With a market cap of $108.8 billion, Comcast Corporation (CMCSA) is a global media and technology conglomerate headquartered in Philadelphia, Pennsylvania. Founded in 1963, Comcast has evolved from a regional cable provider into a diversified entity with significant operations in broadband, wireless, video, and voice services. Its primary consumer-facing brands include Xfinity for broadband and cable services, Sky for European entertainment, and Peacock for streaming.

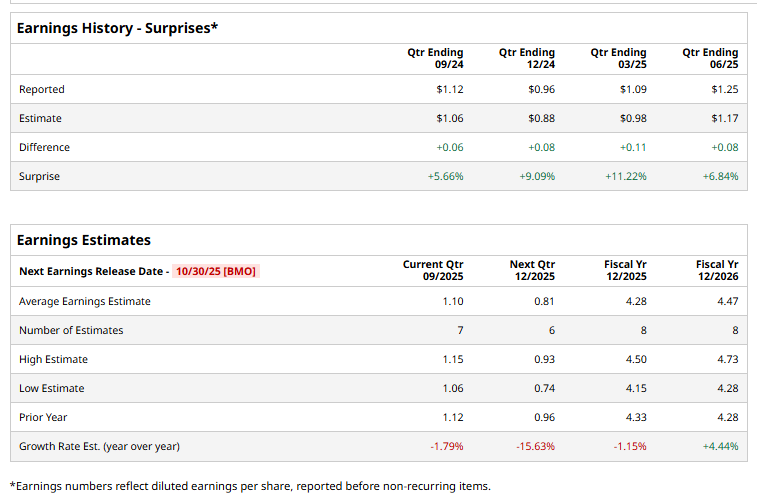

The company is expected to announce its third-quarter results before the markets open on Thursday, Oct. 30. Ahead of the event, analysts expect CMCSA to deliver a profit of $1.10 per share, down 1.8% from $1.12 per share reported in the year-ago quarter. However, the company has surpassed the Street’s bottom-line expectations in each of the past four quarters.

For the current year, analysts expect Comcast’s earnings to drop 1.2% from $4.33 per share reported in 2024 to $4.28 per share. However, in fiscal 2026, its earnings are expected to grow 4.4% year over year to $4.47 per share.

CMCSA stock has dropped 28.7% over the past 52 weeks, notably underperforming the S&P 500 Index’s ($SPX) 14.4% gains and the Communication Services Select Sector SPDR ETF Fund’s (XLC) 25.9% surge during the same time frame.

On Oct. 10, CMCSA shares fell 2.1% following Bernstein analyst Laurent Yoon’s decision to maintain a “Hold” rating on Comcast, with a $36 price target.

The stock holds a consensus “Moderate Buy” rating overall. Of the 32 analysts covering the CMCSA stock, opinions include 15 “Strong Buys,” 15 “Holds,” and two “Strong Sells.” Its mean price target of $39.91 represents a 35.7% premium to current price levels.