Valued at $15.1 billion by market cap, New York-based News Corporation (NWSA) operates as a global media and information services company that creates and distributes content across various platforms, including newspapers, digital media, book publishing, and subscription video services.

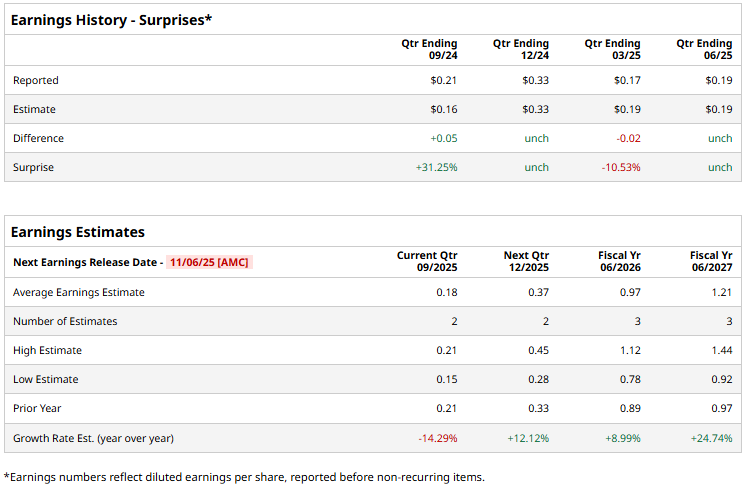

The media giant is gearing up to report its first-quarter results after the markets close on Thursday, Nov. 6. Ahead of the event, analysts expect NWSA to report an adjusted EPS of $0.18, down a notable 14.3% from $0.21 reported in the year-ago quarter. While the company has met or surpassed the Street’s bottom-line expectations thrice over the past four quarters, it missed the projections on one other occasion.

For the full fiscal 2026, NWSA is expected to deliver an adjusted EPS of $0.97, marking a 9% increase from $0.89 reported in fiscal 2025. While in fiscal 2027, its earnings are expected to further surge 24.7% year-over-year to $1.21 per share.

NWSA stock prices have observed a marginal 64 bps uptick over the past 52 weeks, notably underperforming the Communication Services Select Sector SPDR ETF Fund’s (XLC) 27.5% surge and the S&P 500 Index’s ($SPX) 18.3% returns during the same time frame.

News Corp.’s stock prices observed a marginal 48 bps uptick in the trading session following the release of its better-than-expected Q4 results on Aug. 5. The company’s revenues from book publishing and news media segments observed a notable drop, while Dow Jones and digital real estate services revenues observed a notable growth. Overall, its new sales came in at $2.1 billion, up 81 bps year-over-year, slightly above the consensus estimates. Meanwhile, News’ total segment EBITDA increased by 5% to $322 million. Meanwhile, its adjusted EPS dropped 5% year-over-year to $0.19, but matched the Street’s expectations.

Analysts remain optimistic about the stock’s longer-term prospects. NWSA has a consensus “Moderate Buy” rating overall. Of the 10 analysts covering the stock, opinions include eight “Strong Buys,” one “Hold,” and one “Strong Sell.” Its mean price target of $39.10 suggests a 46.6% upside potential from current price levels.