Cincinnati, Ohio-based The Kroger Co. (KR) operates as a food and drug retailer. The company operates a combination of food and drug stores, multi-department stores, marketplace stores, and price impact warehouses. With a market cap of $44.5 billion, Kroger operates as one of the world's largest food retailers in the US.

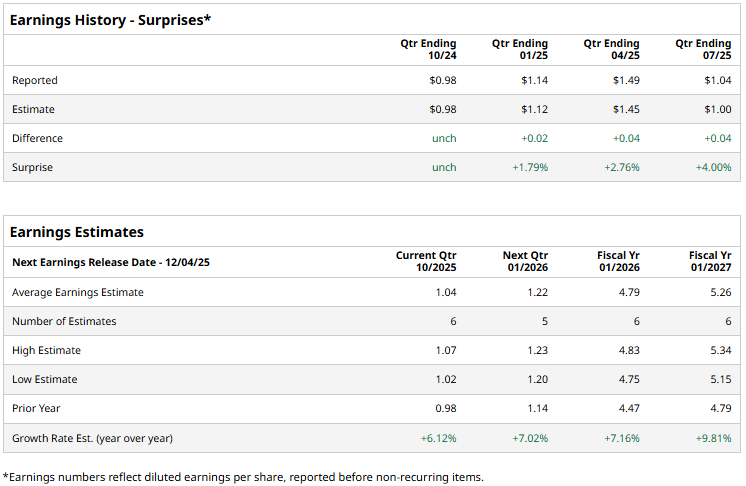

The grocery giant is expected to release its Q3 results by early December. Ahead of the event, analysts expect Kroger to report an adjusted profit of $1.04 per share, up 6.1% from $0.98 per share reported in the year-ago quarter. Further, the company has a robust earnings surprise history. It has met or surpassed the Street’s bottom-line estimates in each of the past four quarters.

For the full fiscal 2026, analysts expect Kroger to report an adjusted EPS of $4.79, up 7.2% from $4.47 in fiscal 2025. While in fiscal 2027, its earnings are expected to surge 9.8% year-over-year to $5.26 per share.

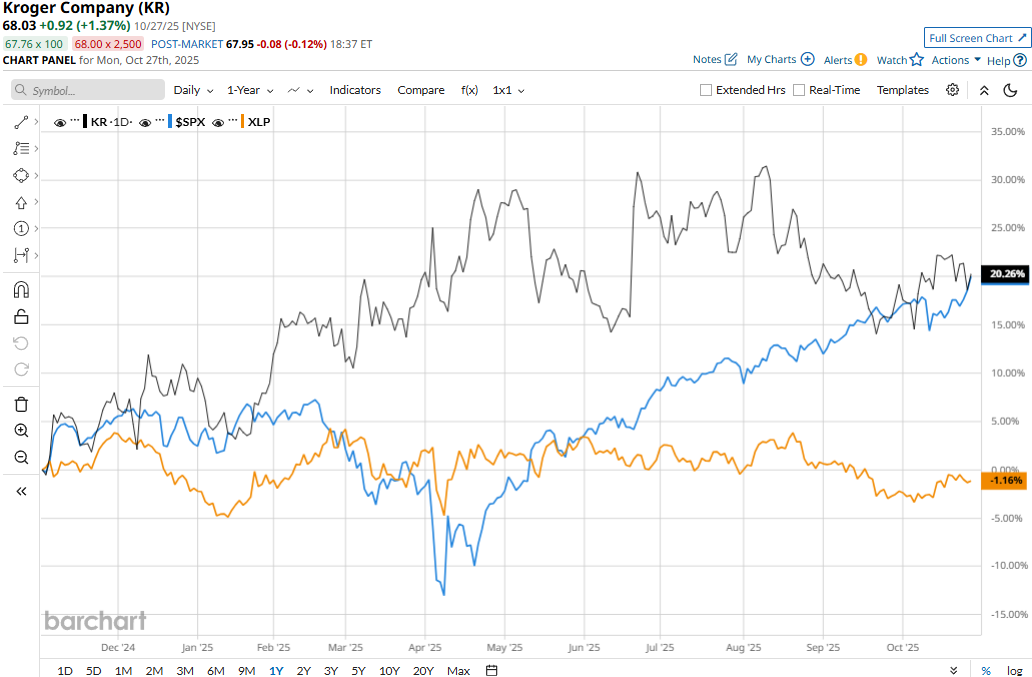

KR stock prices have gained 18.6% over the past 52 weeks, marginally outpacing the S&P 500 Index’s ($SPX) 18.4% gains and significantly outperforming the Consumer Staples Select Sector SPDR Fund’s (XLP) 2.3% decline during the same time frame.

Kroger’s stock prices observed a marginal uptick in the trading session following the release of its mixed Q2 results on Sept. 11. Q2 was marked with an improvement in momentum across its businesses. Kroger registered strong growth in pharmacy, eCommerce, and Fresh sales. However, its topline of $33.9 billion missed the Street’s expectations by 54 bps. On the positive note, Kroger observed a notable improvement in margins, leading to an 11.8% surge in adjusted EPS to $1.04, beating the consensus estimates by a notable 4%.

The consensus view on KR stock remains optimistic, with a “Moderate Buy” rating overall. Of the 21 analysts covering the stock, opinions include 11 “Strong Buys” and 10 “Holds.” Its mean price target of $77.60 suggests a 14.1% upside potential from current price levels.