/Idexx%20Laboratories%2C%20Inc_%20outside%20lab-by%20Sundry%20Photography%20via%20iStock.jpg)

Westbrook, Maine-based IDEXX Laboratories, Inc. (IDXX) develops, manufactures, and distributes products for the companion animal veterinary, livestock and poultry, dairy, and water testing industries. Valued at a market cap of $42.7 billion, the company also offers a range of portable electrolytes and blood gas analyzers for the human point-of-care medical diagnostics market. It is scheduled to announce its fiscal Q2 earnings for 2025 before the market opens on Monday, Aug. 4.

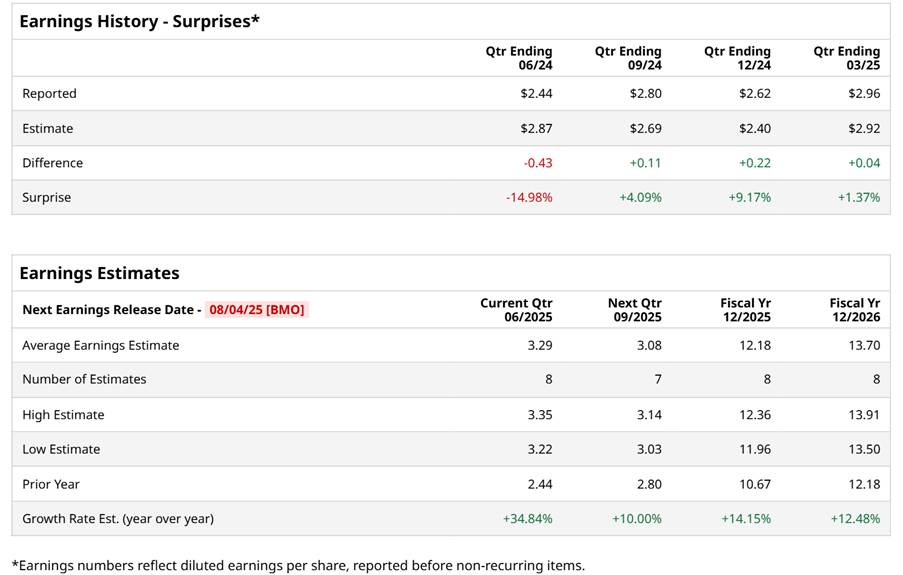

Before this event, analysts project this pet healthcare company to report a profit of $3.29 per share, up 34.8% from $2.44 per share in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in three of the last four quarters, while missing on another occasion. Its earnings of $2.96 per share in the previous quarter topped the consensus estimates by 1.4%.

For the full year, analysts expect IDXX to report EPS of $12.18, up 14.2% from $10.67 in fiscal 2024. Its EPS is expected to further grow 12.5% year-over-year to $13.70 in fiscal 2026.

IDXX has lagged behind the S&P 500 Index's ($SPX) 11.6% return over the past 52 weeks, with its shares up 7.9% during this period. However, it has outpaced the Health Care Select Sector SPDR Fund’s (XLV) 8.9% downtick over the same time frame.

On May 1, shares of IDXX rose 9% after its Q1 earnings release, despite missing the revenue estimates. The company’s revenue improved 3.6% year-over-year to $998.4 million, but fell short of consensus expectations. However, on the upside, both its gross and operating profit margins expanded from the year-ago quarter, leading to a 5.3% increase in its EPS to $2.96, which topped the analyst estimates by 1.4%.

IDEXX also raised its fiscal 2025 guidance, now projecting revenue between $4.1 billion and $4.2 billion, and EPS in the range of $11.93 to $12.43. This might have further bolstered investor confidence.

Wall Street analysts are moderately optimistic about IDXX’s stock, with a "Moderate Buy" rating overall. Among 11 analysts covering the stock, six recommend "Strong Buy," one indicates a "Moderate Buy," and four advise "Hold.” The mean price target for IDXX is $549.50, indicating a 3.4% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.