago quarter. While the company has surpassed the Street’s bottom-line estimates once over the past four quarters, it missed the projections on three other occasions.

For the full fiscal 2025, Target’s EPS is expected to come in at $7.42, down 16.3% from $8.86 reported in fiscal 2024. While in fiscal 2026, its earnings are expected to rebound nearly 9.2% year-over-year to $8.10 per share.

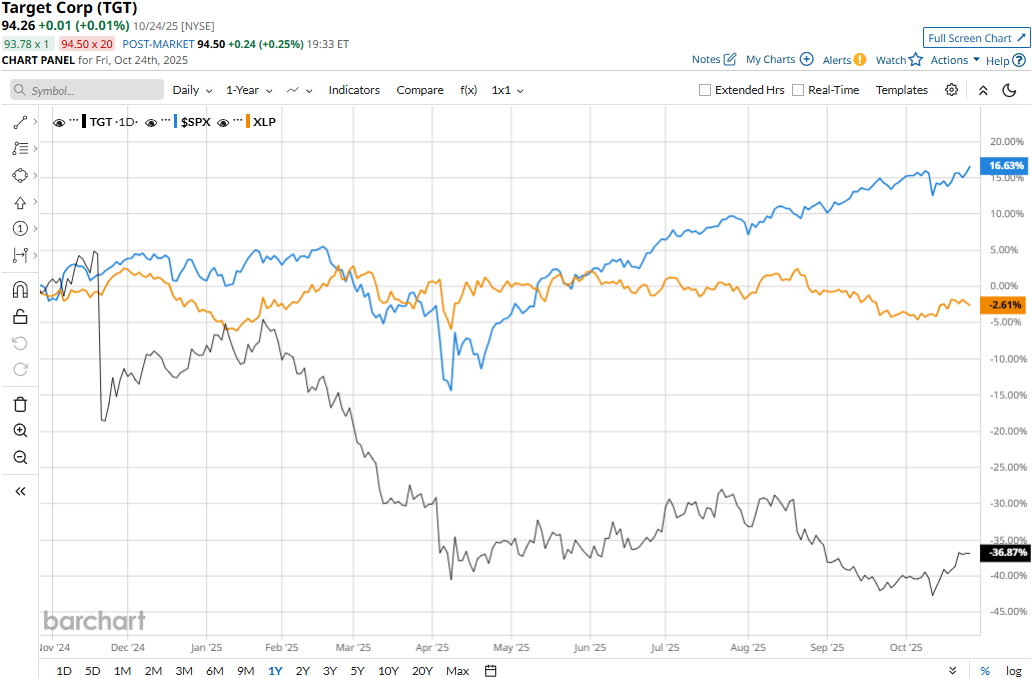

TGT stock prices have tanked 37.2% over the past 52 weeks, notably underperforming the S&P 500 Index’s ($SPX) 16.9% gains and the Consumer Staples Select Sector SPDR Fund’s (XLP) 3.2% decline during the same time frame.

Target’s stock prices dropped 6.3% in a single trading session following the release of its lackluster Q2 results on Aug. 20. While the company’s comparable digital sales grew by 4.3%, its comparable store sales declined by 3.2%, resulting in a 1.9% dip in comps. Moreover, its merchandise sales also decreased by 1.2%. Overall, Target’s topline came in at $25.2 billion, down 95 bps compared to the year-ago quarter. Further, its EPS plummeted 20.2% year-over-year to $2.05, missing the consensus estimates by 1.9%, making investors jittery.

Analysts remain cautious about the stock’s prospects. TGT maintains a consensus “Hold” rating overall. Of the 37 analysts covering the stock, opinions include eight “Strong Buys,” three “Moderate Buys,” 20 “Holds,” one “Moderate Sell,” and five “Strong Sells.” Its mean price target of $105.38 suggests an 11.8% upside potential from current price levels.