With a market cap of $34.7 billion, The Hershey Company (HSY) is a leading global manufacturer of chocolate, non-chocolate confectionery, salty snacks, and pantry items, with operations spanning over 80 countries. It operates through three key segments - North America Confectionery, North America Salty Snacks, and International, offering a wide range of products under iconic brands such as Hershey's, Reese's, Kit Kat, and SkinnyPop.

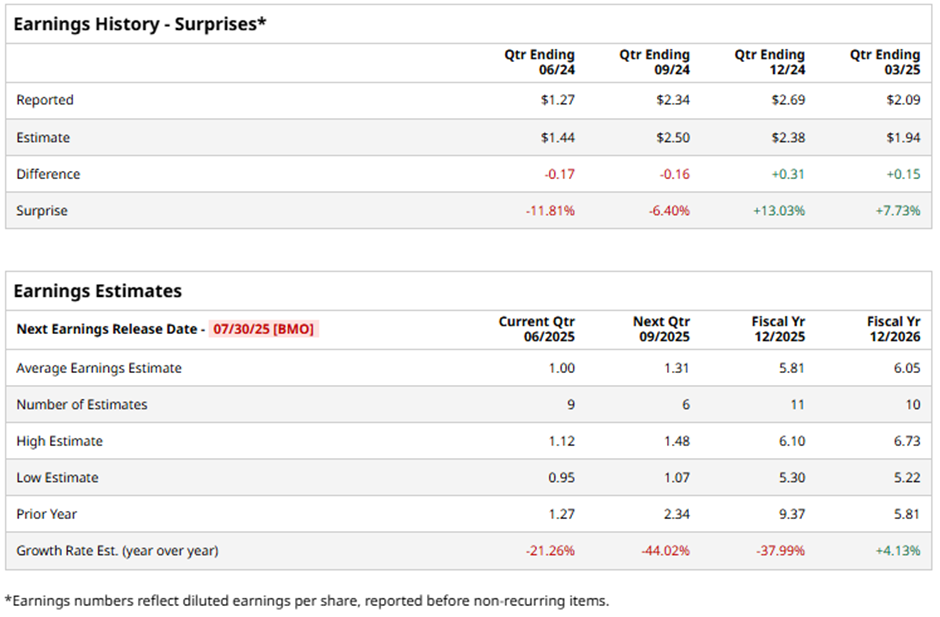

The Hershey, Pennsylvania-based company is expected to announce its fiscal Q2 2025 earnings results before the market opens on Wednesday, Jul. 30. Ahead of this event, analysts expect Hershey to report an adjusted profit of $1 per share, down 21.3% from $1.27 per share in the year-ago quarter. The company has surpassed Wall Street's earnings estimates in two of the last four quarters while missing on two other occasions.

For fiscal 2025, analysts expect the chocolate bar and candy maker to report an adjusted EPS of $5.81, down nearly 38% from $9.37 in fiscal 2024. However, adjusted EPS is projected to rebound, growing 4.1% year-over-year to $6.05 in fiscal 2026.

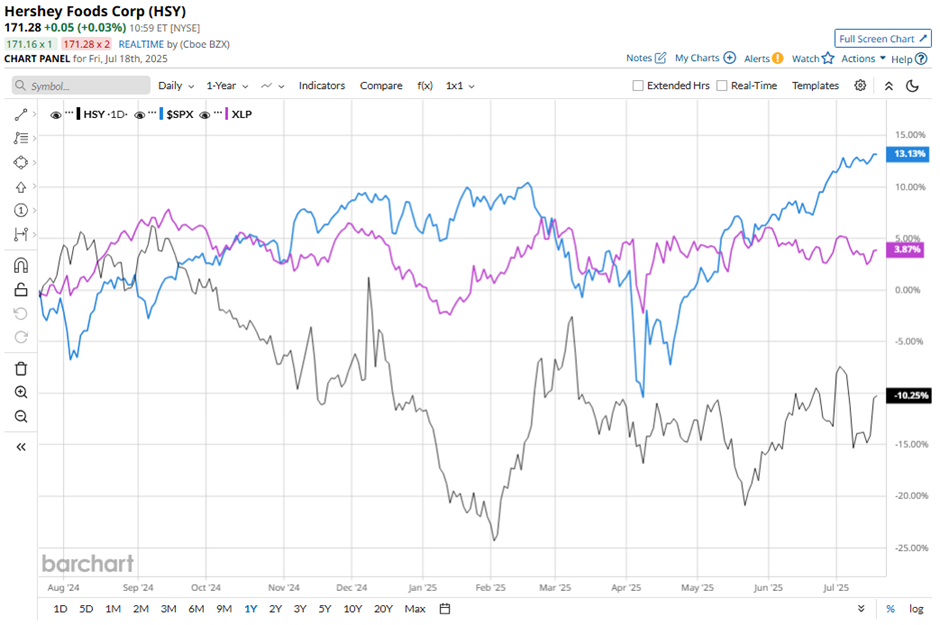

Shares of HSY have declined 10.8% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 13.6% surge and the Consumer Staples Select Sector SPDR Fund’s (XLP) 3.8% return over the same period.

Despite reporting better-than-expected Q1 2025 adjusted EPS of $2.09, Hershey shares fell marginally on May 1 due to a 31.9% year-over-year EPS decline and a 13.8% drop in net sales to $2.8 billion, missing the estimate. Additionally, volume headwinds from ERP-related inventory laps, holiday timing shifts, and reduced shipping days. Furthermore, management guided for a full-year adjusted EPS of $6 - $6.18, reflecting a mid-30% decline from 2024, adding to investor concerns.

Analysts' consensus view on Hershey’s stock is cautious, with a "Hold" rating overall. Among 22 analysts covering the stock, one recommends "Strong Buy," 16 suggest "Hold," one advises "Moderate Sell," and four "Strong Sells." As of writing, the stock is trading above the average analyst price target of $159.36.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.