With a market cap of $54.7 billion, Digital Realty Trust, Inc. (DLR) is a global provider of data center, colocation, and interconnection solutions serving customers across industries such as cloud computing, financial services, healthcare, manufacturing, and communications. As of September 30, 2025, it operates a portfolio of 311 data centers spanning approximately 42.7 million square feet across North America, Europe, South America, Asia, Australia, and Africa.

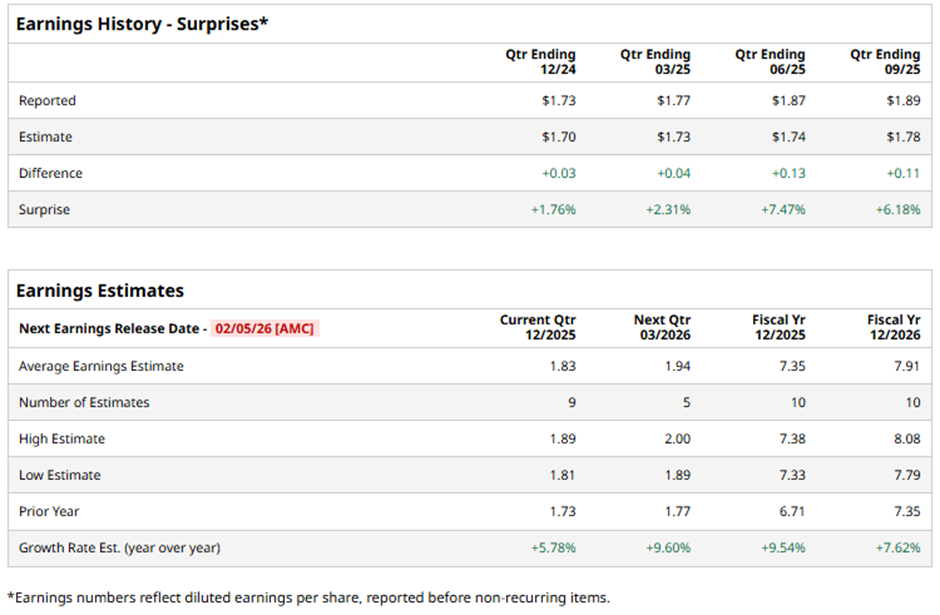

The Dallas, Texas-based company is expected to release its fiscal Q4 2025 results after the market closes on Thursday, Feb. 5. Ahead of this event, analysts project DLR to report core FFO per share of $1.83, a 5.8% rise from $1.73 in the year-ago quarter. It has exceeded Wall Street's bottom-line estimates in the past four quarters.

For fiscal 2025, analysts forecast the REIT to report core FFO per share of $7.35, up 9.5% from $6.71 in fiscal 2024.

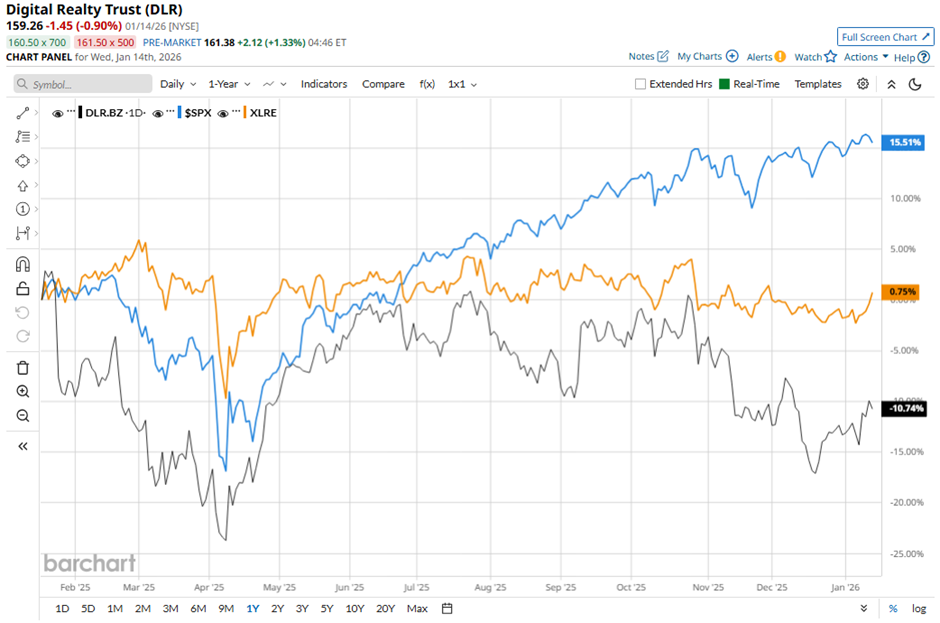

DLR stock has decreased 8.4% over the past 52 weeks, lagging behind the broader S&P 500 Index's ($SPX) 18.6% gain and the State Street Real Estate Select Sector SPDR ETF's (XLRE) 3.4% rise over the same time frame.

Shares of Digital Realty rose 2.2% following its Q3 2025 results on Oct. 23. The company reported stronger-than-expected core FFO of $1.89 per share and revenue of $1.58 billion. Investors also reacted positively to solid operating momentum highlighted by $201 million in new annualized bookings, an expanded $852 million backlog, and 8% cash rental rate growth on renewals. In addition, management raised full-year 2025 core FFO guidance to $7.32 per share - $7.38 per share.

Analysts' consensus view on DLR stock is moderately optimistic, with a "Moderate Buy" rating overall. Among 31 analysts covering the stock, 19 suggest a "Strong Buy," two give a "Moderate Buy," and 10 recommend a "Hold." The average analyst price target for Digital Realty Trust is $193.21, indicating a potential upside of 21.3% from the current levels.