/MGM%20Resorts%20International%20hotel%20by-%20atosan%20via%20iStock.jpg)

With a market cap of $8.8 billion, MGM Resorts International (MGM) is a leading global gaming and entertainment company that owns and operates a portfolio of iconic resorts such as Bellagio, MGM Grand, Mandalay Bay, and The Mirage. It operates through four segments: Las Vegas Strip Resorts; Regional Operations; MGM China; and MGM Digital, offering casino, hotel, and online gaming services worldwide.

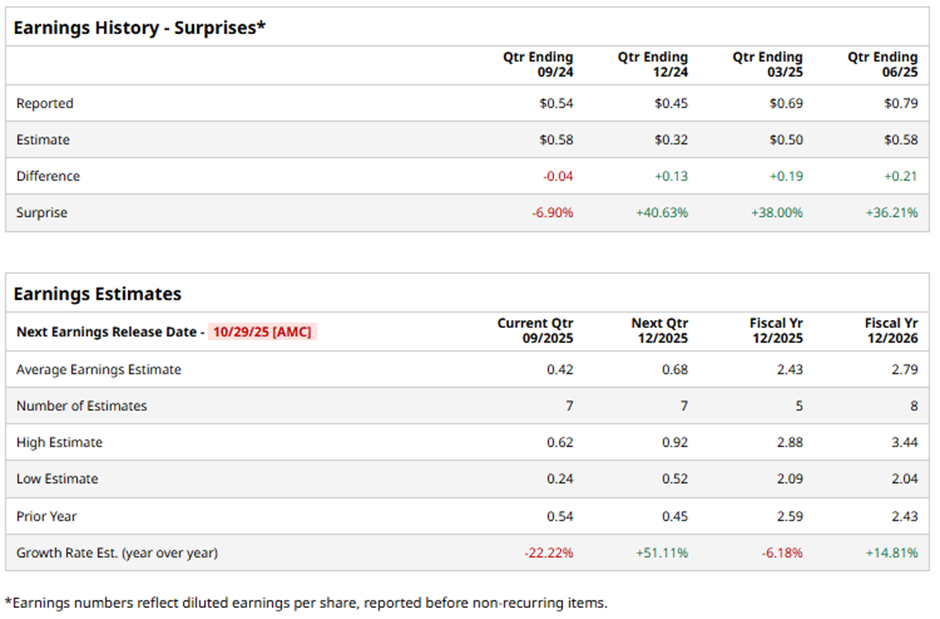

The Las Vegas, Nevada-based company is expected to announce its Q3 2025 results after the market closes on Wednesday, Oct. 29. Ahead of this event, analysts expect MGM Resorts to report an adjusted EPS of $0.42, down 22.2% from $0.54 in the year-ago quarter. It has exceeded Wall Street's earnings estimates in three of the last four quarters while missing on another occasion.

For fiscal 2025, analysts expect the casino and resort operator to report an adjusted EPS of $2.43, a 6.2% decrease from $2.59 in fiscal 2024. However, adjusted EPS is anticipated to grow 14.8% year-over-year to $2.79 in fiscal 2026.

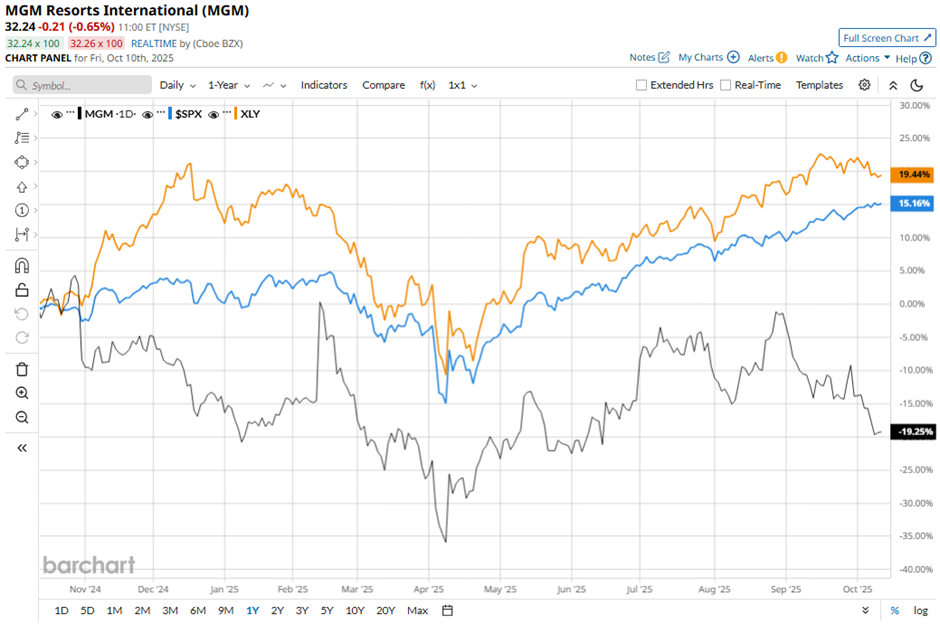

Shares of MGM Resorts have dropped 18.4% over the past 52 weeks, underperforming both the S&P 500 Index's ($SPX) 16.8% gain and the Consumer Discretionary Select Sector SPDR Fund's (XLY) 19.2% increase over the period.

Despite beating estimates with Q2 2025 adjusted EPS of $0.79 and revenue of $4.4 billion on Jul. 30, MGM shares fell 3.8% the next day. Adjusted EPS fell from $0.86 a year earlier, and Las Vegas Strip revenues dropped 4% to $2.11 billion, with EBITDAR down 9% due to room remodel disruptions and lower table games hold. Additionally, MGM Digital posted a larger EBITDAR loss of $25.7 million, raising concerns.

Analysts' consensus view on MGM stock is cautiously optimistic, with an overall "Moderate Buy" rating. Among 20 analysts covering the stock, 11 recommend "Strong Buy," eight suggest "Hold," and one advises "Strong Sell." The average analyst price target for MGM Resorts is $47.20, indicating a potential upside of 46.4% from the current levels.