/Parker-Hannifin%20Corp_%20factory-by%20Jonathan%20Weiss%20via%20Shutterstock.jpg)

Valued at a market cap of $93.2 billion, Parker-Hannifin Corporation (PH) manufactures and sells motion and control technologies and systems for aerospace and defense, in-plant and industrial equipment, transportation, off-highway, energy, and HVAC and refrigeration markets. The Cleveland, Ohio-based company is scheduled to announce its fiscal Q1 earnings for 2026 before the market opens on Thursday, Nov. 6.

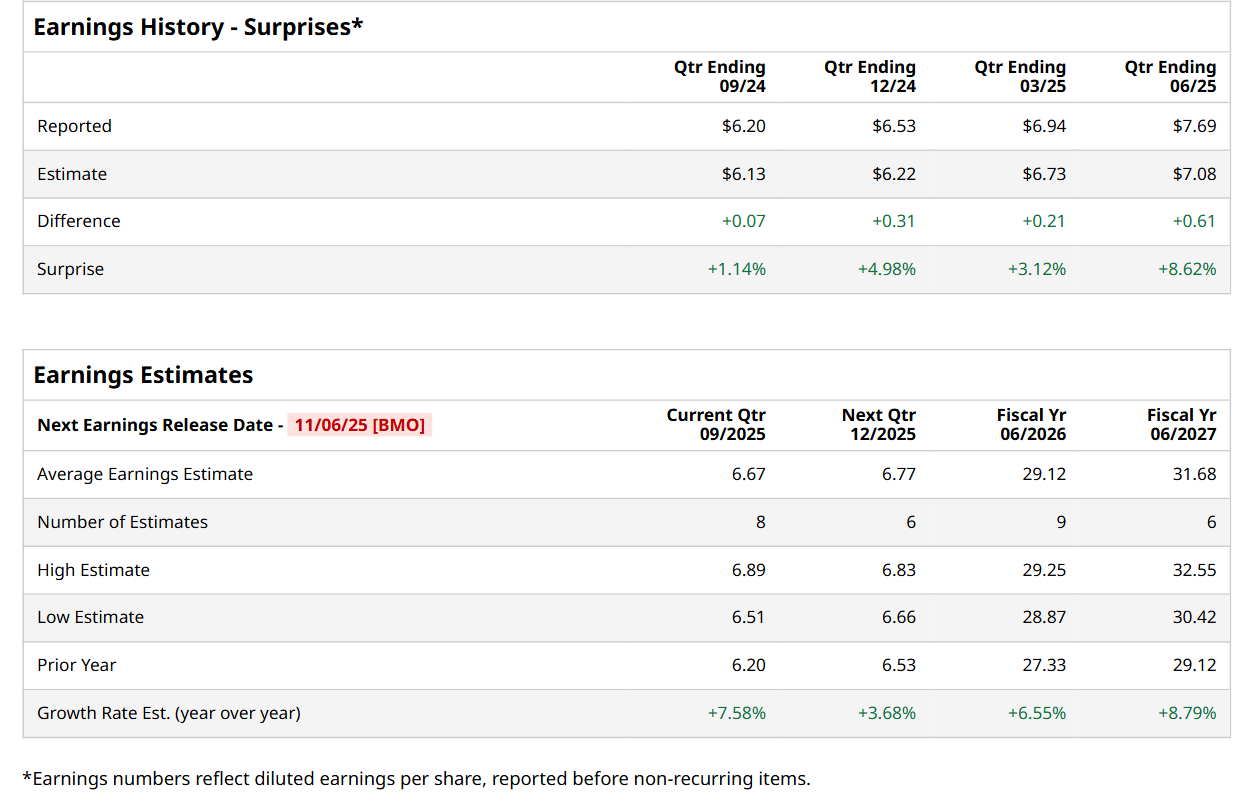

Ahead of this event, analysts expect this motion and control technologies leader to report a profit of $6.67 per share, up 7.6% from $6.20 per share in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in each of the last four quarters. In Q4, PH’s EPS of $7.69 exceeded the forecasted figure by 8.6%.

For fiscal 2026, analysts expect PH to report a profit of $29.12 per share, up 6.6% from $27.33 per share in fiscal 2025. Furthermore, its EPS is expected to grow 8.8% year-over-year to $31.68 in fiscal 2027.

PH has gained 16.6% over the past 52 weeks, outpacing both the S&P 500 Index's ($SPX) 15.1% return and the Industrial Select Sector SPDR Fund’s (XLI) 11.6% uptick over the same time frame.

Shares of PH rose 4.1% after its impressive Q4 earnings release on Aug. 7. The company’s net sales improved 1.1% year-over-year to $5.2 billion, exceeding consensus estimates by 2.7%. Meanwhile, its adjusted EPS grew 13.6% from the year-ago quarter to a record $7.69, surpassing analyst expectations by 8.6%.

Wall Street analysts are highly optimistic about PH’s stock, with an overall "Strong Buy" rating. Among 23 analysts covering the stock, 16 recommend "Strong Buy," one indicates a "Moderate Buy," and six suggest "Hold.” The mean price target for PH is $802.05, implying an 8.9% potential upside from the current levels.