Burlington, Massachusetts-based Keurig Dr Pepper Inc. (KDP) owns, manufactures, and distributes beverages and single-serve brewing systems. Valued at a market cap of $35.1 billion, the company offers its products under various well-known brands, including Dr Pepper, 7UP, Canada Dry, Snapple, Mott’s, and Bai. It is expected to announce its fiscal Q3 earnings for 2025 later this month.

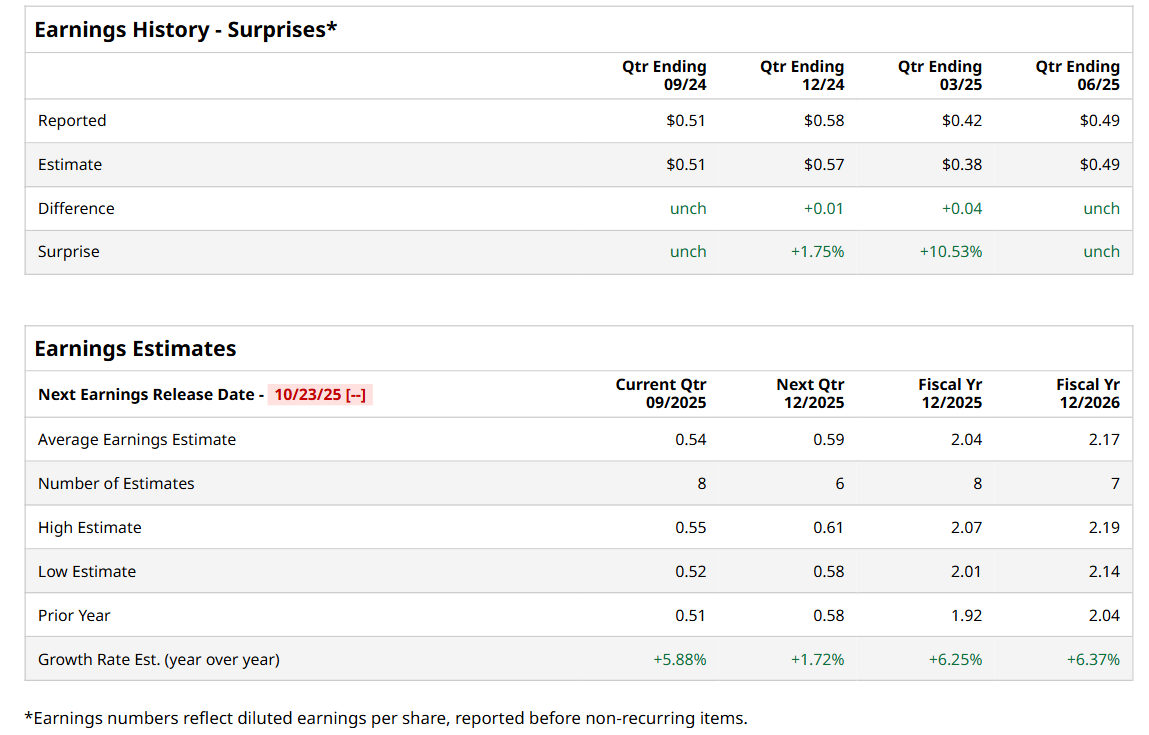

Before this event, analysts expect this beverage company to report a profit of $0.54 per share, up 5.9% from $0.51 per share in the year-ago quarter. The company has met or beaten Wall Street’s bottom-line estimates in each of the last four quarters. Its earnings of $0.49 per share in the previous quarter came in line with the consensus estimates.

For the current fiscal year ending in December, analysts expect KDP to report a profit of $2.04 per share, up 6.3% from $1.92 per share in fiscal 2024. Its EPS is expected to further grow 6.4% year-over-year to $2.17 in fiscal 2026.

KDP has declined 29.5% over the past 52 weeks, considerably lagging behind both the S&P 500 Index's ($SPX) 17.8% uptick and the Consumer Staples Select Sector SPDR Fund’s (XLP) 3.9% drop over the same time frame.

Shares of KDP tumbled 11.5% on Aug. 25 and another 6.9% in the following trading session after the company announced plans to acquire JDE Peet’s (EURONEXT: JDEP), a Dutch-listed coffee giant, for about €15.7 billion. The deal valued JDE Peet’s at a 33% premium to its market price. While KDP’s management described the move as a strategically sound, long-term growth opportunity for stakeholders, investors reacted negatively to the steep premium, triggering a significant sell-off.

Wall Street analysts are moderately optimistic about KDP’s stock, with a "Moderate Buy" rating overall. Among 17 analysts covering the stock, nine recommend "Strong Buy," one indicates a "Moderate Buy," six suggest "Hold,” and one advises a “Strong Sell” rating. The mean price target for KDP is $34.70, implying a 34.3% potential upside from the current levels.