With a market cap of $56.1 billion, Marathon Petroleum Corporation (MPC) is an integrated downstream energy company that transports and markets petroleum products. The Findlay, Ohio-based company also provides transportation, storage, and logistics services for crude oil and refined products. It is scheduled to announce its fiscal Q3 earnings for 2025 before the market opens on Tuesday, Nov. 4.

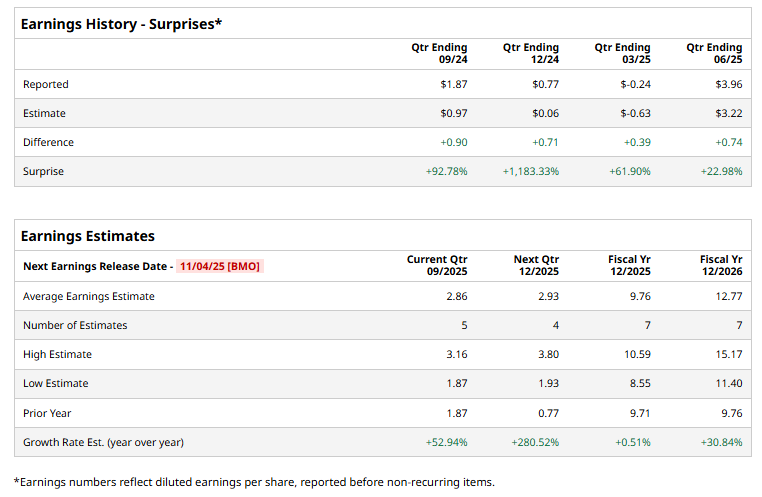

Before this event, analysts project this downstream energy company to report a profit of $2.86 per share, up 52.9% from $1.87 per share in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in each of the last four quarters.

For the current year, analysts expect MPC to report EPS of $9.76, representing a marginal rise from $9.71 in fiscal 2024. Additionally, its EPS is expected to grow an impressive 30.8% annually to $12.77 in fiscal 2026.

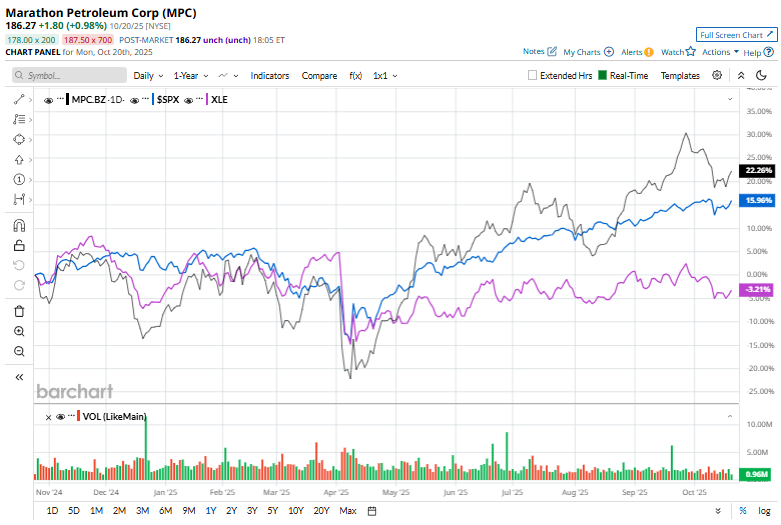

MPC has gained 17.7% over the past 52 weeks, outperforming the S&P 500 Index's ($SPX) 14.8% return and the Energy Select Sector SPDR Fund’s (XLE) 3.8% fall over the same period.

On Sept. 30, Marathon Petroleum shares declined over 1% as energy producers and service providers fell in tandem with a more than 1% drop in WTI crude oil prices to a one-week low.

Wall Street analysts are moderately optimistic about MPC’s stock, with a "Moderate Buy" rating overall. Among 20 analysts covering the stock, eight recommend "Strong Buy," three indicate "Moderate Buy," and nine suggest "Hold.” The mean price target for MPC is $197.65, indicating a potential 6.1% upside from the current price levels.