/CSX%20Corp_%20railcar-by%20Jonathan%20Weiss%20via%20Shutterstock.jpg)

Jacksonville, Florida-based CSX Corporation (CSX) operates as one of the leading transportation companies in North America, providing rail-based freight transportation services in the U.S. and Canada. With a market cap of $63.4 billion, CSX operates through rail and trucking segments.

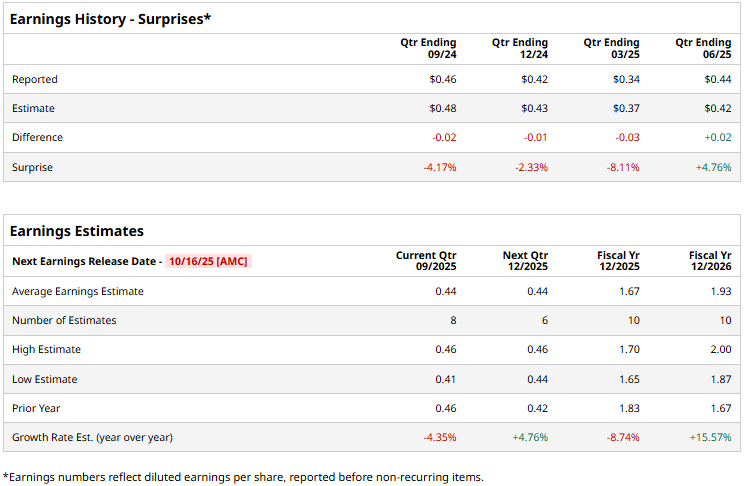

The transportation giant is set to announce its third-quarter results after the market closes on Thursday, Oct. 16. Ahead of the event, analysts expect CSX to deliver a profit of $0.44 per share, down 4.4% from $0.46 per share reported in the year-ago quarter. The company has a mixed earnings surprise history. While it has surpassed the Street’s bottom-line estimates once over the past four quarters, it has missed the projections on three other occasions.

For the full fiscal 2025, analysts expect CSX to report an EPS of $1.67, down 8.7% from $1.83 reported in 2024. In fiscal 2026, its bottom line is expected to rebound 15.6% year-over-year to $1.93 per share.

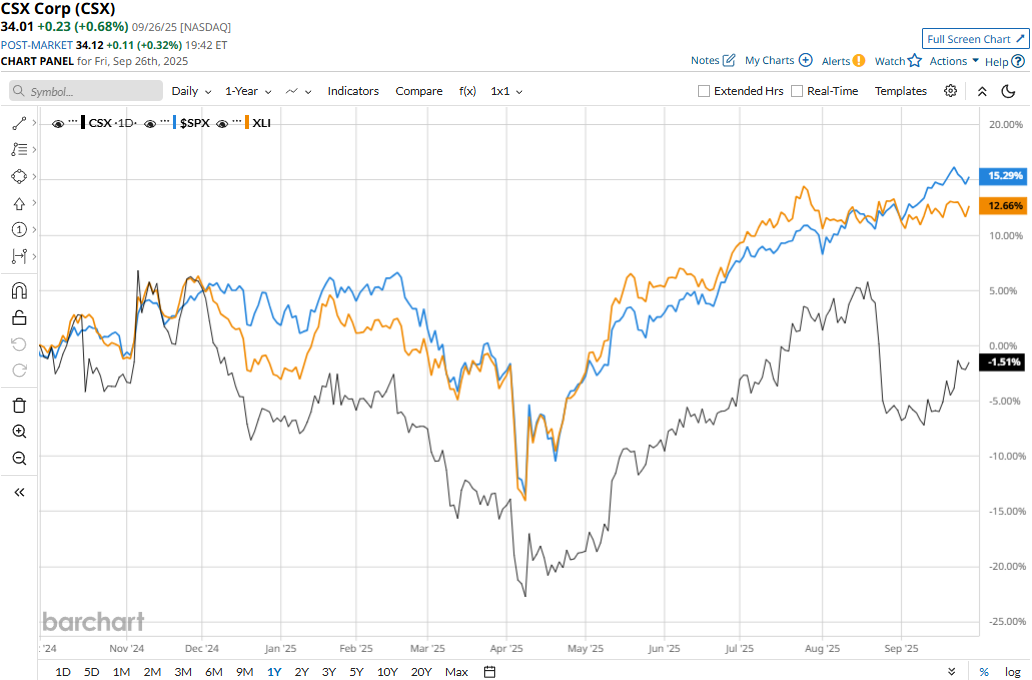

CSX stock prices have observed a marginal 32 bps uptick over the past 52 weeks, notably underperforming the Industrial Select Sector SPDR Fund’s (XLI) 13.3% gains and the S&P 500 Index’s ($SPX) 15.6% returns during the same time frame.

CSX stock prices observed a marginal gain in the trading session after the release of its mixed Q2 results on Jul. 23. Due to the impact of reduced fuel surcharge and drop in merchandise volume, the company’s topline took a notable hit. This was partly offset by an increase in pricing and intermodal volumes, yet the total revenues dropped 3.4% year-over-year to $3.6 billion, missing the Street expectations by a small margin.

Meanwhile, the company did a commendable job at curbing expenses, which led to a smaller drop in earnings compared to expectations. Net earnings came in at $829 million, down 13.9% year-over-year, yet its EPS of $0.44 surpassed the consensus estimates by 4.8%.

Analysts remain optimistic about the stock’s longer-term prospects. CSX maintains a consensus “Moderate Buy” rating overall. Of the 26 analysts covering the CSX stock, opinions include 17 “Strong Buys,” two “Moderate Buys,” and seven “Holds.” Its mean price target of $38.04 suggests an 11.8% upside potential from current price levels.