/Rockwell%20Automation%20Inc%20sign-by%20JHVEPhoto%20via%20Shutterstock.jpg)

Based in Milwaukee, Wisconsin, Rockwell Automation, Inc. (ROK) helps businesses use technology to make their operations faster and more efficient. It makes equipment and software and offers services that improve how things are made.

Rockwell is known for its Allen-Bradley and FactoryTalk brands, which customers use worldwide. Its main goal is to help businesses improve their manufacturing by leveraging modern automation products and solutions. The company has a market capitalization of $39.39 billion.

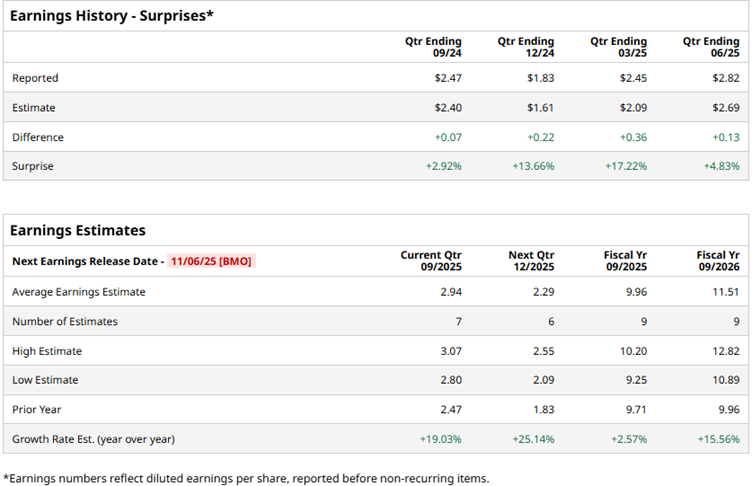

Rockwell is set to report its fourth-quarter results for fiscal 2025 on Nov. 6 before the market opens. Ahead of the results, Wall Street analysts have high expectations for the company’s bottom-line growth. For the fourth quarter about to be reported, analysts expect its profit to grow by 19% year-over-year (YOY) to $2.94 per diluted share.

Rockwell also has a solid history of surpassing estimates, topping the consensus EPS estimates in each of the trailing four quarters. For the full fiscal year 2025, the company’s profit is projected to expand by 2.6% annually to $9.96 per diluted share, followed by another 15.6% YOY surge to $11.51 per diluted share in fiscal 2026.

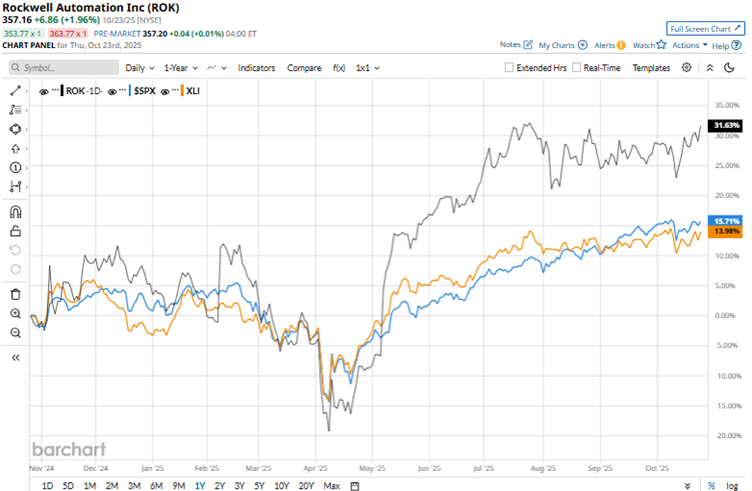

Rockwell’s stock has held up quite well over the past year, driven by strong financials and sustained demand. Over the past 52 weeks, the stock has gained 34.1%, while it is up 25% year-to-date (YTD). The broader S&P 500 Index ($SPX) has gained 16.2% and 14.6% over the same periods, respectively, indicating that the stock has outperformed the broader market.

This specialty machinery stock is classified as an industrial sector stock. It has been an outperformer in this space, as the Industrial Select Sector SPDR Fund (XLI) is up 13.2% over the past 52 weeks and 17.5% YTD.

For the third quarter of fiscal 2025 (the quarter that ended on June 30), Rockwell’s sales grew 4.5% YOY to $2.14 billion, as the company recognized customer wins during the quarter. The topline figure was higher than the $2.07 billion that Wall Street analysts had expected.

The company has a long-term goal of margin expansion. Rockwell’s adjusted EPS was $2.82 for the quarter, up 4.1% annually and surpassing the $2.69 consensus estimate. However, the stock dropped 5% intraday after the Q3 earnings release on Aug. 6, seemingly due to spots of weakness in the operating margins of the intelligent devices and lifecycle services segments compared to the year-ago period.

Wall Street analysts are reasonably optimistic about Rockwell Automation’s future. Among the 24 analysts covering the stock, the consensus rating is “Moderate Buy.” The ratings configuration is less bullish than it was three months ago, with 11 “Strong Buy” ratings now, down from 12. The ratings are completed by 12 “Holds” and one “Strong Sell.”

The mean price target of $357.19 is relatively flat compared to current levels, while the Street-high price target of $410 implies a 14.8% upside.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.