Valued at a market cap of $104.3 billion, New York-based Coinbase Global, Inc. (COIN) is the largest U.S. cryptocurrency exchange. It provides a platform for trading digital assets, offering services for consumers, institutions, and developers in the global crypto economy. COIN is expected to announce its fiscal Q2 2025 earnings results after the market closes on Thursday, Jul. 31.

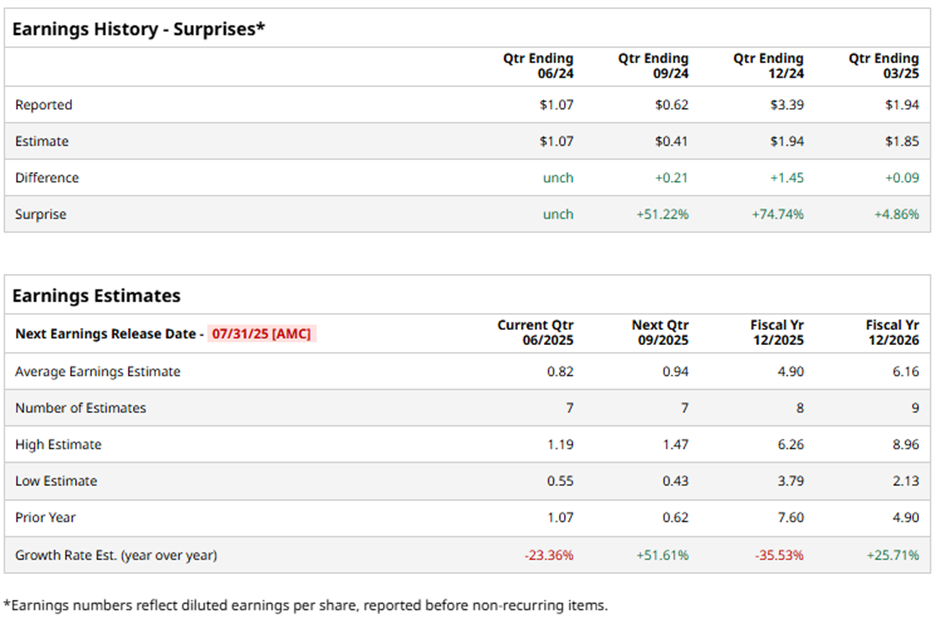

Ahead of this event, analysts expect Coinbase Global to report an adjusted EPS of $0.82, down 23.4% from $1.07 in the year-ago quarter. However, the company has surpassed Wall Street's earnings estimates in the last four quarters. In Q1 2025, COIN exceeded the consensus adjusted EPS estimate by 4.9%.

For fiscal 2025, analysts expect Coinbase Global to report an adjusted EPS of $4.90, a decrease of 35.5% from $7.60 in fiscal 2024. Nevertheless, adjusted EPS is expected to grow 25.7% year-over-year to $6.16 in fiscal 2026.

Shares of Coinbase Global have soared 64.9% over the past 52 weeks, surpassing the S&P 500 Index's ($SPX) 12.7% rise and the iShares U.S. Financials ETF's (IYF) 20.8% return over the same period.

Shares of Coinbase fell 3.5% following its Q1 2025 results on May 8 due to revenue of $2.03 billion missing Wall Street’s estimate, despite year-over-year growth. Consumer trading volume dropped 17% to $78.1 billion, and institutional trading volume declined 9% to $315 billion, signaling weaker trading activity. Although adjusted earnings were strong at $527 million ($1.94 per share), investor sentiment was dampened by concerns over slowing momentum, April crypto volatility from Trump’s tariff policy, and a cautious Q2 forecast of $600 million - $680 million in subscription and service revenue.

Analysts' consensus view on Coinbase Global’s stock is moderately optimistic, with a "Moderate Buy" rating overall. Among 30 analysts covering the stock, 13 recommend "Strong Buy," one "Moderate Buy," 14 suggest "Hold," and two have a "Strong Sell." As of writing, the stock is trading above the average analyst price target of $316.08.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.