/Citizens%20Financial%20Group%20Inc%20branch%20location-by%20Tada%20Images%20via%20Shutterstock.jpg)

Valued at a market cap of $23 billion, Citizens Financial Group, Inc. (CFG) is a Providence, Rhode Island–based super-regional bank with about $220 billion in assets, nearly 1,000 branches, and a mix of consumer and commercial banking operations. Founded in 1828 and formerly part of RBS, it now offers retail deposits, mortgages, credit cards, wealth management, and corporate lending, alongside advisory and treasury services.

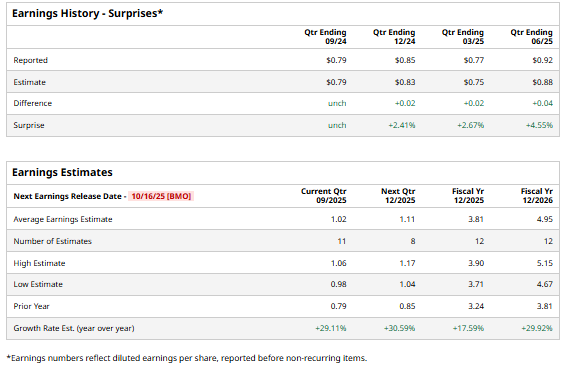

The regional bank is set to release its fiscal Q3 earnings for 2025 before the market opens on Thursday, Oct. 16. Ahead of this event, analysts expect this bank holding company to report a profit of $1.02 per share, up 29.1% from $0.79 per share in the year-ago quarter. The company has met or exceeded Wall Street’s earnings estimates in all of the last four quarters.

For fiscal 2025, analysts expect CFG to report a profit of $3.81 per share, up 17.6% from $3.24 in fiscal 2024. Its EPS is expected to further grow 29.9% year-over-year to $4.95 in fiscal 2026.

CFG has rallied 31.7% over the past 52 weeks, outpacing both the S&P 500 Index's ($SPX) 15.6% rise and the Financial Select Sector SPDR Fund’s (XLF) 19.6% return over the same time frame.

On Sept. 17, Citizens Financial Group shook up the banking scene by announcing a cut in its prime lending rate to 7.25% from 7.50%, effective Sept. 18, 2025. The rate trim not only hinted at easing borrowing costs for customers but also boosted investor sentiment, pushing CFG shares more than 2% higher in the wake of the news.

Wall Street analysts are highly optimistic about CFG’s stock, with a "Strong Buy" rating overall. Among 24 analysts covering the stock, 16 recommend "Strong Buy," two suggest a “Moderate Buy,” and six indicate “Hold.” The mean price target for CFG is $56.23, indicating a 5.3% potential upside from current levels.