/Revvity%20Inc_%20stock%20chart%20and%20logo-by%20T_Schneider%20via%20Shutterstock.jpg)

Waltham, Massachusetts-based Revvity, Inc. (RVTY) is a leading provider of health science solutions, offering advanced technologies, expertise, and services that encompass complete workflows from discovery and development to diagnosis and cure. Valued at $10.6 billion by market cap, Revvity serves customers across healthcare, academia, and governments, and employs over 11,000 people.

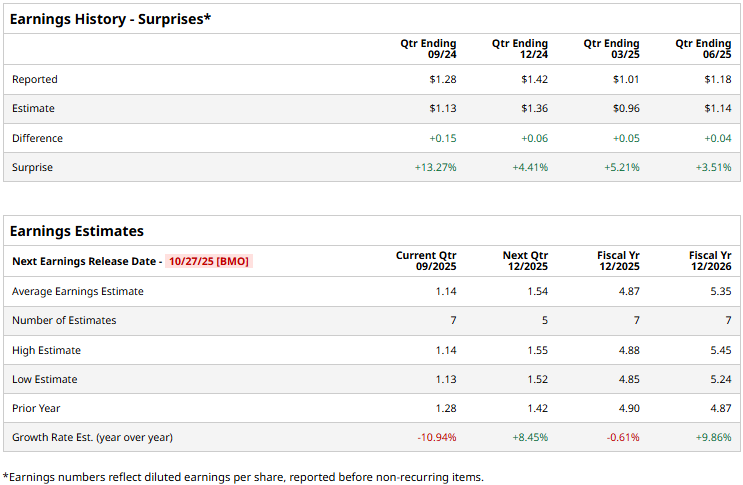

The healthcare major is set to announce its third-quarter results before the market opens on Monday, Oct. 27. Ahead of the event, analysts expect RVTY to report an adjusted earnings of $1.14 per share, down 10.9% from $1.28 per share reported in the year-ago quarter. On a positive note, the company has a robust earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

For the full fiscal 2025, Revvity is expected to deliver an adjusted EPS of $4.87, marginally down from $4.90 reported in 2024. In fiscal 2026, its earnings are expected to surge 9.9% year-over-year to $5.35 per share.

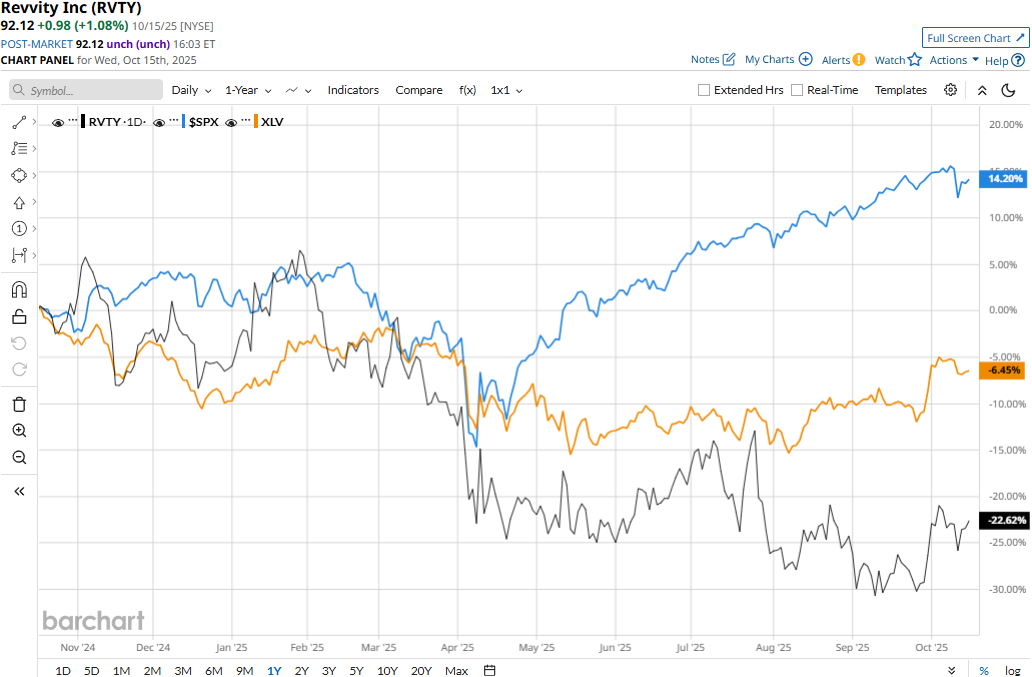

RVTY stock prices have plummeted 25.9% over the past 52 weeks, notably lagging behind the Healthcare Select Sector SPDR Fund’s (XLV) 6.7% decline and the S&P 500 Index’s ($SPX) 14.7% gains during the same time frame.

Despite reporting better-than-expected results, Revvity’s stock prices plunged 8.3% in the trading session following the release of its Q2 results on Jul. 28. The company’s topline for the quarter grew 4.1% year-over-year to $720.3 million, beating the Street’s expectations by 1.3%. Meanwhile, its adjusted EPS dipped 3.3% year-over-year to $1.18, but surpassed the consensus estimates by a notable 3.5%.

Revvity expects the pressure on its margins to remain throughout the year. Further, its organic revenues are also expected to remain subdued in the coming quarters. Due to this, the company reduced its full-year organic revenue growth guidance from the previous range of 3% - 5% to 2% - 4% and lowered its adjusted EPS guidance from the previous range of $4.90 - $5.00 to $4.85 to $4.95, unsettling investor confidence.

Analysts remain cautiously optimistic about the stock’s prospects. RVTY has a consensus “Moderate Buy” rating overall. Of the 17 analysts covering the stock, opinions include nine “Strong Buys,” one “Moderate Buy,” and seven “Holds.” Its mean price target of $111.93 suggests a 21.5% upside potential from current price levels.