Dow Inc. (DOW), headquartered in Midland, Michigan, offers a range of materials science solutions for packaging, infrastructure, mobility, and consumer applications. Valued at $16.9 billion by market cap, the company manufactures and supplies chemicals for the liquid injection molding, architectural fabrication, leather, textile, automotive, rubber, consumer goods, and food industries. The materials science giant is expected to announce its fiscal third-quarter earnings for 2025 before the market opens on Thursday, Oct. 23.

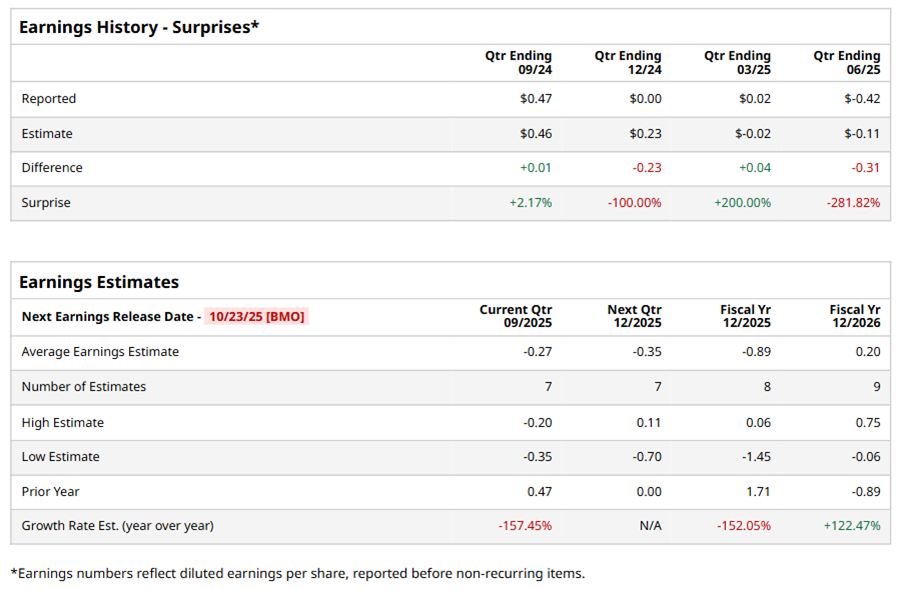

Ahead of the event, analysts expect DOW to report a loss of $0.27 per share on a diluted basis, down 157.5% from a profit of $0.47 per share in the year-ago quarter. The company beat the consensus estimates in two of the last four quarters while missing the forecast on two other occasions.

For the full year, analysts expect DOW to report a loss of $0.89 per share, down 152.1% from EPS of $1.71 in fiscal 2024. However, its EPS is expected to rise 122.5% year-over-year to $0.20 in fiscal 2026.

DOW stock has significantly underperformed the S&P 500 Index’s ($SPX) 17.2% gains over the past 52 weeks, with shares down 57.7% during this period. Similarly, it substantially underperformed the Materials Select Sector SPDR Fund’s (XLB) 5.7% losses over the same time frame.

DOW's underperformance is due to lower prices, restructuring charges, and decreased sales across all segments, particularly in functional polymers, polyurethanes, and coatings. Margin compression also impacted earnings. The company is navigating industry challenges and seeking regulatory intervention to address oversupply and unfair pricing practices.

On Jul. 24, DOW shares closed down by 17.5% after reporting its Q2 results. Its adjusted loss per share of $0.42 is wider than the consensus estimate of $0.11. The company’s net sales were $10.1 billion, missing Wall Street expectations of $10.3 billion.

Analysts’ consensus opinion on DOW stock is cautious, with a “Hold” rating overall. Out of 20 analysts covering the stock, two advise a “Strong Buy” rating, 16 give a “Hold,” and two recommend a “Strong Sell.” DOW’s average analyst price target is $27.67, indicating a potential upside of 18.1% from the current levels.