/Micron%20Technology%20Inc_billboard-by%20Poetra_RH%20via%20Shutterstock.jpg)

Boasting a market cap of $437.9 billion, Micron Technology, Inc. (MU) is a leading semiconductor company. The Boise, Idaho-based company specializes in the design and manufacture of memory and storage solutions, including DRAM, NAND flash, NOR flash, and solid-state drives. Its products are widely used across data centers, cloud computing, mobile devices, automotive systems, artificial intelligence applications, and industrial infrastructure

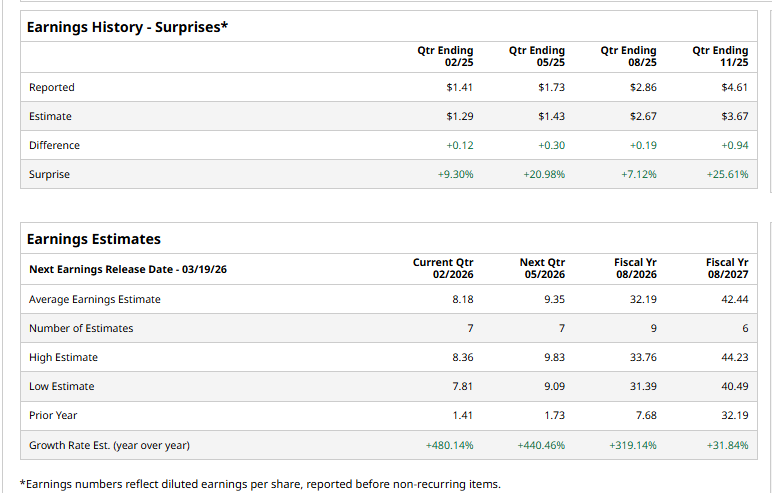

The company is slated to announce its fiscal 2026 Q2 earnings results soon. Analysts expect the company to report an EPS of $8.18, a 480.1% growth from $1.41 in the year-ago quarter. It has consistently exceeded Wall Street’s earnings expectations in the past four quarters, which is impressive.

For the current year, analysts expect Micron Technology to report EPS of $32.19, up 319.1% from $7.68 in fiscal 2025.

Shares of Micron Technology have risen 264% over the past 52 weeks, significantly outpacing the broader S&P 500 Index’s ($SPX) 13.6% gain and the Technology Select Sector SPDR Fund’s (XLK) 20% rise over the same period.

Stifel raised Micron’s price target to $360 from $300 on Jan. 20 while reaffirming its “Buy” rating, citing strong AI cloud demand and strategic fab acquisitions as key drivers of margins and supply strength. The firm noted that Micron has improved flexibility in its supply roadmap, helping ease near-term pressures, as rapid expansion in AI infrastructure continues to absorb global DRAM output and tighten supply. MU shares rose 6.6% in the following trading session.

Analysts’ consensus view on MU stock remains highly bullish, with the chip stock having a “Strong Buy” rating overall. Out of 40 analysts covering the stock, 31 recommend a “Strong Buy,” six have a “Moderate Buy,” and three give a “Hold.” The stock is trading above the average analyst price target of $330.46.