/Generac%20Holdings%20Inc%20logo%20and%20site-by%20T_Schneider%20via%20Shutterstock.jpg)

Wisconsin-based Generac Holdings, Inc. (GNRC) is an industrial manufacturer specializing in backup power generation systems, energy storage solutions, and related power equipment for residential, commercial, and industrial markets. Generac’s market capitalization is around $10.8 billion. The company is expected to announce its fiscal third-quarter earnings report for 2025 soon.

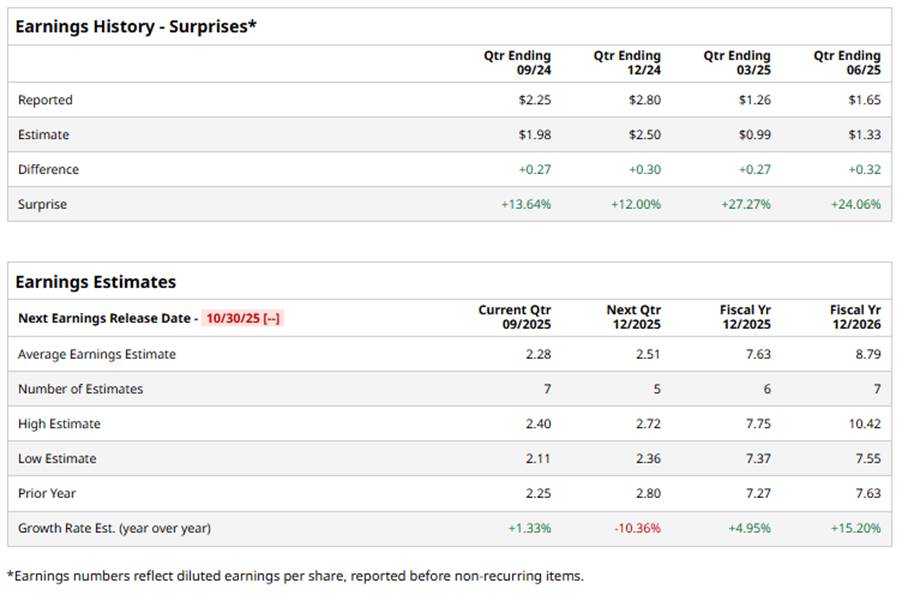

Ahead of this event, analysts project the company to report an EPS of $2.28, a 1.3% rise from the year‑ago quarter. The company has exceeded Wall Street’s bottom-line estimates in the last four quarters.

For fiscal 2025, analysts forecast Generac Holdings’ EPS to be $7.63, up 5% from $7.27 in fiscal 2024. Moreover, its EPS is expected to grow 15.2% year over year (YoY) to $8.79 in fiscal 2026.

Over the past 52 weeks, GNRC stock has increased 5.8%, underperforming the broader S&P 500 Index’s ($SPX) 13.4% return and the Industrial Select Sector SPDR Fund’s (XLI) 10.1% gain over the same period.

Despite operating in a hot sector, Generac’s shares are underperforming largely because its revenue growth has cooled, and growth has been in the single digits in recent periods. The company has also narrowed its full-year sales outlook. At the same time, margins and free cash flows have come under pressure. Add to that cautious investor sentiment and macro headwinds, and the stock struggles to keep pace even when the broader market is advancing.

Analysts’ consensus view on GNRC stock is cautiously optimistic, with a “Moderate Buy” rating overall. Among 20 analysts covering the stock, 10 suggest a “Strong Buy,” and the remaining 10 give a “Hold” rating.

GNRC’s average analyst price target is $205.44, indicating a potential upside of 11.8% from the current levels.