/Lowe)

With a market cap of $136.1 billion, Lowe's Companies, Inc. (LOW) is one of the world’s largest home improvement retailers, committed to helping homeowners, renters, and professionals enhance homes and businesses. Guided by the Total Home Strategy, the company focuses on providing expert service and a seamless omnichannel experience for every project and customer interaction.

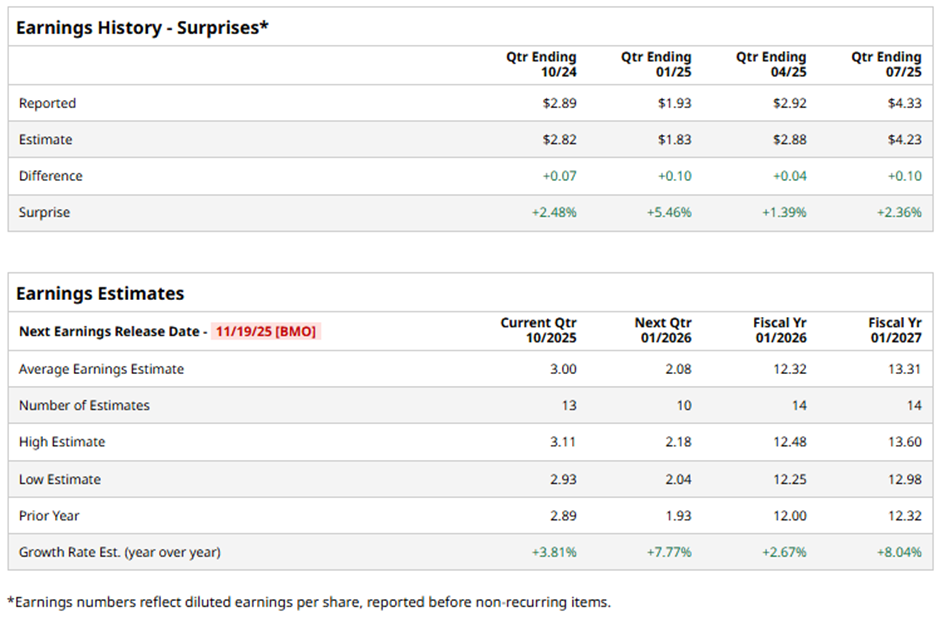

The Mooresville, North Carolina-based company is expected to announce its fiscal Q3 2025 results before the market opens on Wednesday, Nov. 19. Ahead of this event, analysts expect LOW to report an adjusted EPS of $3, up 3.8% from $2.89 in the year-ago quarter. It has surpassed Wall Street's earnings estimates in the last four quarters.

For fiscal 2025, analysts expect the home improvement retailer to report an adjusted EPS of $12.32, a 2.7% rise from $12 in fiscal 2024. In addition, adjusted EPS is anticipated to grow over 8% year-over-year to $13.31 in fiscal 2026.

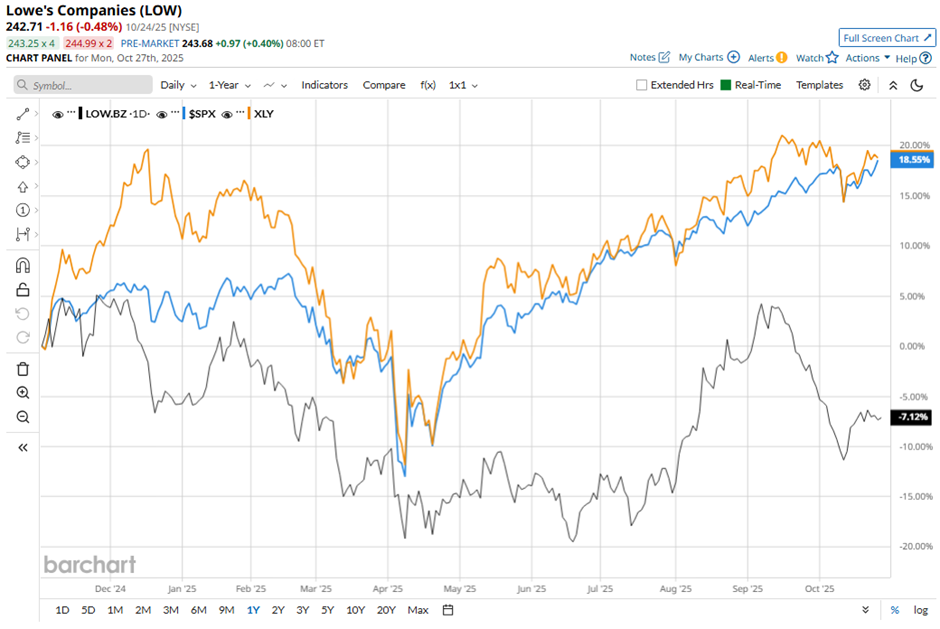

Shares of Lowe's have declined nearly 9% over the past 52 weeks, underperforming both the S&P 500 Index's ($SPX) 16.9% rise and the Consumer Discretionary Select Sector SPDR Fund's (XLY) 19.4% return over the period.

Shares of Lowe’s rose marginally on Aug. 20 after the company reported better-than-expected Q2 2025 adjusted EPS of $4.33. The home improvement retailer also raised its annual sales forecast to a range of $84.5 billion to $85.5 billion. Additionally, investor confidence was boosted by Lowe’s announcement to acquire Foundation Building Materials for $8.8 billion, expanding its presence in the professional contractor market.

Analysts' consensus view on LOW stock is cautiously optimistic, with an overall "Moderate Buy" rating. Among 29 analysts covering the stock, 18 recommend "Strong Buy," one suggests "Moderate Buy," nine indicate “Hold,” and one gives "Strong Sell." The average analyst price target for Lowe's is $282.12, suggesting a potential upside of 16.2% from current levels.