/HP%20Inc%20ink-by%20Ammatar%20via%20Shutterstock.jpg)

Valued at a market cap of $25.9 billion, HP Inc. (HPQ) provides personal computing, printing, 3D printing, hybrid work, gaming, and other related technologies. The Palo Alto, California-based company serves individual consumers, small- and medium-sized businesses, and large enterprises. It is expected to announce its fiscal Q4 earnings for 2025 soon.

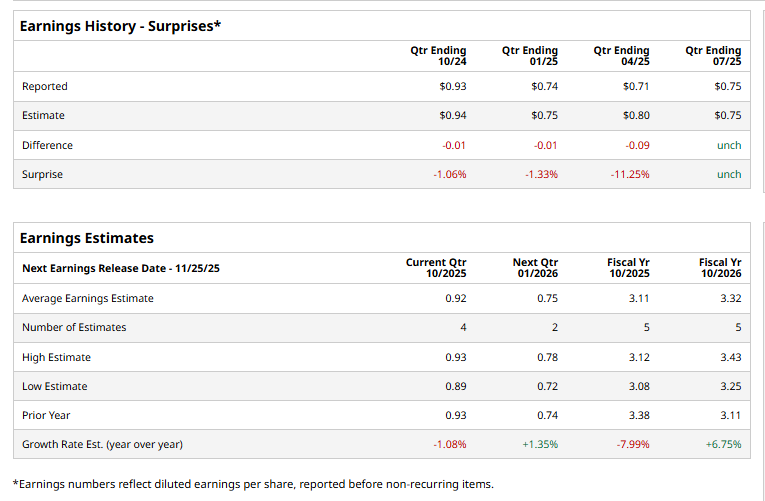

Ahead of this event, analysts expect this computer hardware company to report a profit of $0.92 per share, down 1.1% from $0.93 per share in the year-ago quarter. The company has missed Wall Street’s earnings estimates in three of the last four quarters, while matching in the last quarter.

For fiscal 2025, analysts expect HP to report a profit of $3.11 per share, down 8% from $3.38 per share in fiscal 2024. Nonetheless, its EPS is expected to rebound in fiscal 2026, growing 6.8% annually to $3.32.

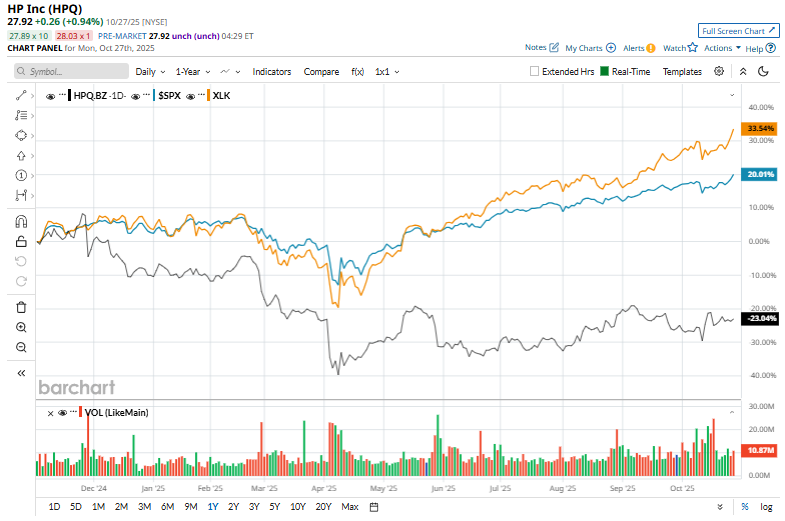

HP has declined 24.3% over the past 52 weeks, considerably underperforming both the S&P 500 Index's ($SPX) 18.4% return and the Technology Select Sector SPDR Fund’s (XLK) 29.8% uptick over the same time frame.

Despite the grim price action over the past year, HP shares rallied in mid-October after a double dose of positive news boosted investor confidence. On Oct. 13, the stock surged 5.9% as the company unveiled a new manufacturing facility and AI R&D Center in Riyadh, marking a major step toward localizing production and strengthening its global supply chain.

The momentum continued the next day, with shares rising another 2.6% after HSBC Holdings plc (HSBC) upgraded HP to “Buy” and lifted its price target to $30, citing renewed optimism for PC and printer sales.

Wall Street analysts are cautious about HPQ’s stock, with an overall “Hold" rating. Among 15 analysts covering the stock, one recommends "Strong Buy," 13 indicate "Hold," and one advises a "Strong Sell” rating. The mean price target for HPQ is $28.23, indicating a 1.1% premium from the current levels.

.jpg?w=600)