Bethesda, Maryland-based Host Hotels & Resorts, Inc. (HST) is the largest lodging real estate investment trust (REIT) and a leading owner of luxury and upper-upscale hotels. Valued at $11.3 billion by market cap, the company delivers exceptional guest experiences in top destinations by partnering with renowned hospitality brands such as Marriott, Ritz-Carlton, Westin, St. Regis, Hyatt, Hilton, and Four Seasons. The largest lodging REIT is expected to announce its fiscal third-quarter earnings for 2025 after the market closes on Wednesday, Nov. 5.

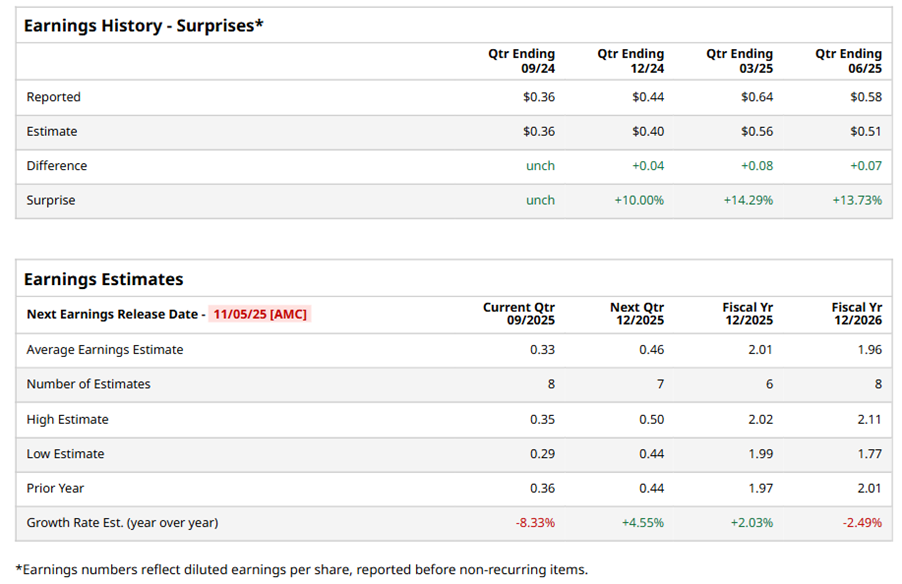

Ahead of the event, analysts expect HST to report an FFO of $0.33 per share on a diluted basis, down 8.3% from $0.36 per share in the year-ago quarter. The company has met or surpassed Wall Street’s FFO estimates in its last four quarterly reports.

For the full year, analysts expect HST to report FFO per share of $2.01, up 2% from $1.97 in fiscal 2024. However, its FFO is expected to decline 2.5% year over year to $1.96 per share in fiscal 2026.

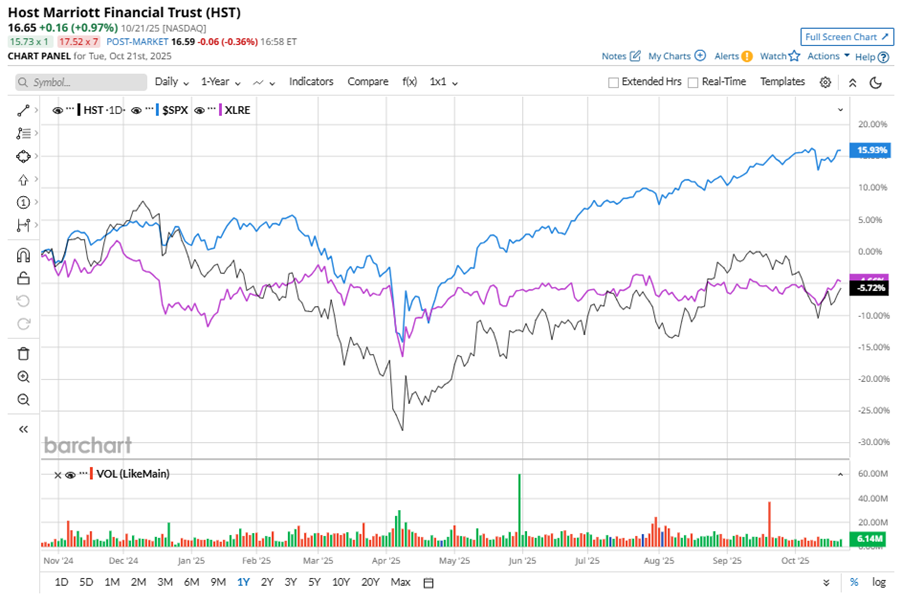

HST stock has underperformed the S&P 500 Index’s ($SPX) 15.1% gains over the past 52 weeks, with shares down 5.6% during this period. Similarly, it underperformed the Real Estate Select Sector SPDR Fund’s (XLRE) 3.4% downtick over the same time frame.

HST faces headwinds from rising costs, economic uncertainty, and inflation, coupled with a slower-than-expected bounce-back in business and group travel demand. Despite resilient operations, these challenges are likely to cap near-term growth and stock price gains.

On Jul. 30, HST shares closed down marginally after reporting its Q2 results. Its adjusted FFO per share of $0.58 surpassed Wall Street expectations of $0.51. The company’s revenue was $1.6 billion, topping Wall Street's $1.5 billion forecast. HST expects full-year adjusted FFO in the range of $1.98 to $2.02 per share.

Analysts’ consensus opinion on HST stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 18 analysts covering the stock, eight advise a “Strong Buy” rating, one suggests a “Moderate Buy,” and nine give a “Hold.” HST’s average analyst price target is $18.58, indicating a potential upside of 11.6% from the current levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.