Federal Realty Investment Trust (FRT), headquartered in North Bethesda, Maryland, is a self-administered real estate investment trust (REIT). Valued at $8.1 billion by market cap, the company specializes in the ownership, management, development, and redevelopment of prime community and neighborhood shopping centers. The shopping center-focused retail REIT is expected to announce its fiscal second-quarter earnings for 2025 after the market closes on Wednesday, Aug. 6.

Ahead of the event, analysts expect FRT to report an FFO of $1.73 per share on a diluted basis, up 2.4% from $1.69 per share in the year-ago quarter. The company beat or matched the consensus estimates in three of the last four quarters while missing the forecast on another occasion.

For the full year, analysts expect FRT to report FFO of $7.15 per share, up 5.6% from $6.77 per share in fiscal 2024. Its FFO is expected to rise 3.2% year over year to $7.38 in fiscal 2026.

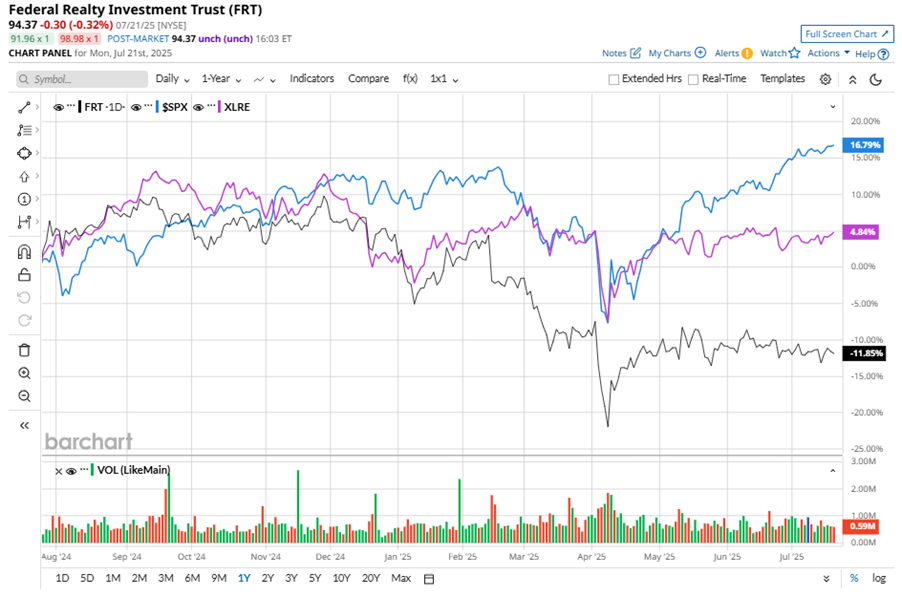

FRT stock has underperformed the S&P 500 Index’s ($SPX) 14.5% gains over the past 52 weeks, with shares down 13.8% during this period. Similarly, it underperformed the Real Estate Select Sector SPDR Fund’s (XLRE) 3.7% gains over the same time frame.

On May 8, FRT reported its Q1 results, and its shares closed down more than 1% in the following trading session. Its FFO of $1.70 per share surpassed Wall Street expectations of $1.69 per share. The company’s revenue was $309.2 million, beating Wall Street forecasts of $306.9 million. FRT expects full-year FFO to be between $7.11 and $7.23 per share.

Analysts’ consensus opinion on FRT stock is reasonably bullish, with an overall “Moderate Buy” rating. Out of 17 analysts covering the stock, nine advise a “Strong Buy” rating, one suggests a “Moderate Buy,” and seven give a “Hold.” FRT’s average analyst price target is $109.31, indicating a potential upside of 15.8% from the current levels.