/Fastenal%20Co_%20truck%20and%20logo%20on%20building-by%20jetcityimage%20via%20iStock.jpg)

Fastenal Company (FAST) is a Minnesota-based industrial supply and distribution company founded in 1967. Valued at approximately $48.1 billion by market cap, it operates as a leading wholesale distributor of industrial and construction supplies, offering a broad range of products such as threaded fasteners, miscellaneous hardware including pins, machinery keys, concrete anchors, wire ropes, rivets and related accessories that serve manufacturing, construction, maintenance, repair and operations (MRO) needs across diverse end markets.

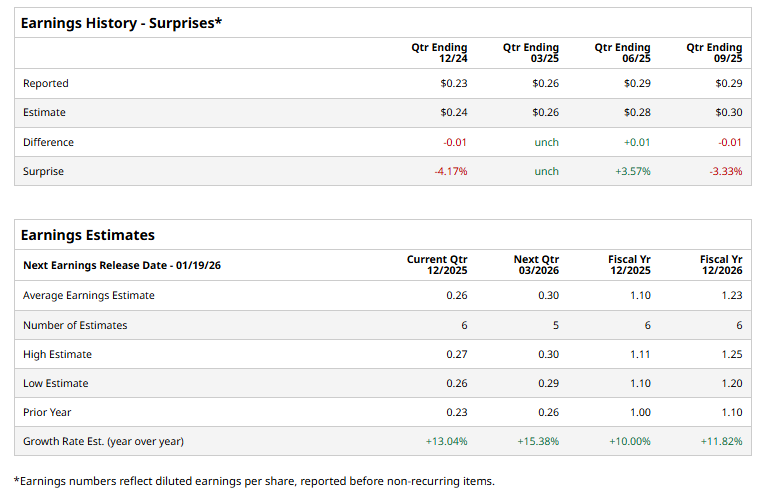

The industrial sector giant is expected to release its fourth-quarter results next month. Ahead of the event, analysts expect FAST to deliver an adjusted EPS of $0.26, up 13% from $0.23 reported in the year-ago quarter. The company has a mixed earnings surprise history. While it has met or exceeded Street’s bottom-line estimates twice over the past four quarters, it has missed Street's projections on two other occasions.

For the current year, analysts expect FAST to deliver an EPS of $1.10, up 10% from $1 reported in 2024.

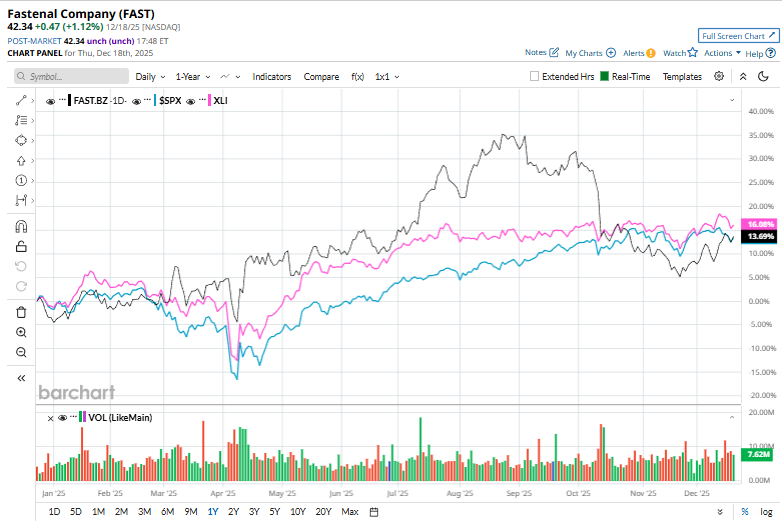

Fastenal’s stock prices have soared 13.4% over the past 52 weeks, slightly trailing the S&P 500 Index’s ($SPX) 15.4% gains and the Industrial Select Sector SPDR Fund’s (XLI) 16.7% returns during the same time frame.

Fastenal shares climbed 1.1% on Dec. 18 after the company entered into a sponsorship agreement with the Belfast Giants, the only professional ice hockey team in Ireland, to expand its brand presence in Northern Ireland. The partnership marks Fastenal’s first sponsorship in the U.K.’s Elite Ice Hockey League (EIHL), building on its existing role as an official NHL partner in North America.

However, analysts remain cautious about the stock’s prospects, maintaining a consensus “Hold” rating overall. Of the 17 analysts covering the stock, opinions include six “Strong Buys,” eight “Holds,” and three “Strong Sells.” Its mean price target of $45.92 implies an upswing potential of 8.5% from the current market prices.