/Eli%20Lilly%20%26%20Co_%20by%20Tada%20Images%20via%20Shutterstock.jpg)

Eli Lilly and Company (LLY), headquartered in Indianapolis, Indiana, is a leading global pharmaceutical company dedicated to developing innovative treatments for diseases such as diabetes, obesity, Alzheimer’s disease, cancer, and autoimmune disorders.

Founded in 1876, the company combines biotechnology, chemistry, and genetic medicine to improve health worldwide. Recently, Lilly announced an investment of over $1 billion to expand manufacturing and supply capabilities in India, reinforcing its commitment to global growth and addressing critical health needs through advanced therapies. The company has a market capitalization of $768.85 billion.

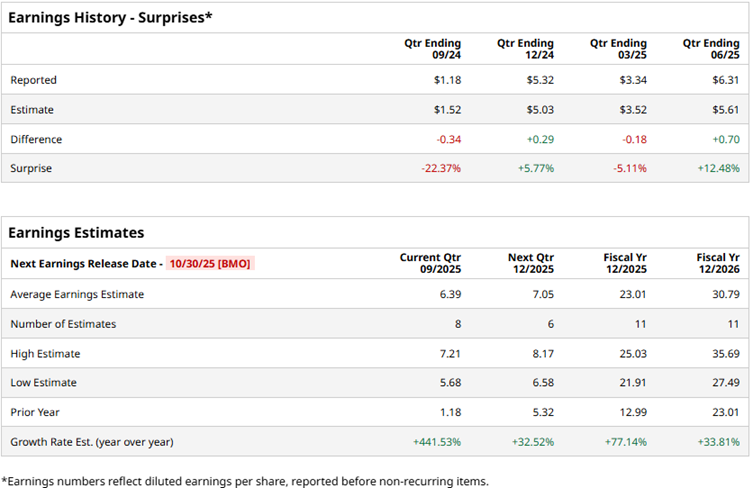

Eli Lilly is set to report its third-quarter results for fiscal 2025 on Oct. 30, 2025, before the market opens. Ahead of the results, Wall Street analysts have robust expectations about its bottom-line growth trajectory. For Q3, its profit is expected to grow a stunning 441.5% year-over-year (YOY) to $6.39 per diluted share. The company has a mixed history of surpassing consensus EPS estimates, topping them in two of the four trailing quarters and missing them twice.

For the current fiscal year, Street analysts expect Eli Lilly’s profit to expand by 77.1% from the prior year to $23.01 per diluted share.

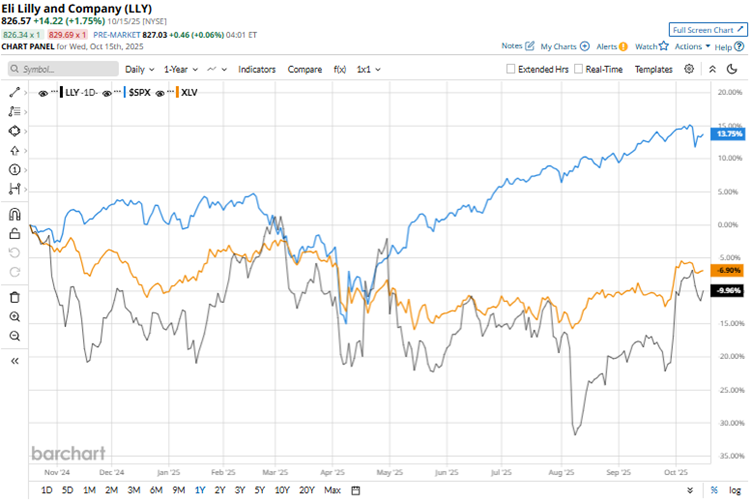

Eli Lilly’s stock has been underperforming the broader market over the past year. Over the past 52 weeks, the stock has declined 9.5%, while it has gained 7.1% year-to-date (YTD). On the other hand, the broader S&P 500 Index ($SPX) has gained 14.7% and 13.4% over the same periods, respectively. Next, we compare the stock with its own sector. The Health Care Select Sector SPDR Fund (XLV) has declined about 6.7% over the past 52 weeks, but rose 3.6% YTD.

On Aug. 7, Eli Lilly reported solid second-quarter results for fiscal 2025. The company’s revenue increased by 38% YOY to $15.56 billion, while its non-GAAP EPS climbed 61% from the prior year’s period to $6.31. However, the stock fell 14% intraday on Aug. 7 after the company’s anticipated weight-loss drug candidate, Orforglipron, showed efficacy below expectations in the Phase 3 ATTAIN-1 results. However, the selloff might have been overdone.

Eli Lilly is committed to expanding its operations. For instance, the company has plans to build a $6.5 billion manufacturing facility in Houston, Texas and a $5 billion manufacturing facility near Richmond, Virginia.

Wall Street analysts have been exceptionally bullish about Eli Lilly’s future. Among the 27 analysts covering the stock, the consensus rating is “Strong Buy.” The ratings configuration is less bullish than it was two months ago, with 19 “Strong Buy” ratings now, down from 20. The ratings are completed by two “Moderate Buy” ratings and six “Holds.”

The mean price target of $909.88 indicates a 10.1% upside from current levels, while the Street-high price target of $1,190 implies a 44% upside.