/Masco%20Corp_%20logo%20on%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Livonia, Michigan-based Masco Corporation (MAS) designs, manufactures, and distributes home improvement and building products in North America, Europe, and internationally. With a market cap of $14.1 billion, Masco operates through the Plumbing Products and Decorative Architectural Products segments.

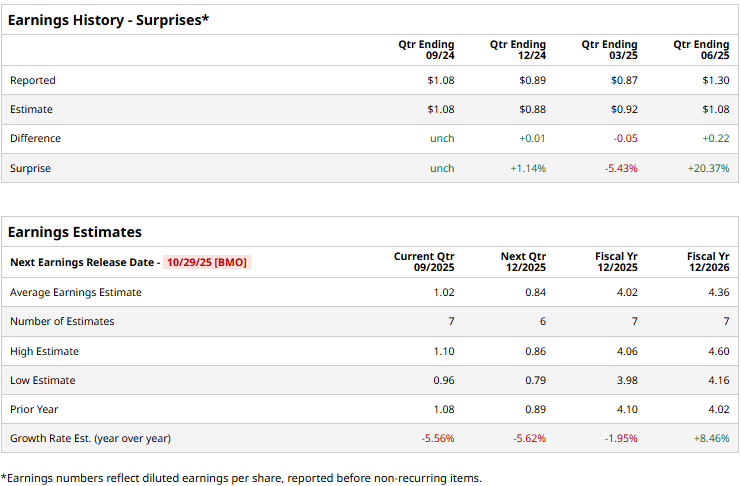

The building products and equipment manufacturer is set to release its third-quarter earnings before the market opens on Wednesday, Oct. 29. Ahead of the event, analysts expect Masco to deliver an adjusted profit of $1.02 per share, down 5.6% from $1.08 per share reported in the year-ago quarter. While the company has met or surpassed the Street’s bottom-line estimates thrice over the past four quarters, it has missed the projections on one other occasion.

For the full fiscal 2025, Masco’s adjusted EPS is expected to come in at $4.02, down nearly 2% from $4.10 in 2024. While in fiscal 2026, its earnings are expected to rebound 8.5% year-over-year to $4.36 per share.

MAS stock prices have plummeted 20.5% over the past 52 weeks, notably lagging behind the Industrial Select Sector SPDR Fund’s (XLI) 8.9% gains and the S&P 500 Index’s ($SPX) 13.5% returns during the same time frame.

Masco’s stock prices gained 3.7% in the trading session following the release of its better-than-expected Q2 results on Jul. 31 and maintained a positive momentum for three subsequent trading sessions. The company’s plumbing product sales grew by 5%, but its decorative architectural products’ sales dropped by 12%. Overall, the company’s net sales came in at $2.1 billion, down 1.9% year-over-year, but 2.3% ahead of the Street’s expectations. Meanwhile, its adjusted EPS inched up 8.3% year-over-year to $1.30, beating the consensus estimates by a staggering 20.4%, boosting investor confidence.

Analysts remain cautiously optimistic about the stock’s prospects. MAS holds a consensus “Moderate Buy” rating overall. Of the 21 analysts covering the stock, opinions include seven “Strong Buys,” 13 “Holds,” and one “Moderate Sell.” Its mean price target of $74.88 suggests a 10.1% upside potential from current price levels.