/Las%20Vegas%20Sands%20Corp%20sign%20by-%20Andy%20Borysowski%20via%20Shutterstock.jpg)

Valued at a market cap of $37.8 billion, Las Vegas Sands Corp. (LVS) is a leading global developer and operator of world-class integrated resorts. The company owns and operates premier properties in Macao, China, and Singapore, featuring luxury accommodations, gaming, retail, dining, and convention facilities.

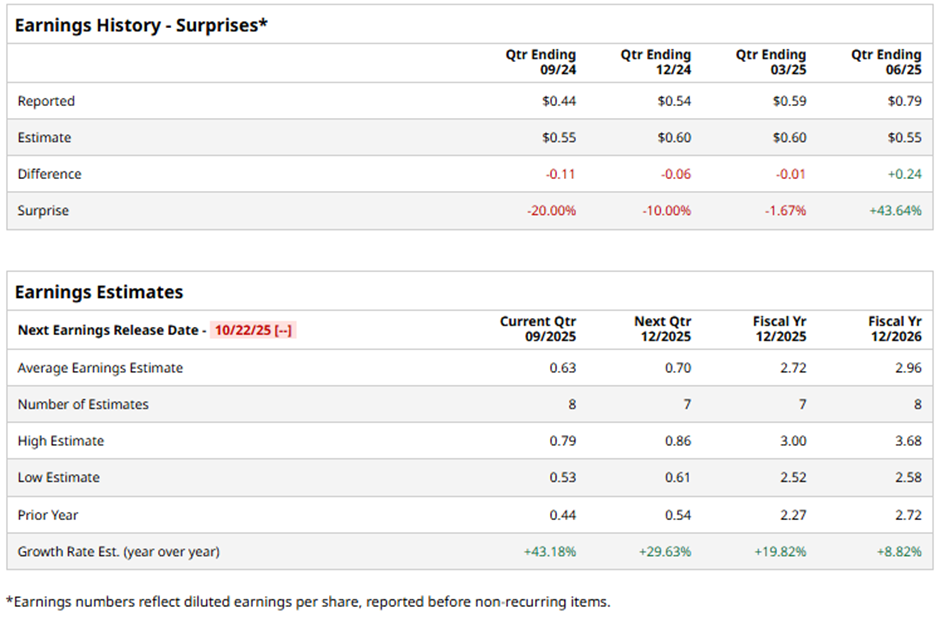

Analysts expect the Las Vegas, Nevada-based company to report an adjusted EPS of $0.63 in Q3 2025, a 43.2% surge from $0.44 in the year-ago quarter. It has exceeded Wall Street's earnings estimates in one of the last four quarters while missing on three other occasions.

For fiscal 2025, analysts forecast the casino operator to post an adjusted EPS of $2.72, up 19.8% from $2.27 in fiscal 2024.

Shares of Las Vegas Sands have fallen marginally over the past 52 weeks, underperforming both the S&P 500 Index's ($SPX) 18.4% gain and the Consumer Discretionary Select Sector SPDR Fund's (XLY) 22.2% return over the period.

Shares of Las Vegas Sands soared 4.3% following its Q2 2025 results on July 23. The company reported adjusted earnings of $0.79 per share and quarterly revenue of $3.1 billion, topping forecasts. Growth was fueled by a 36% revenue jump to $1.4 billion in Singapore and a 2.5% increase to $1.8 billion in Macau, highlighting strong performance in both key markets.

Analysts' consensus view on LVS stock is moderately optimistic, with an overall "Moderate Buy" rating. Among 17 analysts covering the stock, 10 recommend "Strong Buy" and seven indicate “Hold.” This configuration is slightly more bullish than three months ago, with nine analysts suggesting a "Strong Buy."

The average analyst price target for Las Vegas Sands is $60.59, indicating a potential upside of 16.7% from the current levels.