/Lam%20Research%20Corp_%20HQ%20sign-by%20Michael%20Vi%20via%20Shutterstock.jpg)

Lam Research Corporation (LRCX), headquartered in Fremont, California, designs, manufactures, markets, refurbishes, and services semiconductor processing equipment used in the fabrication of integrated circuits. Valued at $183.9 billion by market cap, the company’s products are used to deposit special films on a silicon wafer and etch away portions of various films to create a circuit design. The semiconductor giant is expected to announce its fiscal first-quarter earnings for 2026 after the market closes on Wednesday, Oct. 22.

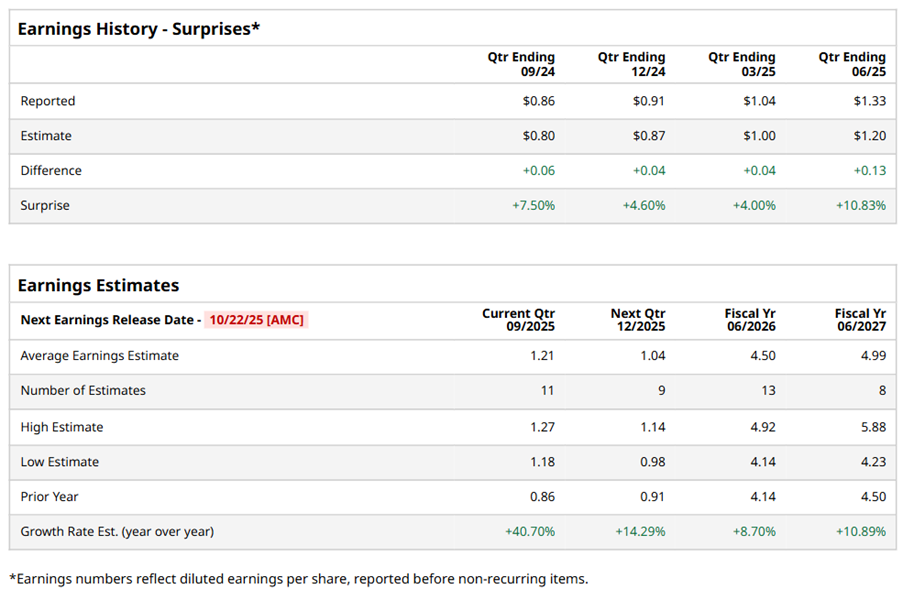

Ahead of the event, analysts expect LRCX to report a profit of $1.21 per share on a diluted basis, up 40.7% from $0.86 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect LRCX to report EPS of $4.50, up 8.7% from $4.14 in fiscal 2025. Its EPS is expected to rise 10.9% year-over-year to $4.99 in fiscal 2027.

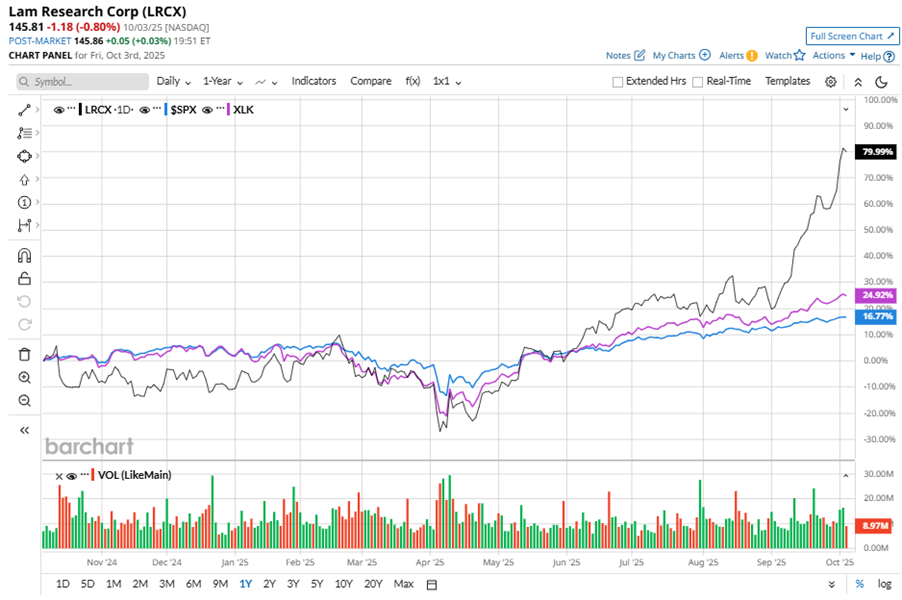

LRCX stock has notably outperformed the S&P 500 Index’s ($SPX) 17.8% gains over the past 52 weeks, with shares up 79.8% during this period. Similarly, it considerably outperformed the Technology Select Sector SPDR Fund’s (XLK) 27.8% gains over the same time frame.

Lam Research reported impressive Q4 results on Jul. 30, with $5.2 billion in revenue and $1.33 in adjusted EPS, both beating expectations. The company's top line surged 33.6% year-over-year, driven by robust demand for its deposition and etch technologies, which resulted in strong gross margins and a record EPS. Despite the stellar performance, Lam Research's shares fell 4.3% in the next trading session, likely due to investor concerns over the company's substantial exposure to China, which poses regulatory and market risks.

Analysts’ consensus opinion on LRCX stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 32 analysts covering the stock, 20 advise a “Strong Buy” rating, two suggest a “Moderate Buy,” and 10 give a “Hold.” While LRCX currently trades above its mean price target of $121.27, the Street-high price target of $160 suggests an upside potential of 9.7%.