/Snap-on%2C%20Inc_tool%20truck-by%20John%20Hanson%20Pye%20via%20Shutterstock.jpg)

With a market cap of $17.8 billion, Snap-on Incorporated (SNA) is a global leader in manufacturing and marketing tools, equipment, diagnostics, repair information, and systems solutions for professional users across a wide range of industries. It offers tools, diagnostics, shop equipment, engineered solutions, and financing programs, serving industries such as automotive, aerospace, agriculture, construction, government, and power generation.

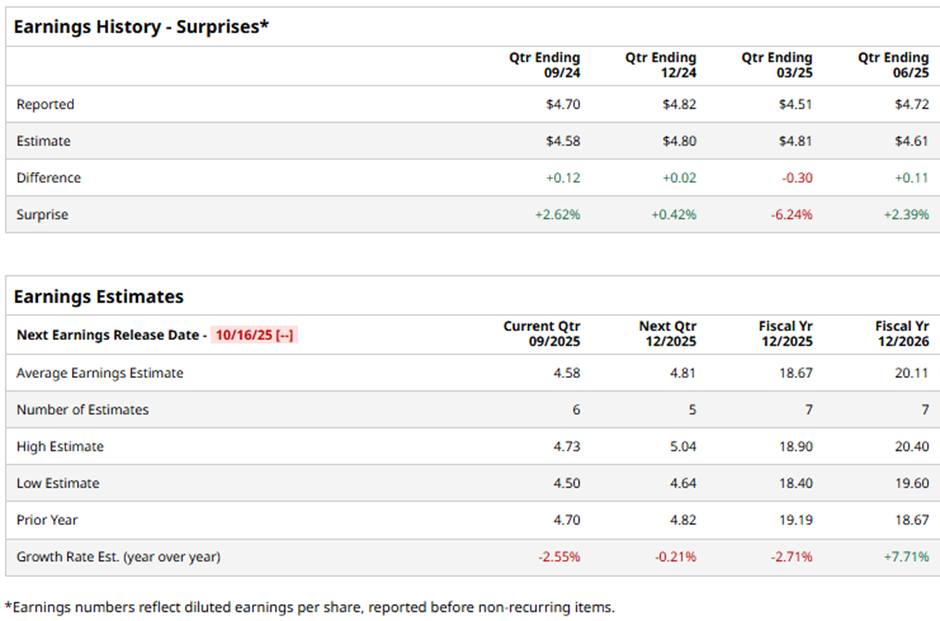

The Kenosha, Wisconsin-based company is expected to announce its fiscal Q3 2025 results on Thursday, Oct. 16. Ahead of this event, analysts expect Snap-on to report an EPS of $4.58, down 2.6% from $4.70 in the year-ago quarter. It has surpassed Wall Street's earnings estimates in three of the last four quarters while missing on another occasion.

For fiscal 2025, analysts predict the tool and diagnostic equipment maker to report an EPS of $18.67, a 2.7% decrease from $19.19 in fiscal 2024. However, EPS is anticipated to grow 7.7% year-over-year to $20.11 in fiscal 2026.

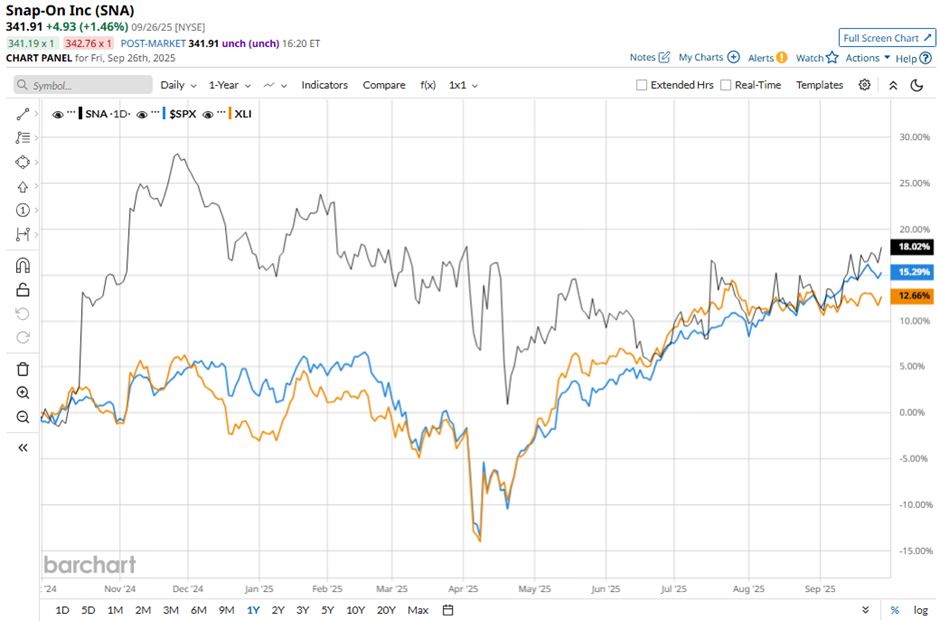

Shares of Snap-on have returned 18.1% over the past 52 weeks, outperforming both the S&P 500 Index's ($SPX) 15.6% gain and the Industrial Select Sector SPDR Fund's (XLI) 13.3% rise over the same period.

Snap-on shares climbed 7.9% on Jul. 17 after the company reported stronger-than-expected Q2 2025 EPS of $4.72. Revenue came in at $1.2 billion, above forecasts, driven by a 2% increase in the Tools Group and a 3% rise in the Repair Systems & Information Group, reflecting steady demand from auto parts companies and repair shops. Investors also responded positively to signs of resilience in the automotive aftermarket, where higher U.S. road travel and inflationary pressures encouraged consumers to keep older vehicles, boosting Snap-on’s core business.

Analysts' consensus view on SNA stock is moderately optimistic, with a "Moderate Buy" rating overall. Among 11 analysts covering the stock, three suggest a "Strong Buy," one gives a "Moderate Buy," six recommend a "Hold," and one has a "Moderate Sell." The average analyst price target for Snap-on is $353.14, indicating a potential upside of 3.3% from the current levels.