The Estée Lauder Companies Inc. (EL) is a leading global beauty and cosmetics company, founded in 1946, that develops, manufactures and markets a broad portfolio of high-end skin care, makeup, fragrance and hair care brands across more than 150 countries, with its headquarters in New York City. Its market cap is around $34.2 billion. The Estée Lauder’s Q1 2026 earnings release is scheduled for Thursday, Oct. 30, before the market opens.

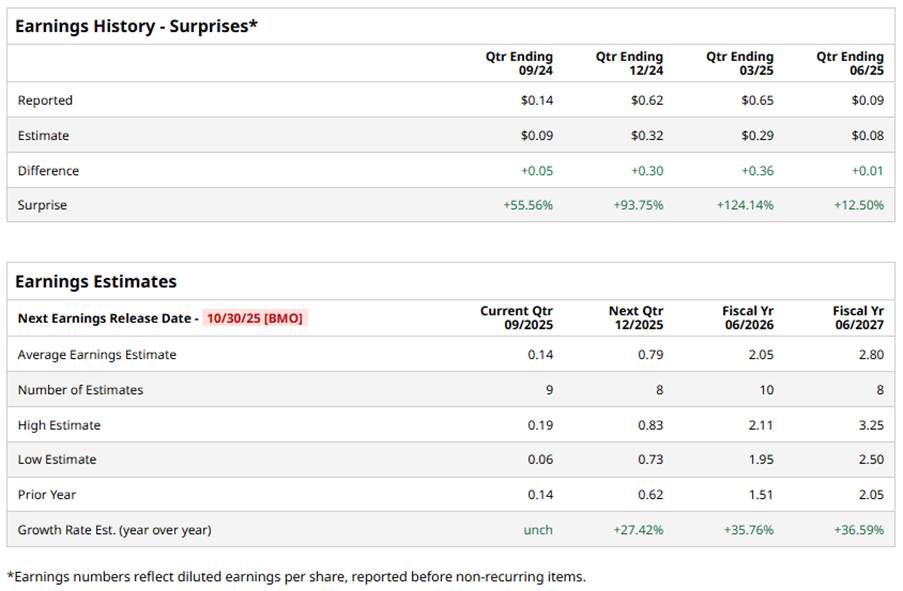

Ahead of this event, analysts expect this cosmetics giant to report a profit of $0.14 per share, unchanged from the year-ago quarter value. On the bright side, the company has consistently beaten Wall Street’s earnings estimates in each of the last four quarters, which is admirable.

For fiscal 2026, analysts expect Estée Lauder to report a profit of $2.05 per share, up 35.8% from $1.51 in fiscal 2025. Also, its EPS is expected to rise in fiscal 2027 by 36.6% year-over-year to $2.80.

EL stock grew 4.2% over the past 52 weeks, significantly underperforming the S&P 500 Index’s ($SPX) 14.7% surge, while outperforming the Consumer Staples Select Sector SPDR Fund’s (XLP) 4% decline over the same time frame.

Over the past 12 months, EL has traversed a choppy landscape. The stock has faced headwinds from slowing demand in China, weakness in travel-retail channels, and disappointing recent earnings. In response, Estée Lauder has announced sweeping cost cuts, including shedding jobs.

However, more recently, the company is seeing renewed bullish momentum. Analysts have taken notice as Goldman Sachs Group, Inc. (GS) has upgraded the stock to a “Buy,” highlighting optimism around its presence on platforms like Amazon (AMZN) and TikTok, and improving sales trends in key regions.

Wall Street analysts are moderately bullish about EL stock, with a “Moderate Buy” rating overall – an upgrade from a “Hold” rating three months back. Among 25 analysts covering the stock, six recommend a “Strong Buy,” one indicates a “Moderate Buy,” and 18 suggest a “Hold” rating.

EL stock currently trades slightly below its mean price target of $95.43. However, the Street-high target of $115 implies the stock could rally as much as 20.7%.